Understanding Form 2210, the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is crucial for individuals and entities that are required to make estimated tax payments throughout the year. One of the critical components of this form is Line 8, where taxpayers calculate the net amount of estimated tax penalty or the amount that can be waived due to the annualized income installment method. In this comprehensive guide, we will delve into the instructions for Form 2210 Line 8, explaining the process step by step.

Understanding the Basics of Form 2210

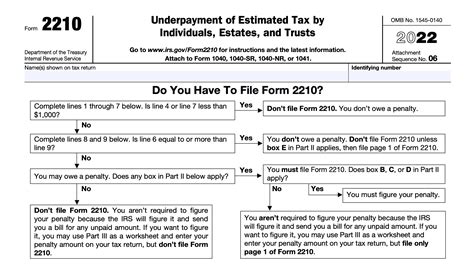

Before diving into Line 8, it's essential to grasp the purpose of Form 2210. This form is used by individuals, estates, and trusts to calculate and report underpayment of estimated tax or to claim the annualized income installment method. The IRS requires taxpayers to make estimated tax payments each quarter if they expect to owe more than $1,000 in taxes for the year. Failure to do so may result in a penalty, which can be calculated using Form 2210.

Step-by-Step Instructions for Line 8

Line 8 of Form 2210 is used to calculate the net amount of estimated tax penalty or the amount that can be waived. Here's how to fill it out step by step:

Step 1: Determine Your Estimated Tax Payments

First, you need to calculate your total estimated tax payments for the year. This includes all quarterly payments made by the due dates for each quarter (April 15th for Q1, June 15th for Q2, September 15th for Q3, and January 15th of the following year for Q4).

Step 2: Calculate Your Total Tax Liability

Next, determine your total tax liability for the year. This can be found on your tax return (Form 1040, 1040-SR, or 1041 for estates and trusts). Subtract any withholding and refundable credits from your total tax liability to find the amount that requires estimated tax payments.

Step 3: Determine the Underpayment Amount

Compare your total estimated tax payments to the amount you should have paid based on your tax liability. If the payments are less than 90% of your current year's tax or 100% of your prior year's tax (110% if your adjusted gross income is over $150,000), you may owe a penalty for underpayment.

Step 4: Calculate the Penalty

If you have an underpayment, calculate the penalty. You can use the Form 2210 worksheets or the Electronic Federal Tax Payment System (EFTPS) to compute the penalty. The penalty is calculated based on the number of days the underpayment remains unpaid.

Step 5: Annualized Income Installment Method

If you qualify, you may be able to waive part or all of the penalty by using the annualized income installment method. This method takes into account the uneven distribution of income throughout the year. Use the Form 2210 worksheets to calculate the annualized income and compare it to your required estimated tax payments.

Step 6: Complete Line 8

Finally, enter the net amount of estimated tax penalty or the amount you are waiving due to the annualized income installment method on Line 8 of Form 2210.

FAQs About Form 2210 Line 8

Q: Who Needs to File Form 2210?

A: Individuals, estates, and trusts that owe more than $1,000 in taxes for the year and did not make sufficient estimated tax payments.

Q: How Do I Calculate the Penalty for Underpayment?

A: Use the Form 2210 worksheets or the EFTPS to compute the penalty based on the underpayment amount and the number of days it remains unpaid.

Q: Can I Waive the Penalty for Underpayment?

A: Yes, if you qualify, you can use the annualized income installment method to waive part or all of the penalty.

Q: What If I Am Required to Make Estimated Tax Payments but Did Not?

A: You may be subject to a penalty, which can be calculated using Form 2210.

What is the purpose of Form 2210?

+Form 2210 is used to calculate and report underpayment of estimated tax or to claim the annualized income installment method.

How do I avoid the penalty for underpayment of estimated tax?

+Make timely estimated tax payments, use the annualized income installment method if qualified, or avoid underpayment by making sufficient payments throughout the year.

Can I file Form 2210 electronically?

+Yes, you can e-file Form 2210 with your tax return or separately if you need to make a payment or claim a waiver.

By following these step-by-step instructions and understanding the nuances of Form 2210 Line 8, individuals and entities can accurately calculate and report their estimated tax underpayment penalty or waiver. Remember, timely and accurate filing can help avoid unnecessary penalties and ensure compliance with tax regulations.

Call to Action

If you're struggling with understanding Form 2210 or have questions about the estimated tax penalty, consider consulting a tax professional. They can provide personalized guidance and help you navigate the complexities of tax law. Additionally, share this article with friends or family members who may benefit from this comprehensive guide.