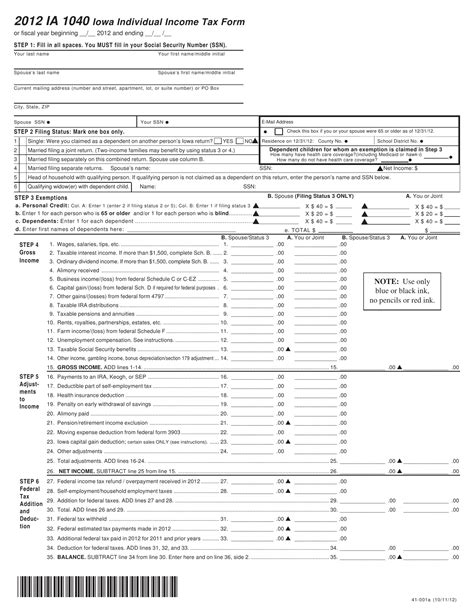

Filling out tax forms can be a daunting task, especially for those who are new to the process or unsure of what they're doing. The Iowa 1040 form, in particular, can be overwhelming due to its complexity and the numerous sections that require attention to detail. However, with the right guidance, completing this form can be a breeze. In this article, we'll explore five easy ways to fill out the Iowa 1040 form, making tax season less stressful and more manageable.

The Importance of Accurate Tax Filing Accurate tax filing is crucial to avoid any potential penalties or delays in receiving your refund. The Iowa 1040 form is used to report your income, claim deductions and credits, and calculate your tax liability. By taking the time to fill out this form correctly, you can ensure that you're in compliance with state tax laws and avoid any potential issues down the line.

Why Filling Out the Iowa 1040 Form Can Be Challenging Despite its importance, filling out the Iowa 1040 form can be challenging for several reasons. Firstly, the form itself can be lengthy and complex, with numerous sections and schedules that require attention to detail. Additionally, tax laws and regulations can change frequently, making it difficult to stay up-to-date on the latest requirements. Furthermore, individuals with complex tax situations, such as self-employment income or investments, may find it particularly difficult to navigate the form.

5 Easy Ways to Fill Out the Iowa 1040 Form Fortunately, there are several ways to make filling out the Iowa 1040 form easier and less time-consuming. Here are five easy ways to get you started:

1. Use Tax Preparation Software

Using tax preparation software is one of the easiest ways to fill out the Iowa 1040 form. These programs, such as TurboTax or H&R Block, guide you through the tax filing process, asking you questions and filling out the form on your behalf. They also ensure that you're taking advantage of all the deductions and credits you're eligible for, which can help reduce your tax liability.

2. Hire a Tax Professional

If you're unsure of how to fill out the Iowa 1040 form or have a complex tax situation, hiring a tax professional may be the best option. These individuals have the knowledge and expertise to navigate the form and ensure that you're in compliance with state tax laws. They can also help you identify deductions and credits you may be eligible for, which can save you money.

3. Use the Iowa Department of Revenue's Website

The Iowa Department of Revenue's website offers a wealth of information and resources to help you fill out the Iowa 1040 form. You can download the form and instructions, as well as access frequently asked questions and tax tables. The website also offers a tax calculator, which can help you estimate your tax liability.

4. Take Advantage of Free Tax Filing Options

If you're eligible, you may be able to take advantage of free tax filing options, such as the IRS's Free File program. This program offers free tax filing software to individuals who meet certain income and eligibility requirements. You can also use the Iowa Department of Revenue's free tax filing option, which is available to individuals who meet certain income and eligibility requirements.

5. Fill Out the Form Yourself

If you're comfortable filling out the Iowa 1040 form yourself, you can do so by downloading the form and instructions from the Iowa Department of Revenue's website. Make sure to read the instructions carefully and take your time filling out the form. You can also use tax tables and calculators to help you estimate your tax liability.

Tips for Filling Out the Iowa 1040 Form Regardless of which method you choose, here are some tips to keep in mind when filling out the Iowa 1040 form:

- Read the instructions carefully before starting to fill out the form.

- Take your time and don't rush through the form.

- Make sure to sign and date the form.

- Use black ink and print clearly.

- Keep a copy of the form for your records.

Common Mistakes to Avoid When filling out the Iowa 1040 form, there are several common mistakes to avoid. These include:

- Failing to sign and date the form.

- Not reporting all income.

- Claiming deductions and credits you're not eligible for.

- Not keeping a copy of the form for your records.

Conclusion Filling out the Iowa 1040 form doesn't have to be a daunting task. By using tax preparation software, hiring a tax professional, using the Iowa Department of Revenue's website, taking advantage of free tax filing options, or filling out the form yourself, you can make the process easier and less time-consuming. Remember to read the instructions carefully, take your time, and avoid common mistakes. With the right guidance, you can ensure that you're in compliance with state tax laws and avoid any potential penalties or delays.

What is the Iowa 1040 form?

+The Iowa 1040 form is a tax form used to report your income, claim deductions and credits, and calculate your tax liability.

How do I fill out the Iowa 1040 form?

+You can fill out the Iowa 1040 form using tax preparation software, hiring a tax professional, using the Iowa Department of Revenue's website, taking advantage of free tax filing options, or filling out the form yourself.

What are some common mistakes to avoid when filling out the Iowa 1040 form?

+Common mistakes to avoid include failing to sign and date the form, not reporting all income, claiming deductions and credits you're not eligible for, and not keeping a copy of the form for your records.