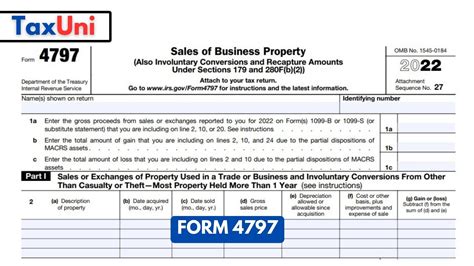

The intricacies of tax filing can be overwhelming, especially for small business owners and self-employed individuals. One of the most critical tax forms for businesses that sell or dispose of assets is Form 4797, also known as the Sales of Business Property form. This form is used to report the sale, exchange, or disposition of business assets, including equipment, vehicles, and real estate. In this article, we will delve into the world of Form 4797 and provide you with 5 essential filing instructions to ensure you navigate the process with ease.

Understanding Form 4797: A Brief Overview

Before we dive into the filing instructions, it's essential to understand the purpose of Form 4797. This form is used to report the sale, exchange, or disposition of business assets, including:

- Equipment and machinery

- Vehicles

- Real estate

- Depreciable assets

- Amortizable assets

The form is used to calculate the gain or loss from the sale of these assets, which is then reported on the business's tax return.

5 Essential Filing Instructions for Form 4797

1. Determine the Type of Asset Sold

The first step in filing Form 4797 is to determine the type of asset sold. This will help you determine the correct category to report the sale in. The most common categories are:

- Section 1245 property (e.g., equipment, machinery, and vehicles)

- Section 1250 property (e.g., real estate)

- Section 1231 property (e.g., depreciable assets)

2. Calculate the Gain or Loss

Once you've determined the type of asset sold, you'll need to calculate the gain or loss from the sale. This is done by subtracting the asset's adjusted basis from the sale price. The adjusted basis is the original purchase price minus any depreciation or amortization taken on the asset.

For example, let's say you sold a piece of equipment for $10,000 that had an original purchase price of $8,000 and had $2,000 in depreciation taken over its useful life. The adjusted basis would be $6,000 ($8,000 - $2,000), and the gain would be $4,000 ($10,000 - $6,000).

3. Complete Part I of Form 4797

Part I of Form 4797 is used to report the sale of assets that are not subject to depreciation or amortization. This includes assets such as:

- Inventory

- Stock

- Bonds

- Securities

You'll need to report the sale price, adjusted basis, and gain or loss for each asset sold.

4. Complete Part II of Form 4797

Part II of Form 4797 is used to report the sale of assets that are subject to depreciation or amortization. This includes assets such as:

- Equipment and machinery

- Vehicles

- Real estate

- Depreciable assets

You'll need to report the sale price, adjusted basis, and gain or loss for each asset sold, as well as any depreciation or amortization taken on the asset.

5. Attach Supporting Documentation

Finally, you'll need to attach supporting documentation to Form 4797, including:

- Proof of sale (e.g., bill of sale, invoice)

- Proof of adjusted basis (e.g., depreciation schedules, amortization records)

- Proof of gain or loss (e.g., calculation worksheets)

Common Mistakes to Avoid When Filing Form 4797

When filing Form 4797, there are several common mistakes to avoid, including:

- Failing to report all assets sold

- Incorrectly calculating the gain or loss

- Failing to attach supporting documentation

- Not signing and dating the form

By following these 5 essential filing instructions and avoiding common mistakes, you'll be able to navigate the process of filing Form 4797 with ease.

What is Form 4797 used for?

+Form 4797 is used to report the sale, exchange, or disposition of business assets, including equipment, vehicles, and real estate.

What types of assets are reported on Form 4797?

+Form 4797 is used to report the sale of assets that are subject to depreciation or amortization, including equipment, vehicles, real estate, and depreciable assets.

What is the adjusted basis of an asset?

+The adjusted basis of an asset is the original purchase price minus any depreciation or amortization taken on the asset.

We hope this article has provided you with a comprehensive understanding of Form 4797 and the 5 essential filing instructions to ensure a smooth and accurate filing process. If you have any further questions or concerns, please don't hesitate to reach out.