Receiving a tax form can be an overwhelming experience, especially if you're not familiar with the document. The CT Form 1099-G is one such form that can cause confusion among taxpayers. This form is used by the state of Connecticut to report certain government payments, and understanding its contents is crucial for accurate tax filing. In this article, we will delve into the world of CT Form 1099-G, exploring its components, purposes, and how to navigate its complexities.

What is CT Form 1099-G?

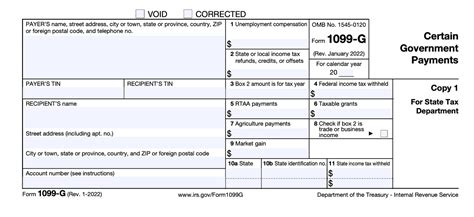

The CT Form 1099-G, also known as the Certain Government Payments, is a tax form used by the state of Connecticut to report various government payments made to individuals and businesses. These payments can include state and local income tax refunds, unemployment compensation, and other government-funded benefits. The form is typically issued by the Connecticut Department of Revenue Services (DRS) and is used to report these payments to the recipient and the Internal Revenue Service (IRS).

Understanding the Components of CT Form 1099-G

The CT Form 1099-G contains several sections and boxes that report different types of government payments. Here's a breakdown of the key components:

- Box 1: State and Local Income Tax Refunds

- Box 2: Unemployment Compensation

- Box 3: Railroad Retirement Benefits

- Box 4: Federal Income Tax Withheld

- Box 5: Medicare Tax Withheld

Each box reports a specific type of government payment, and the amounts are used to calculate the recipient's tax liability.

Purposes of CT Form 1099-G

The CT Form 1099-G serves several purposes:

- Tax Reporting: The form reports government payments to the recipient and the IRS, ensuring accurate tax filing and compliance.

- Tax Liability Calculation: The amounts reported on the form are used to calculate the recipient's tax liability, including federal and state income taxes.

- Refund Calculation: The form helps determine the recipient's refund amount, if applicable.

How to Navigate CT Form 1099-G Complexities

Navigating the complexities of CT Form 1099-G can be challenging, especially for those unfamiliar with tax forms. Here are some tips to help you understand and manage the form:

- Carefully Review the Form: Take the time to thoroughly review the form, ensuring accuracy and completeness.

- Verify Payment Amounts: Verify the payment amounts reported on the form to ensure they match your records.

- Seek Professional Help: If you're unsure about any aspect of the form, consider consulting a tax professional or accountant.

Common Scenarios and Solutions

Here are some common scenarios and solutions related to CT Form 1099-G:

- Scenario 1: Incorrect Payment Amounts

- Solution: Contact the Connecticut Department of Revenue Services (DRS) to correct the error.

- Scenario 2: Missing Form

- Solution: Contact the DRS to request a duplicate form or access the information online.

- Scenario 3: Unemployment Benefits

- Solution: Report the benefits on your tax return, and claim any applicable credits or deductions.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind:

- File Accurately: Ensure accurate tax filing by reporting all government payments on your tax return.

- Keep Records: Keep records of all government payments, including CT Form 1099-G, for at least three years.

- Seek Help: Don't hesitate to seek help from a tax professional or accountant if you're unsure about any aspect of the form.

Conclusion and Next Steps

Understanding CT Form 1099-G is crucial for accurate tax filing and compliance. By familiarizing yourself with the form's components, purposes, and complexities, you can navigate its intricacies with confidence. If you have any questions or concerns, don't hesitate to seek help from a tax professional or accountant. Remember to file accurately, keep records, and seek help when needed.

We hope this article has provided you with a comprehensive understanding of CT Form 1099-G. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information, and don't forget to follow us for more informative content.

What is CT Form 1099-G?

+CT Form 1099-G is a tax form used by the state of Connecticut to report certain government payments, including state and local income tax refunds, unemployment compensation, and other government-funded benefits.

What are the purposes of CT Form 1099-G?

+The purposes of CT Form 1099-G include tax reporting, tax liability calculation, and refund calculation.

How do I navigate CT Form 1099-G complexities?

+To navigate CT Form 1099-G complexities, carefully review the form, verify payment amounts, and seek professional help if needed.