As a homebuyer or homeowner, navigating the complex world of mortgage financing can be overwhelming. One crucial document that may come into play during this process is the Notice of Deficiency Waiver Form 5564. This form plays a significant role in the mortgage financing process, particularly when dealing with government-backed loans like FHA and VA loans. In this comprehensive guide, we will delve into the world of Notice of Deficiency Waiver Form 5564, explaining its purpose, benefits, and the steps involved in obtaining one.

Understanding the Notice of Deficiency Waiver Form 5564

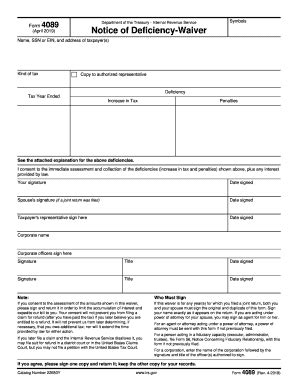

The Notice of Deficiency Waiver Form 5564 is a document used by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) to notify borrowers of a deficiency in their mortgage application. This deficiency can arise due to various reasons such as incomplete or inaccurate information, insufficient credit history, or failure to meet the minimum requirements for loan approval. The Notice of Deficiency Waiver Form 5564 is designed to inform borrowers of the specific issues that need to be addressed before their loan application can be approved.

Why is the Notice of Deficiency Waiver Form 5564 Important?

The Notice of Deficiency Waiver Form 5564 is a critical document in the mortgage financing process. Its importance can be understood from the following perspectives:

- Borrower Awareness: The form ensures that borrowers are aware of the issues that need to be resolved before their loan application can be approved. This helps borrowers to take corrective action and provide the necessary documentation or information to rectify the deficiency.

- Lender Compliance: The Notice of Deficiency Waiver Form 5564 helps lenders to comply with regulatory requirements. By issuing this form, lenders demonstrate their due diligence in verifying the borrower's creditworthiness and ensuring that the loan meets the necessary standards.

- Streamlined Process: The form facilitates a streamlined process for resolving deficiencies. By clearly outlining the issues that need to be addressed, lenders and borrowers can work together to resolve the deficiency and move forward with the loan application.

Benefits of the Notice of Deficiency Waiver Form 5564

The Notice of Deficiency Waiver Form 5564 offers several benefits to both lenders and borrowers. Some of the key benefits include:

- Improved Communication: The form ensures clear communication between lenders and borrowers regarding the issues that need to be addressed.

- Increased Transparency: The Notice of Deficiency Waiver Form 5564 provides transparency in the loan application process, helping borrowers to understand the reasons for the deficiency.

- Reduced Delays: By clearly outlining the issues that need to be resolved, the form helps to reduce delays in the loan application process.

How to Obtain a Notice of Deficiency Waiver Form 5564

Obtaining a Notice of Deficiency Waiver Form 5564 is a straightforward process. Here are the steps involved:

- Contact the Lender: Borrowers should contact their lender to request a Notice of Deficiency Waiver Form 5564.

- Submit Required Documentation: Borrowers will need to submit the required documentation to support their loan application.

- Lender Review: The lender will review the documentation and issue a Notice of Deficiency Waiver Form 5564 outlining the issues that need to be addressed.

Steps to Resolve a Deficiency

Resolving a deficiency requires careful attention to detail and timely action. Here are the steps to follow:

- Review the Notice: Borrowers should carefully review the Notice of Deficiency Waiver Form 5564 to understand the issues that need to be addressed.

- Gather Required Documentation: Borrowers should gather the required documentation to support their loan application.

- Submit Documentation: Borrowers should submit the required documentation to the lender.

- Lender Review: The lender will review the documentation and update the loan application.

Common Deficiencies and Solutions

Some common deficiencies that may arise during the loan application process include:

- Insufficient Credit History: Borrowers with insufficient credit history may need to provide additional documentation to support their creditworthiness.

- Inaccurate Income Information: Borrowers who have provided inaccurate income information may need to submit corrected documentation.

- Inadequate Collateral: Borrowers who have provided inadequate collateral may need to provide additional collateral to secure the loan.

Conclusion and Next Steps

In conclusion, the Notice of Deficiency Waiver Form 5564 is a critical document in the mortgage financing process. By understanding the purpose and benefits of this form, borrowers can take proactive steps to resolve deficiencies and move forward with their loan application. If you have received a Notice of Deficiency Waiver Form 5564, we encourage you to review the information carefully and take timely action to resolve the deficiency. By working closely with your lender and providing the required documentation, you can overcome the deficiency and achieve your goal of homeownership.

Frequently Asked Questions

What is the purpose of the Notice of Deficiency Waiver Form 5564?

+The Notice of Deficiency Waiver Form 5564 is used to notify borrowers of a deficiency in their mortgage application.

How do I obtain a Notice of Deficiency Waiver Form 5564?

+Borrowers can obtain a Notice of Deficiency Waiver Form 5564 by contacting their lender and submitting the required documentation.

What are some common deficiencies that may arise during the loan application process?

+Common deficiencies include insufficient credit history, inaccurate income information, and inadequate collateral.

We hope this comprehensive guide has provided you with a deeper understanding of the Notice of Deficiency Waiver Form 5564. If you have any further questions or concerns, please don't hesitate to reach out to us.