The VA Form 10-7959c, also known as the "Request for Certificate of Eligibility" form, is a crucial document for veterans and their families who are seeking to utilize their VA loan benefits. In this article, we will delve into the details of the form, its importance, and provide a comprehensive guide on how to fill it out accurately.

Understanding the VA Form 10-7959c

The VA Form 10-7959c is used to request a Certificate of Eligibility (COE), which is a required document for veterans and their families to prove their eligibility for a VA loan. The COE is issued by the Department of Veterans Affairs and confirms the borrower's status as a veteran or their entitlement to VA loan benefits.

Why is the VA Form 10-7959c Important?

The VA Form 10-7959c is a critical document in the VA loan process. Without it, veterans and their families may not be able to take advantage of their VA loan benefits, which include favorable terms, lower interest rates, and lower mortgage insurance premiums. By filling out the form accurately, borrowers can ensure that they receive their COE in a timely manner and avoid delays in the loan process.

How to Fill Out the VA Form 10-7959c

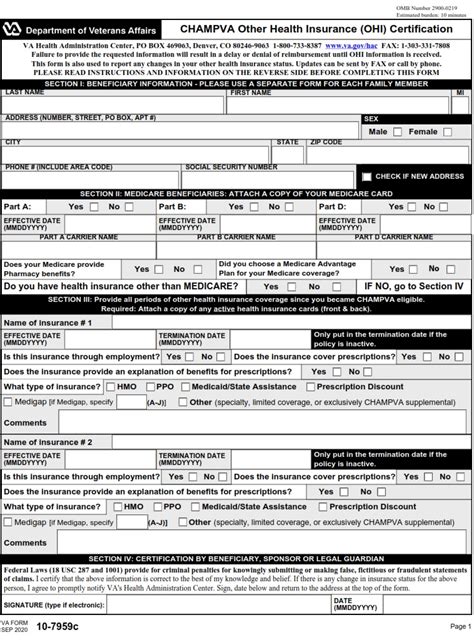

To fill out the VA Form 10-7959c, borrowers will need to provide the following information:

- Personal details, such as name, Social Security number, and date of birth

- Military service information, including branch, dates of service, and discharge status

- Information about previous VA loans, if applicable

- The purpose of the loan, such as purchasing a home or refinancing an existing mortgage

Section 1: Borrower Information

- Section 1 requires borrowers to provide their personal details, including name, Social Security number, and date of birth.

- Borrowers must also provide their contact information, including address and phone number.

Section 2: Military Service Information

- Section 2 requires borrowers to provide information about their military service, including branch, dates of service, and discharge status.

- Borrowers must also provide their military identification number and DD Form 214, if applicable.

Section 3: Previous VA Loans

- Section 3 requires borrowers to provide information about previous VA loans, if applicable.

- Borrowers must provide the loan number, property address, and the date the loan was closed.

Section 4: Purpose of the Loan

- Section 4 requires borrowers to state the purpose of the loan, such as purchasing a home or refinancing an existing mortgage.

- Borrowers must also provide the estimated value of the property and the loan amount.

Tips for Filling Out the VA Form 10-7959c

Here are some tips for filling out the VA Form 10-7959c:

- Make sure to read the instructions carefully and fill out the form accurately.

- Provide all required documentation, including DD Form 214 and proof of income.

- Double-check the form for errors before submitting it.

- If you have any questions or concerns, contact the VA or a qualified lender for assistance.

FAQs

What is the purpose of the VA Form 10-7959c?

+The VA Form 10-7959c is used to request a Certificate of Eligibility (COE), which is a required document for veterans and their families to prove their eligibility for a VA loan.

How do I fill out the VA Form 10-7959c?

+To fill out the VA Form 10-7959c, borrowers will need to provide personal details, military service information, information about previous VA loans, and the purpose of the loan.

What documents do I need to provide with the VA Form 10-7959c?

+Borrowers will need to provide DD Form 214, proof of income, and other documentation as required by the VA.

By following the tips and guidelines outlined in this article, veterans and their families can ensure that they fill out the VA Form 10-7959c accurately and receive their COE in a timely manner. If you have any questions or concerns, don't hesitate to reach out to the VA or a qualified lender for assistance.

In conclusion, the VA Form 10-7959c is a critical document in the VA loan process. By understanding its importance and following the tips outlined in this article, borrowers can ensure that they take advantage of their VA loan benefits and achieve their dream of homeownership.