Completing tax forms can be a daunting task, especially for those who are new to filing taxes in Oregon. The Oregon Form 40 is the state's standard income tax form, and it's essential to fill it out accurately to avoid delays or penalties. In this article, we'll break down the process into five manageable steps, guiding you through the necessary information and calculations to complete the form successfully.

Understanding the Oregon Form 40

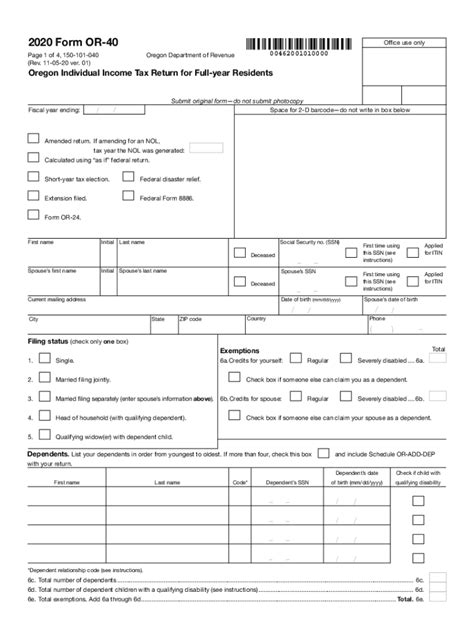

Before diving into the steps, let's quickly overview the purpose and components of the Oregon Form 40. This form is used to report an individual's income tax to the state of Oregon. It's a comprehensive form that covers various types of income, deductions, and credits. The form is divided into sections, each addressing a specific aspect of your tax situation.

Step 1: Gather Necessary Documents and Information

To complete the Oregon Form 40 accurately, you'll need to gather various documents and information. Make sure you have the following:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if applicable)

- W-2 forms from all employers

- 1099 forms for freelance work, interest, dividends, or other income

- Records of deductions, such as mortgage interest, charitable donations, and medical expenses

- Information about your dependents, including their Social Security numbers or ITINs

Calculating Your Income

In this section, we'll focus on calculating your total income, which includes wages, salaries, tips, and other types of income.

Types of Income

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Rental income

- Other income, such as alimony or prizes

Step 2: Calculate Your Total Income

Using the information from your W-2 and 1099 forms, calculate your total income. You'll need to add up the following:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Rental income

- Other income

Example:

Let's say you have a W-2 form showing $50,000 in wages and a 1099 form showing $10,000 in freelance income. Your total income would be $60,000.

Step 3: Calculate Your Deductions

Deductions can help reduce your taxable income. You can choose to itemize deductions or use the standard deduction. If you itemize, you'll need to calculate your deductions for:

- Mortgage interest

- Charitable donations

- Medical expenses

- State and local taxes

- Other deductions, such as home office expenses or investment expenses

Example:

Let's say you have $10,000 in mortgage interest, $2,000 in charitable donations, and $5,000 in medical expenses. Your total itemized deductions would be $17,000.

Step 4: Calculate Your Tax Liability

Using your total income and deductions, calculate your tax liability. You'll need to:

- Calculate your taxable income by subtracting your deductions from your total income

- Use the Oregon tax tables or calculator to determine your tax liability

Example:

Let's say your taxable income is $43,000. Using the Oregon tax tables, you determine your tax liability is $6,500.

Step 5: Complete the Oregon Form 40

Now that you have calculated your income, deductions, and tax liability, it's time to complete the Oregon Form 40.

- Fill in the necessary information, including your name, address, Social Security number, and filing status

- Report your income, deductions, and tax liability

- Sign and date the form

Take Action and Stay Informed

Completing the Oregon Form 40 requires attention to detail and accurate calculations. If you're unsure about any aspect of the process, consider consulting a tax professional or seeking guidance from the Oregon Department of Revenue.

Stay informed about changes to Oregon's tax laws and regulations by visiting the Oregon Department of Revenue website or consulting with a tax expert.

What is the deadline for filing the Oregon Form 40?

+The deadline for filing the Oregon Form 40 is typically April 15th of each year.

Can I e-file my Oregon Form 40?

+Yes, you can e-file your Oregon Form 40 through the Oregon Department of Revenue website or through a tax preparation software.

What if I need an extension to file my Oregon Form 40?

+If you need an extension to file your Oregon Form 40, you can file Form OR-40-EXT by the original deadline.