Receiving a tax form from the government can be a daunting experience, especially if you're unsure what it means or how to proceed. For Illinois residents, the 1099-G form is a crucial document that reports various types of income and payments. As a taxpayer, understanding the Illinois 1099-G form is essential to ensure you're in compliance with state tax laws and taking advantage of the credits and deductions you're eligible for.

The Illinois 1099-G form is an annual report that summarizes certain types of income, including unemployment compensation, state and local income tax refunds, and other government payments. This form is typically mailed to recipients by January 31st of each year, and it's essential to review it carefully to ensure accuracy and completeness. In this article, we'll delve into the details of the Illinois 1099-G form, explaining its purpose, how to read it, and what to do with the information it contains.

What is the Illinois 1099-G Form?

The Illinois 1099-G form is a tax document issued by the Illinois Department of Employment Security (IDES) and the Illinois Department of Revenue (IDOR). Its primary purpose is to report various types of income and payments made to individuals, including:

- Unemployment compensation

- State and local income tax refunds

- Repayments of prior-year state and local income tax overpayments

- Certain government payments, such as state and local government-funded pensions and annuities

The form is used to report these payments to the recipient and to the Internal Revenue Service (IRS) and the IDOR. The information on the 1099-G form is used to determine an individual's taxable income and to calculate any tax liability or refund due.

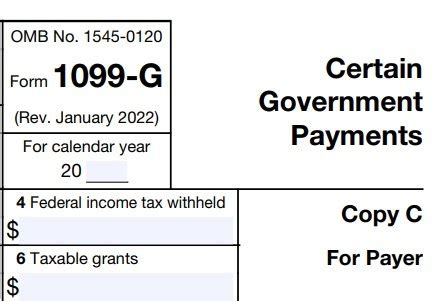

How to Read the Illinois 1099-G Form

The Illinois 1099-G form is divided into several sections, each containing different types of information. Here's a breakdown of what you'll find on the form:

- Recipient's Information: This section includes the recipient's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Payer's Information: This section includes the payer's name, address, and Federal Employer Identification Number (FEIN) or other identifying number.

- Box 1: Unemployment Compensation: This section reports the total amount of unemployment compensation paid to the recipient during the tax year.

- Box 2: State and Local Income Tax Refunds: This section reports the total amount of state and local income tax refunds paid to the recipient during the tax year.

- Box 3: Repayments of Prior-Year State and Local Income Tax Overpayments: This section reports the total amount of repayments made to the recipient for prior-year state and local income tax overpayments.

- Box 4: Certain Government Payments: This section reports the total amount of certain government payments, such as state and local government-funded pensions and annuities.

What to Do with the Illinois 1099-G Form

When you receive your Illinois 1099-G form, it's essential to review it carefully to ensure accuracy and completeness. Here are some steps to take:

- Verify the Information: Check the recipient's information, payer's information, and the amounts reported in each box to ensure everything is accurate.

- Report the Income: If you received unemployment compensation, state and local income tax refunds, or certain government payments, you'll need to report this income on your Illinois state tax return.

- Claim the Credits: If you're eligible for credits, such as the Earned Income Tax Credit (EITC), you'll need to claim them on your Illinois state tax return.

- Keep the Form for Your Records: Keep a copy of the 1099-G form with your tax records in case you need to refer to it later.

Tax Implications of the Illinois 1099-G Form

The Illinois 1099-G form has several tax implications, including:

- Taxable Income: The income reported on the 1099-G form is considered taxable income and must be reported on your Illinois state tax return.

- Tax Credits: You may be eligible for tax credits, such as the EITC, based on the income reported on the 1099-G form.

- Tax Liability: You may have a tax liability if you owe taxes on the income reported on the 1099-G form.

Frequently Asked Questions

Here are some frequently asked questions about the Illinois 1099-G form:

- Q: What is the deadline for receiving the Illinois 1099-G form? A: The Illinois 1099-G form is typically mailed by January 31st of each year.

- Q: What types of income are reported on the Illinois 1099-G form? A: The form reports unemployment compensation, state and local income tax refunds, and certain government payments.

- Q: Do I need to report the income on the Illinois 1099-G form on my tax return? A: Yes, you'll need to report the income on your Illinois state tax return.

What if I didn't receive my Illinois 1099-G form?

+If you didn't receive your Illinois 1099-G form, you can contact the IDES or IDOR to request a duplicate copy.

Can I file my tax return without the Illinois 1099-G form?

+No, you'll need to wait until you receive your Illinois 1099-G form before filing your tax return.

How do I report the income on the Illinois 1099-G form on my tax return?

+You'll need to report the income on your Illinois state tax return, using the information reported on the 1099-G form.

In conclusion, understanding the Illinois 1099-G form is crucial for taxpayers to ensure they're in compliance with state tax laws and taking advantage of the credits and deductions they're eligible for. By reviewing the form carefully, verifying the information, and reporting the income on your tax return, you can ensure a smooth tax filing process. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the IDES or IDOR for assistance.