Idaho is a state with a rich history, diverse landscape, and a growing population. As the state continues to evolve, its tax laws and regulations also undergo changes. One of the essential documents for Idaho residents and businesses is the Idaho Form 51. In this article, we will delve into the world of Idaho Form 51, exploring its purpose, benefits, and key facts.

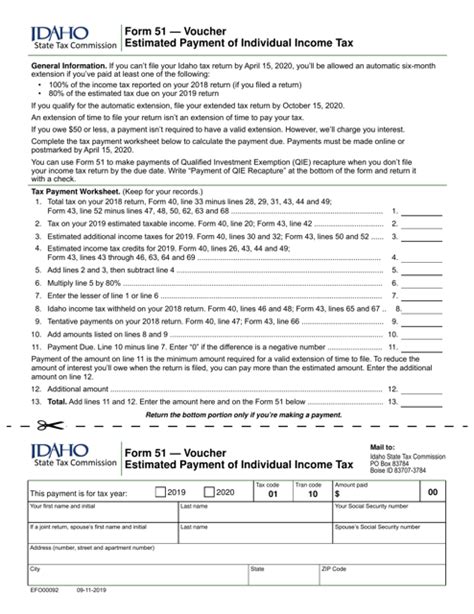

Idaho Form 51, also known as the Individual Income Tax Return, is a crucial document for individuals and businesses operating in the state. The form is used to report income, claim deductions, and calculate tax liability. In this section, we will explore five essential facts about Idaho Form 51 that you should know.

Fact #1: Filing Requirements

Idaho Form 51 is required to be filed by all residents and non-residents who have earned income within the state. This includes individuals, businesses, and corporations. The form must be filed on or before April 15th of each year, unless an extension is granted. Failure to file the form on time may result in penalties and fines.

Who Needs to File?

- Residents with Idaho-source income exceeding $1,200

- Non-residents with Idaho-source income exceeding $1,200

- Individuals with self-employment income exceeding $400

- Businesses and corporations with Idaho-source income

Fact #2: Tax Rates and Brackets

Idaho has a progressive tax system, with tax rates ranging from 1.125% to 6.925%. The tax rates and brackets are adjusted annually to reflect changes in the cost of living. The tax rates apply to taxable income, which is calculated by subtracting deductions and exemptions from total income.

Tax Rates and Brackets

- 1.125% on the first $1,568 of taxable income

- 3.075% on taxable income between $1,569 and $3,936

- 4.625% on taxable income between $3,937 and $7,874

- 6.925% on taxable income exceeding $7,874

Fact #3: Deductions and Credits

Idaho Form 51 allows for various deductions and credits to reduce tax liability. These include standard deductions, itemized deductions, and tax credits for education expenses, charitable donations, and renewable energy investments.

Common Deductions and Credits

- Standard deduction of $12,400 for single filers and $24,800 for joint filers

- Itemized deductions for mortgage interest, property taxes, and medical expenses

- Tax credits for education expenses, charitable donations, and renewable energy investments

Fact #4: Filing Status and Exemptions

Idaho Form 51 requires filers to indicate their filing status, which determines the tax rates and brackets applied. The filing status also affects the exemptions and deductions available. Common filing statuses include single, married filing jointly, married filing separately, and head of household.

Filing Status and Exemptions

- Single filers: standard deduction of $12,400 and exemption of $4,300

- Married filing jointly: standard deduction of $24,800 and exemption of $8,600

- Married filing separately: standard deduction of $12,400 and exemption of $4,300

- Head of household: standard deduction of $18,650 and exemption of $6,500

Fact #5: Amended Returns and Extensions

Idaho Form 51 allows for amended returns and extensions in certain circumstances. An amended return can be filed to correct errors or report additional income. An extension can be granted to extend the filing deadline.

Amended Returns and Extensions

- Amended returns: file Idaho Form 51X within three years of the original filing date

- Extensions: file Idaho Form 2210 within six months of the original filing date

In conclusion, Idaho Form 51 is a critical document for individuals and businesses operating in the state. Understanding the filing requirements, tax rates and brackets, deductions and credits, filing status and exemptions, and amended returns and extensions is essential for navigating the Idaho tax system. By following these five essential facts, you can ensure accurate and timely filing of your Idaho Form 51.

We hope this article has provided valuable insights into the world of Idaho Form 51. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with friends and family who may benefit from this information.

What is Idaho Form 51?

+Idaho Form 51 is the Individual Income Tax Return form used by the Idaho State Tax Commission to report income, claim deductions, and calculate tax liability.

Who needs to file Idaho Form 51?

+Residents and non-residents with Idaho-source income exceeding $1,200, individuals with self-employment income exceeding $400, and businesses and corporations with Idaho-source income.

What is the deadline for filing Idaho Form 51?

+The deadline for filing Idaho Form 51 is April 15th of each year, unless an extension is granted.