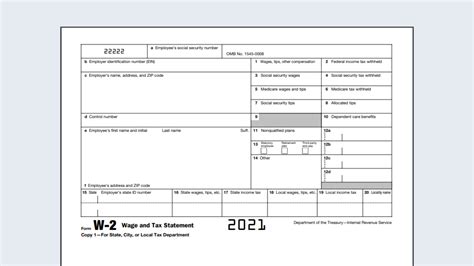

Working as an employee of The Cheesecake Factory can be a rewarding experience, but when tax season arrives, one crucial document you'll need is your W2 form. The W2 form, also known as the Wage and Tax Statement, is a vital document that reports your income and taxes withheld to the Social Security Administration (SSA) and the Internal Revenue Service (IRS). If you're having trouble obtaining your W2 form from The Cheesecake Factory, don't worry – we've got you covered. Here are five ways to get your Cheesecake Factory W2 form.

Understanding the Importance of W2 Forms

Before we dive into the ways to obtain your W2 form, it's essential to understand why this document is crucial. The W2 form provides a record of your income and taxes withheld, which you'll need to file your tax return accurately. Your employer is required to provide you with a W2 form by January 31st of each year, showing the previous year's income and taxes withheld.

Method 1: Requesting a W2 Form from The Cheesecake Factory HR Department

If you're having trouble finding your W2 form or didn't receive one, you can contact The Cheesecake Factory's HR department directly. They should be able to provide you with a duplicate W2 form or guide you on how to obtain one. You can reach out to them via phone or email, and they'll assist you in getting the necessary documentation.

What to Do When Contacting the HR Department

- Have your employee ID and Social Security number ready to verify your identity.

- Explain your situation and request a duplicate W2 form.

- Provide your mailing address or email address where you'd like the W2 form to be sent.

Method 2: Logging into The Cheesecake Factory's Employee Portal

If you're a current or former employee of The Cheesecake Factory, you may be able to access your W2 form through the company's employee portal. This portal is usually available online, and you can log in using your employee ID and password.

Steps to Access Your W2 Form on the Employee Portal

- Go to The Cheesecake Factory's employee portal website.

- Log in using your employee ID and password.

- Navigate to the "Payroll" or "Tax Documents" section.

- Click on the "W2 Form" option and select the year you need.

- Download or print your W2 form.

Method 3: Contacting the IRS for a W2 Form

If you're unable to get a W2 form from The Cheesecake Factory, you can contact the IRS for assistance. The IRS can provide you with a transcript of your W2 form, which you can use to file your tax return.

What to Do When Contacting the IRS

- Call the IRS at 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses).

- Explain your situation and request a W2 transcript.

- Provide your Social Security number and the tax year you need.

Method 4: Using the SSA Website to Get a W2 Form

The Social Security Administration (SSA) also provides a way to obtain a W2 form. You can create an account on their website and request a W2 transcript.

Steps to Get a W2 Form on the SSA Website

- Go to the SSA website and create an account.

- Log in to your account and navigate to the "My Account" section.

- Click on the "W2 Transcript" option and select the year you need.

- Download or print your W2 transcript.

Method 5: Reaching Out to Your Former Manager or Supervisor

If you're a former employee of The Cheesecake Factory, you can try reaching out to your former manager or supervisor for assistance. They may be able to provide you with a W2 form or guide you on how to obtain one.

What to Do When Reaching Out to Your Former Manager

- Explain your situation and request a W2 form.

- Provide your employee ID and Social Security number to verify your identity.

- Ask if they can provide you with a duplicate W2 form or guide you on how to obtain one.

By following these five methods, you should be able to obtain your Cheesecake Factory W2 form. Remember to keep your W2 form safe and secure, as it contains sensitive information.

We hope this article has been helpful in guiding you on how to get your Cheesecake Factory W2 form. If you have any further questions or concerns, please don't hesitate to reach out.

What is a W2 form?

+A W2 form, also known as the Wage and Tax Statement, is a document that reports an employee's income and taxes withheld to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Why do I need a W2 form?

+You need a W2 form to file your tax return accurately. The W2 form provides a record of your income and taxes withheld, which you'll need to report on your tax return.

What if I didn't receive a W2 form from The Cheesecake Factory?

+If you didn't receive a W2 form from The Cheesecake Factory, you can try contacting the HR department, logging into the employee portal, or reaching out to the IRS for assistance.