Employers and employees in Illinois need to be aware of the IL 2848 form, which is a crucial document in the process of income tax withholding. The IL 2848 form, also known as the Employee's Certificate of Non-Residence in Illinois, plays a significant role in ensuring that employees are not subject to unnecessary state income tax withholding. In this article, we will delve into the essential facts about the IL 2848 form, exploring its purpose, benefits, and the steps involved in completing it.

What is the IL 2848 Form?

The IL 2848 form is a certificate that employees can submit to their employers to certify that they are not residents of Illinois. This form is used to claim exemption from Illinois state income tax withholding. By completing and submitting the IL 2848 form, employees can avoid having Illinois state income tax withheld from their wages.

Why is the IL 2848 Form Important?

The IL 2848 form is essential for several reasons:

- It helps employees avoid unnecessary state income tax withholding.

- It ensures that employees are not subject to double taxation.

- It simplifies the tax filing process for employees who are not Illinois residents.

Benefits of the IL 2848 Form

The IL 2848 form offers several benefits to employees, including:

- Reduced tax liability: By claiming exemption from Illinois state income tax withholding, employees can reduce their overall tax liability.

- Increased take-home pay: By avoiding unnecessary state income tax withholding, employees can take home more of their hard-earned money.

- Simplified tax filing: The IL 2848 form helps employees avoid the complexity of filing multiple state tax returns.

Who is Eligible to Complete the IL 2848 Form?

To be eligible to complete the IL 2848 form, employees must meet the following criteria:

- They must not be a resident of Illinois.

- They must have a legitimate reason for not being a resident of Illinois, such as living in a different state or working remotely.

How to Complete the IL 2848 Form

Completing the IL 2848 form is a straightforward process. Here are the steps involved:

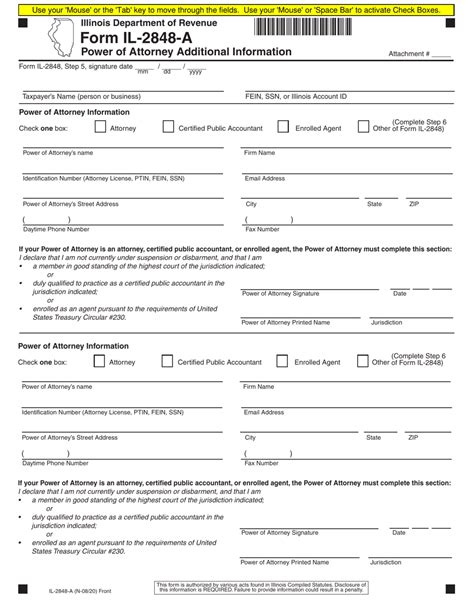

- Download the IL 2848 form from the Illinois Department of Revenue website or obtain a copy from your employer.

- Fill out the form accurately and completely, providing all required information.

- Sign and date the form.

- Submit the completed form to your employer.

What Happens After Submitting the IL 2848 Form?

After submitting the IL 2848 form, your employer will review and verify the information provided. If the form is approved, your employer will stop withholding Illinois state income tax from your wages. You may need to provide additional documentation or information to support your claim of non-residency.

Common Mistakes to Avoid When Completing the IL 2848 Form

When completing the IL 2848 form, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some common mistakes to avoid:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Submission of the form to the wrong authority

Conclusion and Next Steps

The IL 2848 form is a crucial document that helps employees avoid unnecessary state income tax withholding. By understanding the essential facts about the IL 2848 form, employees can take advantage of its benefits and simplify their tax filing process. If you have any questions or concerns about the IL 2848 form, consult with your employer or a tax professional.

We encourage you to share your thoughts and experiences with the IL 2848 form in the comments section below. Your feedback will help others navigate the process more effectively.

What is the purpose of the IL 2848 form?

+The IL 2848 form is used to claim exemption from Illinois state income tax withholding for employees who are not residents of Illinois.

Who is eligible to complete the IL 2848 form?

+Employees who are not residents of Illinois and have a legitimate reason for not being a resident of Illinois are eligible to complete the IL 2848 form.

How do I submit the IL 2848 form?

+The completed IL 2848 form should be submitted to your employer, who will review and verify the information provided.