Applying for a personal loan can be a daunting task, especially when it comes to filling out the application form. A well-structured and comprehensive loan application form is essential for lenders to assess the creditworthiness of borrowers and make informed decisions. In this article, we will discuss the importance of a free personal loan application form template download, its benefits, and what to include in the form.

Benefits of Using a Free Personal Loan Application Form Template

Using a free personal loan application form template can save time and effort for both lenders and borrowers. Here are some benefits of using a template:

- Streamlined Application Process: A template helps to organize the application process, making it easier for borrowers to provide the required information and for lenders to review the application.

- Reduced Errors: A template reduces the likelihood of errors and omissions, ensuring that all necessary information is provided.

- Faster Processing: With a template, lenders can quickly review and process the application, reducing the time it takes to approve or reject the loan.

- Improved Customer Experience: A well-designed template can improve the overall customer experience, making it easier for borrowers to apply for a loan and increasing the chances of approval.

What to Include in a Personal Loan Application Form Template

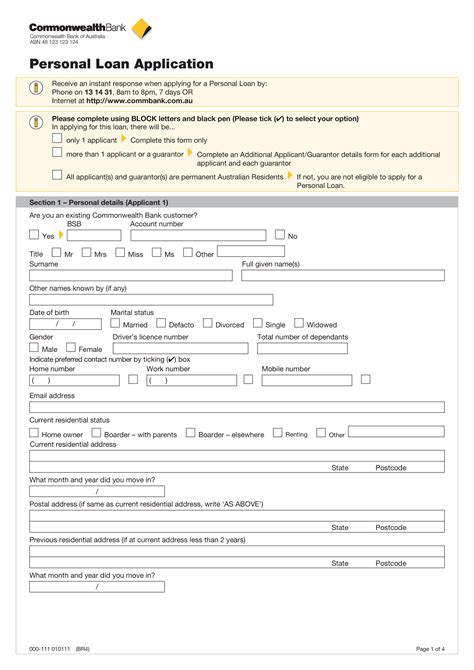

A comprehensive personal loan application form template should include the following sections:

- Borrower Information: This section should include the borrower's personal details, such as name, address, date of birth, and contact information.

- Employment Information: This section should include the borrower's employment details, such as job title, employer, income, and employment duration.

- Income and Expenses: This section should include the borrower's income and expenses, such as salary, rent, utilities, and other debt obligations.

- Credit History: This section should include the borrower's credit history, including credit scores, credit accounts, and any past defaults or bankruptcies.

- Loan Details: This section should include the loan details, such as the loan amount, interest rate, repayment term, and loan purpose.

- Guarantor Information: If the borrower has a guarantor, this section should include the guarantor's personal and employment details.

- Additional Information: This section should include any additional information that the lender requires, such as bank statements, pay stubs, or identification documents.

Personal Loan Application Form Template Download

There are many websites that offer free personal loan application form templates that can be downloaded and customized to suit the lender's needs. Some popular websites include:

- Microsoft Word Templates: Microsoft offers a range of free loan application form templates that can be downloaded and customized.

- Google Docs Templates: Google Docs offers a range of free loan application form templates that can be downloaded and customized.

- Loan Application Form Templates: There are many websites that offer free loan application form templates, such as Vertex42, Template.net, and PDF Templates.

Best Practices for Using a Personal Loan Application Form Template

When using a personal loan application form template, there are several best practices to keep in mind:

- Customize the Template: Customize the template to suit the lender's needs and branding.

- Make it Easy to Understand: Make sure the template is easy to understand and fill out, with clear instructions and labels.

- Test the Template: Test the template before using it to ensure that it is working correctly and that all fields are functioning properly.

- Keep it Up-to-Date: Keep the template up-to-date with the latest regulations and requirements.

Common Mistakes to Avoid When Using a Personal Loan Application Form Template

When using a personal loan application form template, there are several common mistakes to avoid:

- Using an Outdated Template: Using an outdated template that does not comply with the latest regulations and requirements.

- Not Customizing the Template: Not customizing the template to suit the lender's needs and branding.

- Making it Too Complicated: Making the template too complicated or difficult to fill out.

- Not Testing the Template: Not testing the template before using it to ensure that it is working correctly.

In conclusion, a free personal loan application form template download can save time and effort for both lenders and borrowers. By including all the necessary sections and following best practices, lenders can streamline the application process and improve the overall customer experience.

What is a personal loan application form template?

+A personal loan application form template is a pre-designed form that lenders can use to collect information from borrowers when applying for a personal loan.

What are the benefits of using a personal loan application form template?

+The benefits of using a personal loan application form template include streamlined application process, reduced errors, faster processing, and improved customer experience.

What should be included in a personal loan application form template?

+A personal loan application form template should include borrower information, employment information, income and expenses, credit history, loan details, guarantor information, and additional information.