The world of tax filing can be overwhelming, especially when dealing with investment income and losses. Form Schedule D 1040 is a crucial part of the tax filing process for individuals who have investment income, such as capital gains and losses from the sale of stocks, bonds, and other investment assets. In this article, we will provide you with 8 essential tips to help you accurately fill out Form Schedule D 1040.

As the tax season approaches, it's essential to understand the importance of accurately reporting investment income and losses on Form Schedule D 1040. This form is used to calculate the total capital gains and losses from the sale of investment assets, which can significantly impact your tax liability. Failure to accurately report this information can lead to delays in processing your tax return, penalties, and even audits.

Here are 8 valuable tips to help you fill out Form Schedule D 1040 with confidence:

Understanding the Purpose of Form Schedule D 1040

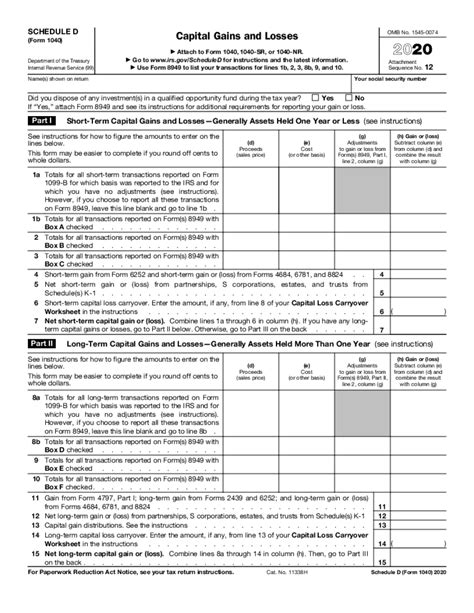

Form Schedule D 1040 is used to report the sale or exchange of investment assets, such as stocks, bonds, and real estate. This form is used to calculate the total capital gains and losses from these transactions, which are then reported on Form 1040.

What is a Capital Gain or Loss?

A capital gain occurs when you sell an investment asset for more than its original purchase price. Conversely, a capital loss occurs when you sell an investment asset for less than its original purchase price. For example, if you buy a stock for $1,000 and sell it for $1,200, you have a capital gain of $200. On the other hand, if you buy a stock for $1,000 and sell it for $800, you have a capital loss of $200.

Tips for Filling Out Form Schedule D 1040

- Gather all necessary documents: Before starting to fill out Form Schedule D 1040, gather all necessary documents, including:

- Form 1099-B (Proceeds from Broker and Barter Exchange Transactions)

- Form 1099-DIV (Dividend Income)

- Form 1099-INT (Interest Income)

- Your investment statements and records

- Understand the different types of capital gains and losses: There are two types of capital gains and losses:

- Short-term capital gains and losses (assets held for one year or less)

- Long-term capital gains and losses (assets held for more than one year)

- Complete Part I of Form Schedule D: Part I is used to report the sale or exchange of investment assets. You will need to report the date of sale, the gross proceeds from the sale, and the cost or other basis of the asset.

- Complete Part II of Form Schedule D: Part II is used to report the gains and losses from the sale of investment assets. You will need to report the gain or loss from each sale, as well as the total gain or loss.

- Complete Part III of Form Schedule D: Part III is used to report the total capital gains and losses from all investment assets. You will need to report the total gain or loss from all sales, as well as the net gain or loss.

- Apply the correct tax rates: The tax rates for capital gains and losses depend on the type of asset and the length of time it was held. For example, long-term capital gains are generally taxed at a lower rate than short-term capital gains.

- Report wash sales: If you sell an investment asset at a loss and purchase a substantially identical asset within 30 days before or after the sale, you may be subject to the wash sale rule. This rule prohibits you from claiming the loss on your tax return.

- Seek professional help if needed: If you are unsure about how to fill out Form Schedule D 1040 or have complex investment transactions, consider seeking the help of a tax professional.

Common Mistakes to Avoid When Filling Out Form Schedule D 1040

- Failing to report all investment income and losses

- Incorrectly calculating the gain or loss from the sale of an investment asset

- Failing to apply the correct tax rates

- Not reporting wash sales

- Not seeking professional help when needed

By following these 8 tips and avoiding common mistakes, you can accurately fill out Form Schedule D 1040 and ensure that you are taking advantage of all the tax benefits available to you.

What's Next?

Now that you have a better understanding of how to fill out Form Schedule D 1040, take the next step and start gathering all the necessary documents and information. If you have any questions or need further guidance, consider seeking the help of a tax professional.

Don't forget to share this article with your friends and family who may also benefit from this information. And, if you have any questions or comments, please leave them below.

What is Form Schedule D 1040 used for?

+Form Schedule D 1040 is used to report the sale or exchange of investment assets, such as stocks, bonds, and real estate.

What is a capital gain or loss?

+A capital gain occurs when you sell an investment asset for more than its original purchase price. A capital loss occurs when you sell an investment asset for less than its original purchase price.

What are the different types of capital gains and losses?

+There are two types of capital gains and losses: short-term capital gains and losses (assets held for one year or less) and long-term capital gains and losses (assets held for more than one year).