In recent years, the Internal Revenue Service (IRS) has introduced various forms and schedules to ensure accurate and transparent reporting of a corporation's financial activities. One such crucial schedule is the Form 1120 Schedule M-3, which plays a vital role in the tax compliance process for certain corporations. In this article, we will delve into the world of Form 1120 Schedule M-3, exploring its importance, benefits, and providing essential tips for accurate completion.

Understanding the Basics of Form 1120 Schedule M-3

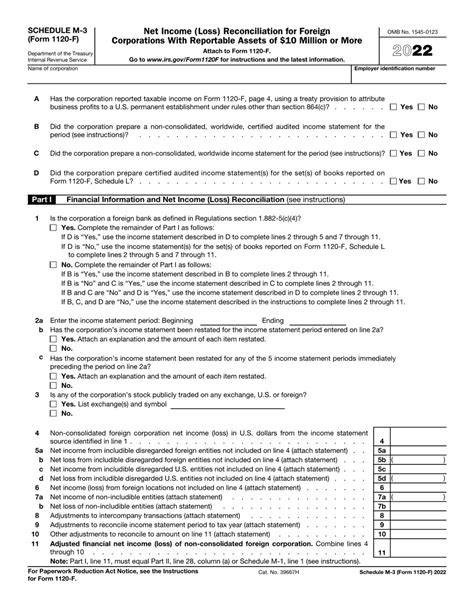

The Form 1120 Schedule M-3 is a crucial component of the corporate tax return process. It is used to reconcile financial statements with the corporation's tax return, providing the IRS with a clear picture of the company's financial activities. The schedule is divided into several parts, including:

- Part I: Financial Information and Net Income (Loss) Reconciliation

- Part II: Reconciliation of Net Income (Loss) per Financial Statements with Taxable Income per Return

- Part III: Reconciliation of Taxable Income per Return with Total Income per Financial Statements

Benefits of Accurate Completion of Form 1120 Schedule M-3

Accurate completion of the Form 1120 Schedule M-3 offers several benefits to corporations, including:

- Reduced risk of audit and penalties

- Improved financial transparency and compliance

- Enhanced accuracy in tax reporting

- Better management of financial data and records

10 Essential Tips for Form 1120 Schedule M-3

1. Understand the Eligibility Criteria

Not all corporations are required to complete the Form 1120 Schedule M-3. Corporations with total assets of $10 million or more are eligible to file this schedule. It is essential to understand the eligibility criteria to ensure accurate completion.

2. Gather Accurate Financial Data

Accurate completion of the Form 1120 Schedule M-3 requires precise financial data. Corporations must gather financial statements, including balance sheets, income statements, and cash flow statements, to ensure accurate reporting.

3. Reconcile Financial Statements with Tax Return

The primary purpose of the Form 1120 Schedule M-3 is to reconcile financial statements with the corporation's tax return. Corporations must ensure that their financial statements accurately reflect their tax return, reducing the risk of audit and penalties.

4. Identify and Report Differences

Corporations must identify and report any differences between their financial statements and tax return. This includes differences in accounting methods, depreciation, and amortization.

5. Maintain Accurate Records

Accurate completion of the Form 1120 Schedule M-3 requires maintaining accurate records. Corporations must ensure that their financial records are up-to-date and accurately reflect their financial activities.

6. Seek Professional Guidance

Completing the Form 1120 Schedule M-3 can be a complex process. Corporations may seek professional guidance from certified public accountants or tax professionals to ensure accurate completion.

7. Review and Revise

Corporations must review and revise their Form 1120 Schedule M-3 to ensure accuracy and completeness. This includes reviewing financial statements, tax returns, and any supporting documentation.

8. File Electronically

The IRS encourages corporations to file their Form 1120 Schedule M-3 electronically. Electronic filing reduces errors and ensures faster processing times.

9. Meet the Filing Deadline

Corporations must meet the filing deadline for the Form 1120 Schedule M-3. The filing deadline is typically March 15th for calendar-year corporations.

10. Stay Informed

Finally, corporations must stay informed about any changes to the Form 1120 Schedule M-3. The IRS regularly updates its forms and schedules, and corporations must stay up-to-date to ensure accurate completion.

Invitation to Engage

Completing the Form 1120 Schedule M-3 is a critical component of the corporate tax compliance process. By following these essential tips, corporations can ensure accurate completion, reducing the risk of audit and penalties. Share your experiences and tips for completing the Form 1120 Schedule M-3 in the comments section below.

What is the purpose of the Form 1120 Schedule M-3?

+The primary purpose of the Form 1120 Schedule M-3 is to reconcile financial statements with the corporation's tax return.

Who is eligible to file the Form 1120 Schedule M-3?

+Corporations with total assets of $10 million or more are eligible to file the Form 1120 Schedule M-3.

What is the filing deadline for the Form 1120 Schedule M-3?

+The filing deadline for the Form 1120 Schedule M-3 is typically March 15th for calendar-year corporations.