Passive activity loss limitations are a complex and often misunderstood aspect of tax law. Form 8582 is a crucial document for taxpayers who need to report and calculate their passive activity losses. In this article, we will delve into the world of passive activity loss limitations, exploring the ins and outs of Form 8582 and providing guidance on how to navigate this complex topic.

Passive activity losses can arise from a variety of sources, including rental properties, partnerships, and S corporations. These losses can be significant, and taxpayers may be eager to claim them on their tax returns. However, the IRS has established rules to limit the amount of passive activity losses that can be deducted in a given year. This is where Form 8582 comes in – to help taxpayers calculate and report their passive activity losses.

What is Form 8582?

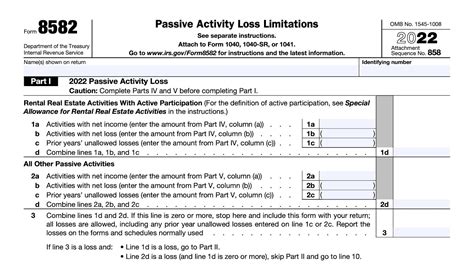

Form 8582, also known as the "Passive Activity Loss Limitations" form, is a document used by taxpayers to report and calculate their passive activity losses. The form is used to determine the amount of passive activity losses that can be deducted in a given year, as well as the amount of losses that must be carried over to future years.

Who Needs to File Form 8582?

Form 8582 is required for taxpayers who have passive activity losses from sources such as:

- Rental properties

- Partnerships

- S corporations

- Limited liability companies (LLCs)

Taxpayers who have passive activity losses from these sources must file Form 8582 to report and calculate their losses.

How to Calculate Passive Activity Losses

Calculating passive activity losses involves several steps. First, taxpayers must determine their total passive activity income and expenses for the year. This includes income and expenses from all passive activities, such as rental properties and partnerships.

Next, taxpayers must calculate their net passive activity income or loss for the year. This is done by subtracting total passive activity expenses from total passive activity income.

Passive Activity Loss Limitations

Once the net passive activity income or loss is calculated, taxpayers must apply the passive activity loss limitations. These limitations are designed to prevent taxpayers from deducting excessive passive activity losses.

The passive activity loss limitations are as follows:

- $25,000 for single taxpayers

- $50,000 for married taxpayers filing jointly

- $12,500 for married taxpayers filing separately

These limitations apply to the total net passive activity loss for the year.

Carrying Over Passive Activity Losses

If a taxpayer's passive activity losses exceed the limitations, the excess losses must be carried over to future years. This is done by completing Part 2 of Form 8582.

The carried-over losses can be deducted in future years, subject to the same limitations.

Special Rules for Rental Properties

Rental properties are subject to special rules when it comes to passive activity losses. Taxpayers who actively participate in the management of their rental properties may be able to deduct up to $25,000 of passive activity losses.

However, this special rule is subject to phase-out limits, which begin at $100,000 of modified adjusted gross income (MAGI).

Conclusion

Passive activity loss limitations can be complex and confusing, but Form 8582 is designed to help taxpayers navigate these rules. By following the instructions and completing the form accurately, taxpayers can ensure that they are taking advantage of the passive activity losses they are eligible for.

If you have questions or concerns about passive activity loss limitations or Form 8582, it's always best to consult with a tax professional.

We encourage you to share your thoughts and experiences with passive activity loss limitations in the comments below. Have you had to navigate these complex rules? What challenges have you faced, and how have you overcome them? Share your story and help others who may be struggling with the same issues.

What is passive activity loss?

+Passive activity loss is a loss that arises from a passive activity, such as rental properties, partnerships, and S corporations.

Who needs to file Form 8582?

+Taxpayers who have passive activity losses from sources such as rental properties, partnerships, and S corporations must file Form 8582.

How do I calculate passive activity losses?

+Calculating passive activity losses involves determining total passive activity income and expenses, and then calculating the net passive activity income or loss.