Working from home has become increasingly popular, and with it, the need to understand the nuances of home office tax deductions. The HT 110 form is a crucial document for those who want to claim a deduction for their home office expenses. In this article, we will delve into the world of home office tax deductions, exploring the benefits, eligibility criteria, and steps to claim your deduction.

As a self-employed individual or a freelancer, you are entitled to deduct a portion of your home expenses as a business expense. This can significantly reduce your taxable income, resulting in lower taxes. However, the process can be complex, and the HT 110 form is an essential part of it.

What is the HT 110 Form?

The HT 110 form is a document used by the Canada Revenue Agency (CRA) to calculate the business-use-of-home expenses. It is a critical component of the tax return process, and completing it accurately is essential to ensure you receive the maximum deduction.

Benefits of Claiming Home Office Tax Deductions

Claiming home office tax deductions can have a significant impact on your tax liability. Here are some benefits of claiming this deduction:

- Reduced taxable income: By deducting a portion of your home expenses, you can reduce your taxable income, resulting in lower taxes.

- Increased cash flow: Claiming home office tax deductions can result in a larger tax refund or lower tax liability, providing you with more cash flow.

- Simplified tax preparation: Completing the HT 110 form can help you identify eligible expenses and simplify the tax preparation process.

Eligibility Criteria for Home Office Tax Deductions

To be eligible for home office tax deductions, you must meet the following criteria:

- You are self-employed or a freelancer

- You have a dedicated workspace in your home

- You use your home workspace for business purposes more than 50% of the time

- You have records to support your business-use-of-home expenses

Steps to Claim Your Home Office Tax Deduction

To claim your home office tax deduction, follow these steps:

- Determine your business-use-of-home percentage: Calculate the percentage of your home used for business purposes.

- Calculate your total home expenses: Gather records of your home expenses, including rent, mortgage interest, property taxes, and utilities.

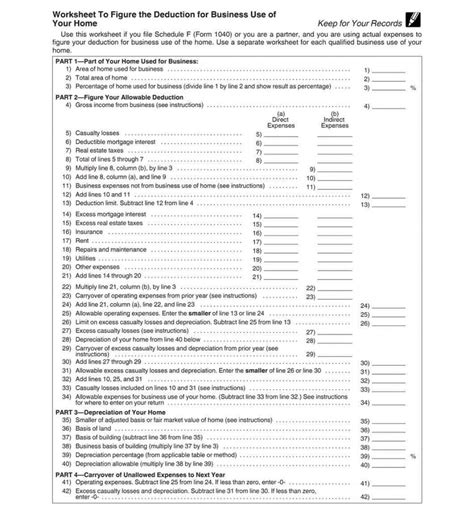

- Complete the HT 110 form: Use the HT 110 form to calculate your business-use-of-home expenses.

- Claim your deduction: Claim your home office tax deduction on your tax return.

Tips for Completing the HT 110 Form

To ensure you complete the HT 110 form accurately, follow these tips:

- Keep accurate records of your home expenses

- Calculate your business-use-of-home percentage carefully

- Use the correct exchange rate if you have foreign currency expenses

- Consult a tax professional if you are unsure about any part of the process

Common Mistakes to Avoid

To avoid common mistakes when claiming home office tax deductions, keep the following in mind:

- Inaccurate records: Failing to keep accurate records of your home expenses can result in an audit or reduced deduction.

- Incorrect business-use-of-home percentage: Miscalculating your business-use-of-home percentage can result in an incorrect deduction.

- Missing documentation: Failing to provide supporting documentation can result in a reduced deduction or audit.

Conclusion

Claiming home office tax deductions can be a complex process, but with the right guidance, you can ensure you receive the maximum deduction. By following the steps outlined in this article and avoiding common mistakes, you can simplify the tax preparation process and reduce your taxable income.

Call to Action

Don't miss out on the opportunity to reduce your taxable income. Claim your home office tax deduction today by completing the HT 110 form and following the steps outlined in this article. If you are unsure about any part of the process, consult a tax professional to ensure you receive the maximum deduction.

FAQs

What is the HT 110 form used for?

+The HT 110 form is used to calculate the business-use-of-home expenses for tax purposes.

What are the eligibility criteria for home office tax deductions?

+To be eligible, you must be self-employed or a freelancer, have a dedicated workspace in your home, use your home workspace for business purposes more than 50% of the time, and have records to support your business-use-of-home expenses.

How do I calculate my business-use-of-home percentage?

+Calculate the percentage of your home used for business purposes by measuring the square footage of your dedicated workspace and dividing it by the total square footage of your home.