As a business owner, understanding how to calculate depreciation can be a daunting task, especially when it comes to filling out Form 4562, the Depreciation and Amortization form. However, accurately calculating depreciation is crucial to ensure you're taking advantage of the deductions you're eligible for, which can help reduce your taxable income and lower your tax bill. In this article, we'll provide a step-by-step guide on how to complete Form 4562, including explanations of the different sections and examples to help illustrate the process.

What is Form 4562?

Form 4562 is a tax form used by the Internal Revenue Service (IRS) to report depreciation and amortization of assets. It's used to calculate the depreciation of tangible assets, such as buildings, equipment, and vehicles, as well as intangible assets, such as patents and copyrights. The form is typically filed annually, along with your business's tax return.

Section 1: Part I - Depreciation of Property Placed in Service

The first section of Form 4562 is Part I, which deals with the depreciation of property placed in service. This section requires you to list each asset, including the date it was placed in service, the cost of the asset, and the depreciation method used.

How to Complete Part I

To complete Part I, follow these steps:

- List each asset separately, including the date it was placed in service.

- Enter the cost of each asset in column (b).

- Choose the depreciation method used for each asset from the options listed in the instructions.

- Enter the depreciation amount for each asset in column (d).

Section 2: Part II - Amortization of Intangibles

Part II of Form 4562 deals with the amortization of intangible assets, such as patents, copyrights, and trademarks.

How to Complete Part II

To complete Part II, follow these steps:

- List each intangible asset separately, including the date it was acquired.

- Enter the cost of each intangible asset in column (b).

- Choose the amortization method used for each intangible asset from the options listed in the instructions.

- Enter the amortization amount for each intangible asset in column (d).

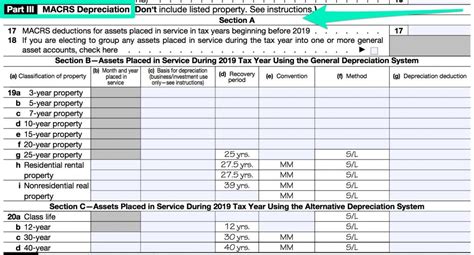

Section 3: Part III - MACRS Depreciation

Part III of Form 4562 deals with the Modified Accelerated Cost Recovery System (MACRS) depreciation method. This method is used to depreciate tangible assets, such as buildings and equipment.

How to Complete Part III

To complete Part III, follow these steps:

- List each asset separately, including the date it was placed in service.

- Enter the cost of each asset in column (b).

- Choose the MACRS depreciation method used for each asset from the options listed in the instructions.

- Enter the depreciation amount for each asset in column (d).

Section 4: Part IV - Special Depreciation Allowance

Part IV of Form 4562 deals with the special depreciation allowance, which is a bonus depreciation that can be claimed in the first year an asset is placed in service.

How to Complete Part IV

To complete Part IV, follow these steps:

- List each asset separately, including the date it was placed in service.

- Enter the cost of each asset in column (b).

- Choose the special depreciation allowance method used for each asset from the options listed in the instructions.

- Enter the special depreciation allowance amount for each asset in column (d).

Section 5: Part V - Listed Property

Part V of Form 4562 deals with listed property, which includes assets such as vehicles and aircraft.

How to Complete Part V

To complete Part V, follow these steps:

- List each listed property separately, including the date it was placed in service.

- Enter the cost of each listed property in column (b).

- Choose the depreciation method used for each listed property from the options listed in the instructions.

- Enter the depreciation amount for each listed property in column (d).

Section 6: Part VI - Amortization of Section 197 Intangibles

Part VI of Form 4562 deals with the amortization of Section 197 intangibles, which includes assets such as patents and copyrights.

How to Complete Part VI

To complete Part VI, follow these steps:

- List each Section 197 intangible separately, including the date it was acquired.

- Enter the cost of each Section 197 intangible in column (b).

- Choose the amortization method used for each Section 197 intangible from the options listed in the instructions.

- Enter the amortization amount for each Section 197 intangible in column (d).

Conclusion

Completing Form 4562 can be a complex and time-consuming process, but by following the steps outlined in this guide, you can ensure you're taking advantage of the depreciation deductions you're eligible for. Remember to keep accurate records of your assets and depreciation methods, and consult with a tax professional if you're unsure about any part of the process. By doing so, you can reduce your taxable income and lower your tax bill.

Frequently Asked Questions

What is the purpose of Form 4562?

+Form 4562 is used to report depreciation and amortization of assets.

What is the difference between depreciation and amortization?

+Depreciation is the decrease in value of tangible assets, while amortization is the decrease in value of intangible assets.

What is the Modified Accelerated Cost Recovery System (MACRS) depreciation method?

+MACRS is a depreciation method that allows for accelerated depreciation of tangible assets.