Filing taxes can be a daunting task, especially for Wisconsin residents who are new to the process. The Wisconsin Form 1 is the state's individual income tax return, and it's essential to fill it out accurately to avoid delays or penalties. In this article, we'll break down the process into six manageable steps, making it easier for you to complete your Wisconsin Form 1.

Gather Necessary Documents

Before starting to fill out your Wisconsin Form 1, make sure you have all the necessary documents. These include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Any other relevant tax documents

Having these documents ready will save you time and ensure you report all your income accurately.

Step 1: Determine Your Filing Status

Your filing status affects your tax rate and the amount of taxes you owe. Wisconsin recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you're taxed correctly.

Step 2: Report Your Income

Report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Unemployment compensation

- Social Security benefits

Use the information from your W-2 and 1099 forms to report your income accurately.

Step 3: Claim Deductions and Credits

Wisconsin offers various deductions and credits to reduce your tax liability. Some common deductions include:

- Standard deduction

- Itemized deductions (e.g., mortgage interest, charitable donations)

- Personal exemptions

Credits include:

- Earned Income Tax Credit (EITC)

- Child tax credit

- Education credits

Claim the deductions and credits you're eligible for to minimize your tax bill.

Step 4: Calculate Your Tax Liability

Using the information from the previous steps, calculate your total tax liability. You can use the tax tables or worksheets provided in the Wisconsin Form 1 instructions to determine your tax.

Step 5: Complete the Form 1 Schedules

If you have specific types of income or deductions, you may need to complete additional schedules, such as:

- Schedule H: Household employment taxes

- Schedule K-1: Partner's share of income, deductions, and credits

- Schedule 1: Additional income and adjustments

Follow the instructions for each schedule to ensure you complete them accurately.

Step 6: Sign and Submit Your Return

Once you've completed your Wisconsin Form 1, sign and date it. You can submit your return electronically or by mail. Make sure to keep a copy of your return for your records.

By following these six steps, you'll be able to accurately fill out your Wisconsin Form 1 and submit it on time.

We hope this article has been helpful in guiding you through the process. If you have any questions or concerns, feel free to ask in the comments below.

What is the deadline for filing Wisconsin Form 1?

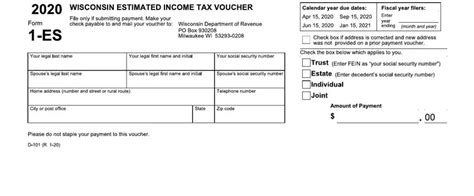

+The deadline for filing Wisconsin Form 1 is typically April 15th of each year. However, if you need an extension, you can file Form 1-ES to request a 6-month extension.

Do I need to file Wisconsin Form 1 if I only have income from self-employment?

+Yes, if you have self-employment income, you're required to file Wisconsin Form 1, even if you don't have any other income. You'll need to complete Schedule C to report your business income and expenses.

Can I e-file my Wisconsin Form 1?

+Yes, you can e-file your Wisconsin Form 1 through the Wisconsin Department of Revenue's website or through a tax preparation software. E-filing is a convenient and faster way to file your return.