Dealing with the loss of a loved one is never easy, and navigating the complexities of inheritance tax can add to the emotional burden. In Pennsylvania, the inheritance tax waiver form is a crucial document that must be completed and filed in a timely manner to ensure that the deceased person's estate is distributed according to their wishes. In this article, we will provide a step-by-step guide on how to complete the Pennsylvania inheritance tax waiver form, as well as offer valuable insights into the process.

Understanding the Purpose of the Inheritance Tax Waiver Form

The inheritance tax waiver form is a document that allows the executor of an estate to transfer assets from the deceased person's name to the beneficiaries without having to pay inheritance tax. In Pennsylvania, inheritance tax is levied on the transfer of assets from the deceased person to their beneficiaries, and the rate varies depending on the relationship between the deceased person and the beneficiary.

Who Needs to Complete the Inheritance Tax Waiver Form?

The executor of the estate is responsible for completing and filing the inheritance tax waiver form. The executor is typically named in the deceased person's will or appointed by the court if there is no will. The executor's role is to manage the estate, pay off debts, and distribute the assets to the beneficiaries.

Step 1: Gather Required Documents and Information

Before completing the inheritance tax waiver form, the executor must gather all the required documents and information. These include:

- The deceased person's will and any codicils (amendments to the will)

- The deceased person's death certificate

- A list of all assets, including real estate, bank accounts, investments, and personal property

- A list of all debts, including outstanding bills, loans, and credit card balances

- The names and addresses of all beneficiaries

Step 2: Determine the Type of Inheritance Tax Waiver Form Needed

There are two types of inheritance tax waiver forms in Pennsylvania: the Rev-1500 and the Rev-1510. The Rev-1500 is used for estates with a value of $50,000 or less, while the Rev-1510 is used for estates with a value greater than $50,000.

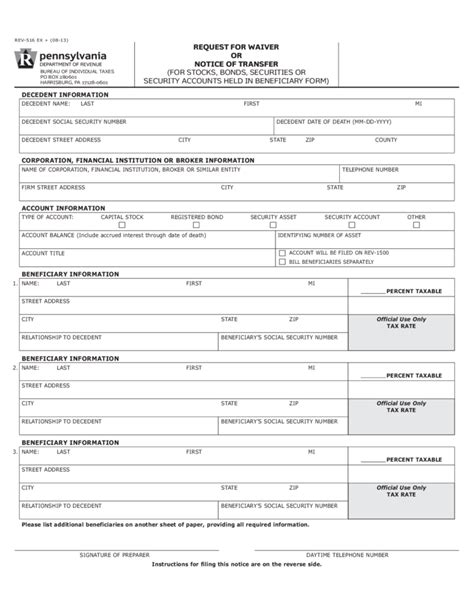

Step 3: Complete the Inheritance Tax Waiver Form

Once the executor has determined which form to use, they must complete it accurately and thoroughly. The form requires information about the deceased person, the estate, and the beneficiaries.

- Section 1: Deceased Person's Information

- Name and address

- Date of birth and date of death

- Social Security number

- Section 2: Estate Information

- Value of the estate

- List of assets and debts

- Section 3: Beneficiary Information

- Names and addresses of all beneficiaries

- Relationship to the deceased person

- Amount of inheritance

Step 4: File the Inheritance Tax Waiver Form

Once the form is complete, the executor must file it with the Pennsylvania Department of Revenue. The form can be filed online or by mail.

- Online: Visit the Pennsylvania Department of Revenue website and follow the instructions for filing the inheritance tax waiver form.

- Mail: Send the completed form to the address listed on the form.

Step 5: Pay Any Required Inheritance Tax

If the estate is subject to inheritance tax, the executor must pay the tax within nine months of the deceased person's date of death. The tax can be paid online or by mail.

Common Mistakes to Avoid

When completing the inheritance tax waiver form, there are several common mistakes to avoid:

- Failure to file the form on time

- Inaccurate or incomplete information

- Failure to pay required inheritance tax

Benefits of Using a Professional

While the executor can complete the inheritance tax waiver form on their own, it is highly recommended to use a professional, such as an attorney or accountant, to ensure that the form is completed accurately and on time. A professional can also help with any questions or issues that may arise during the process.

Conclusion

Completing the Pennsylvania inheritance tax waiver form is a crucial step in the estate administration process. By following the steps outlined in this guide, the executor can ensure that the form is completed accurately and on time. Remember to avoid common mistakes and consider using a professional to ensure that the process goes smoothly.

What is the purpose of the inheritance tax waiver form in Pennsylvania?

+The inheritance tax waiver form is a document that allows the executor of an estate to transfer assets from the deceased person's name to the beneficiaries without having to pay inheritance tax.

Who needs to complete the inheritance tax waiver form?

+The executor of the estate is responsible for completing and filing the inheritance tax waiver form.

What are the consequences of failing to file the inheritance tax waiver form on time?

+Failing to file the inheritance tax waiver form on time can result in penalties and interest on the inheritance tax due.