As a business owner or an individual who files taxes, you're likely familiar with the numerous forms and deadlines that come with tax season. One such form is the Form 8752, which is used to report required payment or overpayment of estimated tax by a section 1446 withholding agent. In this article, we'll delve into the Form 8752 filing deadline and other key dates to remember.

The importance of meeting tax deadlines cannot be overstated. Missing a deadline can result in penalties, fines, and even loss of benefits. Therefore, it's essential to stay on top of the filing requirements and deadlines for Form 8752. In this article, we'll provide an overview of the form, its purpose, and the key dates to remember.

What is Form 8752?

Form 8752 is a tax form used by section 1446 withholding agents to report the required payment or overpayment of estimated tax. A section 1446 withholding agent is typically a partnership or an S corporation that has foreign partners or shareholders. The form is used to report the withholding and payment of tax on the foreign partner's or shareholder's share of effectively connected income.

The form consists of several sections, including the identification of the withholding agent, the foreign partner's or shareholder's information, and the calculation of the required payment or overpayment of estimated tax. The form must be filed annually, and the deadline for filing is typically March 15th of each year.

Form 8752 Filing Deadline

The Form 8752 filing deadline is March 15th of each year. This means that the form must be filed on or before March 15th to avoid penalties and fines. However, if the 15th falls on a weekend or a federal holiday, the deadline is moved to the next business day.

It's essential to note that the deadline for filing Form 8752 is earlier than the deadline for filing the partnership return (Form 1065) or the S corporation return (Form 1120S). This is because the form is used to report the withholding and payment of tax on the foreign partner's or shareholder's share of effectively connected income, which must be reported separately from the partnership or S corporation return.

Consequences of Missing the Deadline

Missing the Form 8752 filing deadline can result in penalties and fines. The penalty for failing to file the form on time is $100 for each month or part of a month, up to a maximum of $500. Additionally, the IRS may impose interest on the unpaid tax.

To avoid these penalties and fines, it's essential to file the form on time. If you're unable to file the form by the deadline, you can request an extension of time to file using Form 7004.

Other Key Dates to Remember

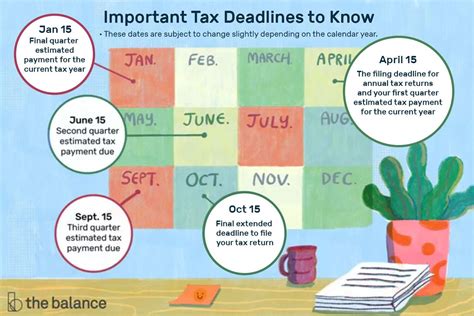

In addition to the Form 8752 filing deadline, there are several other key dates to remember. These include:

-

January 31st

: This is the deadline for furnishing a copy of Schedule K-1 (Form 1065) to each partner. -

March 15th

: This is the deadline for filing Form 8752 and Form 1065. -

April 15th

: This is the deadline for filing the individual tax return (Form 1040). -

September 15th

: This is the deadline for filing the partnership return (Form 1065) if an extension of time to file was requested.

How to File Form 8752

Form 8752 can be filed electronically or by mail. To file electronically, you'll need to use the IRS's Electronic Federal Tax Payment System (EFTPS). To file by mail, you'll need to send the completed form to the IRS address listed in the instructions.

Before filing the form, make sure to review the instructions carefully and ensure that all required information is complete and accurate. You may also want to consider consulting with a tax professional to ensure that you're meeting all the filing requirements.

Conclusion

In conclusion, the Form 8752 filing deadline is an essential date to remember for section 1446 withholding agents. Missing the deadline can result in penalties and fines, so it's crucial to file the form on time. By understanding the purpose of the form and the key dates to remember, you can ensure that you're meeting all the filing requirements and avoiding any potential penalties.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Remember to share this article with others who may find it useful.

What is the Form 8752 filing deadline?

+The Form 8752 filing deadline is March 15th of each year.

What is the penalty for missing the Form 8752 filing deadline?

+The penalty for missing the Form 8752 filing deadline is $100 for each month or part of a month, up to a maximum of $500.

How do I file Form 8752?

+Form 8752 can be filed electronically or by mail. To file electronically, use the IRS's Electronic Federal Tax Payment System (EFTPS). To file by mail, send the completed form to the IRS address listed in the instructions.