Understanding the Importance of Converting to a Roth IRA with TD Ameritrade

Converting your traditional IRA to a Roth IRA can be a strategic move for your retirement savings, offering potential tax benefits and increased flexibility. TD Ameritrade, a leading online brokerage firm, provides a straightforward process for completing a Roth conversion. In this article, we'll guide you through the 5 steps to complete the TD Ameritrade Roth conversion form, helping you make the most of this financial opportunity.

What is a Roth IRA Conversion?

A Roth IRA conversion involves transferring funds from a traditional IRA to a Roth IRA. This process allows you to pay taxes on the converted amount upfront, potentially reducing your tax liability in retirement. The main benefits of a Roth IRA include tax-free growth and withdrawals, as well as no required minimum distributions (RMDs) during your lifetime.

Benefits of Converting to a Roth IRA with TD Ameritrade

- Tax-free growth and withdrawals

- No RMDs during your lifetime

- Increased flexibility and control over your retirement savings

- Potential for lower taxes in retirement

Step 1: Determine Your Eligibility for a Roth IRA Conversion

Before starting the conversion process, ensure you meet the eligibility requirements. TD Ameritrade allows conversions from traditional IRAs, rollover IRAs, and employer-sponsored retirement plans. You'll need to have a TD Ameritrade account and meet the income limits set by the IRS.

- Check your income level: The IRS has income limits for Roth IRA conversions. For the 2022 tax year, you can convert a traditional IRA to a Roth IRA if your income is below $137,500 for single filers or $208,500 for joint filers.

- Verify your account eligibility: Ensure your TD Ameritrade account is eligible for a Roth IRA conversion.

Step 2: Gather Required Documents and Information

To complete the Roth conversion form, you'll need to gather the following documents and information:

- TD Ameritrade account number

- Traditional IRA account information

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Date of birth

- Address

Additional Requirements

- If you have multiple traditional IRAs, you may need to aggregate the values to determine the taxable amount.

- If you have outstanding loans or other obligations, you may need to provide additional documentation.

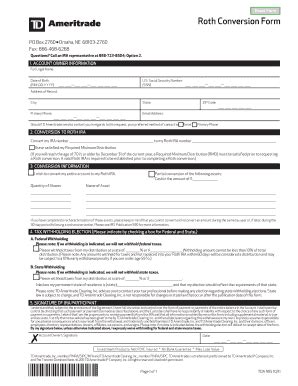

Step 3: Complete the TD Ameritrade Roth Conversion Form

Once you have gathered the required documents and information, you can complete the TD Ameritrade Roth conversion form. You can access the form through your online account or by contacting TD Ameritrade customer support.

- Log in to your TD Ameritrade account and navigate to the "My Accounts" section.

- Select the traditional IRA account you want to convert.

- Click on the "Convert to Roth IRA" button and follow the prompts.

- Review and submit the conversion form.

Step 4: Review and Confirm the Conversion

After submitting the conversion form, review and confirm the details to ensure accuracy.

- Verify the converted amount and tax implications.

- Review the converted funds' investment options and asset allocation.

- Confirm the conversion is complete and the funds are now in your Roth IRA.

Step 5: Monitor and Adjust Your Roth IRA

Once the conversion is complete, it's essential to monitor and adjust your Roth IRA as needed.

- Regularly review your investment portfolio and rebalance as necessary.

- Consider consulting with a financial advisor to optimize your retirement strategy.

- Keep track of any changes to tax laws or regulations that may impact your Roth IRA.

By following these 5 steps, you can successfully complete the TD Ameritrade Roth conversion form and take advantage of the benefits a Roth IRA has to offer. Remember to carefully review and understand the tax implications and potential consequences before initiating the conversion process.

What is the deadline for completing a Roth IRA conversion?

+The deadline for completing a Roth IRA conversion is typically December 31st of each year. However, it's essential to check with TD Ameritrade and the IRS for any specific requirements or deadlines.

Can I convert a traditional IRA to a Roth IRA if I have outstanding loans or other obligations?

+Yes, you can convert a traditional IRA to a Roth IRA with outstanding loans or other obligations. However, you may need to provide additional documentation and meet specific requirements. It's best to consult with TD Ameritrade and a financial advisor to determine the best course of action.

How do I report a Roth IRA conversion on my tax return?

+You'll need to report the Roth IRA conversion on Form 8606, Nondeductible IRAs. You'll also receive a Form 1099-R from TD Ameritrade, which will show the amount of the conversion. Consult with a tax professional or financial advisor to ensure accurate reporting and compliance with tax regulations.