Accurate and timely tax payments are crucial for individuals and businesses to avoid penalties and interest. However, unforeseen circumstances can sometimes lead to missed or underpaid tax obligations, resulting in the need to file Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts. When requesting a waiver for penalties associated with underpayment, a clear and well-structured explanation statement is essential. This article provides guidance on crafting a compelling Form 2210 waiver explanation statement.

Understanding Form 2210 and the Waiver Process

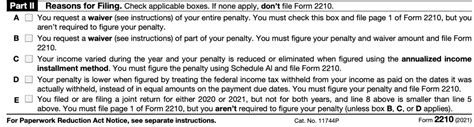

Before delving into the specifics of writing a waiver explanation statement, it's crucial to grasp the purpose of Form 2210 and the waiver process. Form 2210 is used to calculate and report underpayment of estimated tax by individuals, estates, and trusts. If you owe $1,000 or more in taxes after subtracting withholdings and refundable credits, you might need to file this form. The waiver, if approved, can reduce or eliminate the penalty for underpayment.

Why a Clear Waiver Explanation Statement Matters

A well-crafted waiver explanation statement is vital for several reasons:

- Reduces the Risk of Rejection: A clear and concise statement helps the IRS understand the circumstances surrounding the underpayment, reducing the likelihood of waiver rejection.

- Provides Context: By explaining the reasons behind the underpayment, you provide context that might not be immediately apparent from the tax return or other documentation.

- Demonstrates Compliance Intent: A thoughtful explanation can demonstrate your intent to comply with tax laws and regulations, despite unforeseen circumstances that led to underpayment.

5 Ways to Write a Form 2210 Waiver Explanation Statement

Crafting an effective waiver explanation statement requires attention to detail, honesty, and a clear understanding of the circumstances surrounding the underpayment. Here are five approaches to consider:

1. Explain Unforeseen Circumstances

Start by describing any unforeseen circumstances that led to the underpayment, such as:

- Serious illness or hospitalization

- Death of a family member or key business partner

- Unexpected business losses or expenses

- Natural disasters or other catastrophic events

Be specific about the dates and how these circumstances affected your ability to make timely payments.

2. Document Changes in Income or Expenses

If changes in income or expenses contributed to the underpayment, provide detailed documentation to support your claim. This might include:

- Letters or statements from employers or financial institutions

- Medical bills or insurance statements

- Business financial statements or invoices

3. Highlight Compliance Efforts

Emphasize any efforts you made to comply with tax laws and regulations, despite the underpayment. This could include:

- Payments made towards the underpayment

- Attempts to communicate with the IRS or tax authorities

- Steps taken to rectify the underpayment and prevent future occurrences

4. Show Reasonable Cause for Waiver

Clearly explain why you believe you have reasonable cause for a waiver. This might involve:

- Demonstrating that the underpayment was not willful neglect or intentional disregard

- Showing that you relied on incorrect advice from a tax professional or other authority

- Highlighting any mitigating circumstances that reduced your ability to make timely payments

5. Keep it Concise and Well-Organized

While it's essential to provide sufficient detail to support your waiver request, keep your explanation statement concise and well-organized. Use clear headings, bullet points, and concise paragraphs to make your statement easy to follow.

Additional Tips for Writing a Form 2210 Waiver Explanation Statement

When crafting your waiver explanation statement, keep the following tips in mind:

- Use clear and concise language, avoiding jargon or technical terms whenever possible

- Provide supporting documentation or evidence to substantiate your claims

- Proofread your statement carefully to ensure accuracy and completeness

- Consider seeking professional advice from a tax expert or attorney to ensure you are presenting the strongest possible case

By following these guidelines and approaches, you can increase the chances of a successful waiver request and reduce the risk of penalties and interest associated with underpayment of estimated tax.

Conclusion

Writing a clear and effective waiver explanation statement is crucial when requesting a waiver for penalties associated with underpayment of estimated tax. By understanding the purpose of Form 2210 and the waiver process, explaining unforeseen circumstances, documenting changes in income or expenses, highlighting compliance efforts, showing reasonable cause for waiver, and keeping your statement concise and well-organized, you can present a strong case for a waiver. Remember to provide supporting documentation, proofread your statement carefully, and consider seeking professional advice to ensure the best possible outcome.

FAQ Section

What is the purpose of Form 2210?

+Form 2210 is used to calculate and report underpayment of estimated tax by individuals, estates, and trusts.

What are the consequences of not filing Form 2210?

+If you fail to file Form 2210, you may be subject to penalties and interest on the underpayment.

How do I request a waiver for penalties associated with underpayment?

+You can request a waiver by completing Form 2210 and submitting it to the IRS along with a clear and well-structured explanation statement.