The world of tax-saving investments can be overwhelming, but fear not! We're here to guide you through the process of filling out Form 15G online with ease. Before we dive in, let's quickly understand what Form 15G is and why it's essential.

What is Form 15G?

Form 15G is a declaration form that you, as an individual, can submit to your bank or other financial institutions to request exemption from Tax Deducted at Source (TDS) on your investments. TDS is a mechanism where the tax is deducted at the source of income, and in this case, it's the interest earned on your fixed deposits, recurring deposits, or other investments.

Why do I need to fill out Form 15G?

If you're an individual with a low taxable income, you might not be required to pay taxes on your investments. By submitting Form 15G, you're declaring that your income is below the taxable limit, and therefore, you're exempt from paying TDS on your interest earnings.

Benefits of filling out Form 15G

Filling out Form 15G can help you:

- Avoid TDS on your interest earnings

- Increase your take-home income

- Reduce your tax liability

Who is eligible to fill out Form 15G?

To be eligible to fill out Form 15G, you should meet the following criteria:

- You're an individual (not a company or a firm)

- You're a resident of India

- Your age is 60 years or less (if you're 60 years or older, you'll need to fill out Form 15H)

- Your estimated tax liability for the financial year is nil

How to fill out Form 15G online

Now that we've covered the basics, let's move on to the step-by-step guide to filling out Form 15G online:

Step 1: Gather required documents and information

Before you start filling out the form, ensure you have the following documents and information:

- PAN (Permanent Account Number)

- Aadhaar number

- Investment details (fixed deposits, recurring deposits, etc.)

- Estimated income for the financial year

Step 2: Choose the correct form

As mentioned earlier, if you're 60 years or older, you'll need to fill out Form 15H. Otherwise, you can proceed with Form 15G.

Step 3: Fill out the form

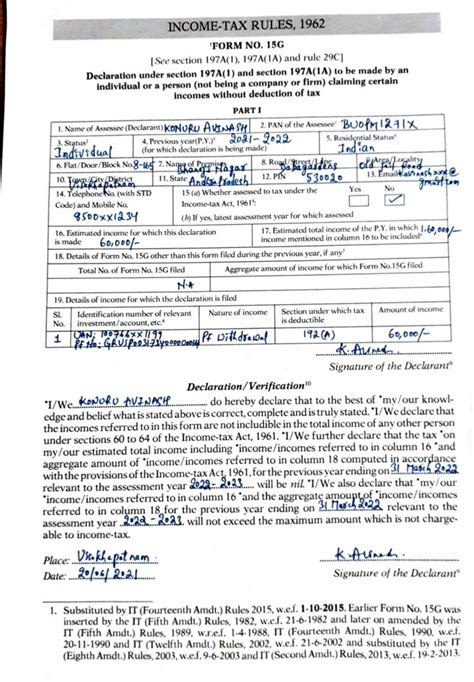

You can fill out Form 15G online through the official website of the Income Tax Department or through your bank's website (if they provide this facility). The form will ask for the following information:

- Your personal details (name, PAN, Aadhaar number, etc.)

- Investment details (type of investment, interest rate, etc.)

- Estimated income for the financial year

- Declaration that you're eligible for exemption from TDS

Step 4: Verify and submit the form

Once you've filled out the form, verify the information carefully and submit it. You might need to upload scanned copies of your PAN and Aadhaar cards.

Step 5: Get an acknowledgement

After submitting the form, you'll receive an acknowledgement number. Keep this number safe, as you might need it for future reference.

Common mistakes to avoid

When filling out Form 15G, avoid the following common mistakes:

- Incorrect PAN or Aadhaar number

- Incomplete or inaccurate investment details

- Failure to declare all sources of income

- Submitting the form after the deadline (usually the 15th of April for the previous financial year)

Tips for a smooth Form 15G filing experience

To ensure a smooth Form 15G filing experience, follow these tips:

- Fill out the form carefully and accurately

- Use the correct form (15G or 15H) based on your age

- Submit the form well before the deadline

- Keep a record of your acknowledgement number

Conclusion

Filling out Form 15G online is a straightforward process that can help you save taxes on your investments. By following the steps outlined in this article, you can ensure a smooth and hassle-free experience. Remember to verify your information carefully and submit the form well before the deadline.

Invite our readers to share their experiences

Have you filled out Form 15G online before? Share your experiences and tips in the comments section below. If you have any questions or concerns, feel free to ask, and we'll do our best to help.

What is the purpose of Form 15G?

+Form 15G is a declaration form that you can submit to your bank or other financial institutions to request exemption from Tax Deducted at Source (TDS) on your investments.

Who is eligible to fill out Form 15G?

+To be eligible to fill out Form 15G, you should be an individual, a resident of India, 60 years or less, and have an estimated tax liability for the financial year of nil.

What documents do I need to fill out Form 15G?

+You'll need your PAN, Aadhaar number, investment details, and estimated income for the financial year.