Are you tired of printing, signing, and scanning W-9 forms? With the advancement of technology, it's now possible to sign W-9 forms online, saving you time and effort. In this article, we will guide you through the process of signing a W-9 form online in 5 easy steps.

Signing a W-9 form is a crucial step in verifying your identity and taxpayer status. The form is used by the Internal Revenue Service (IRS) to collect information from freelancers, independent contractors, and businesses. Traditionally, signing a W-9 form required printing, signing, and scanning the document, which can be a hassle. However, with the rise of digital signatures, you can now sign W-9 forms online, making the process faster and more efficient.

Why Sign a W-9 Form Online?

Signing a W-9 form online offers several benefits, including:

- Convenience: You can sign the form from anywhere, at any time, as long as you have an internet connection.

- Time-saving: You don't have to print, sign, and scan the document, which saves you time and effort.

- Accuracy: Digital signatures reduce the risk of errors and ensure that the form is filled out correctly.

- Environmentally friendly: By signing the form online, you reduce the need for paper and minimize your carbon footprint.

5 Easy Steps to Sign a W-9 Form Online

Signing a W-9 form online is a straightforward process that can be completed in 5 easy steps:

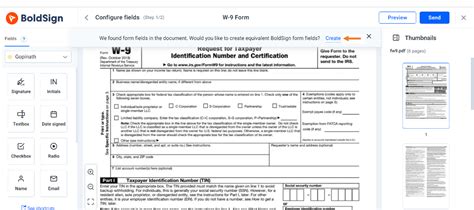

Step 1: Choose a Digital Signature Platform

There are several digital signature platforms available that allow you to sign a W-9 form online. Some popular options include DocuSign, Adobe Sign, and HelloSign. Choose a platform that meets your needs and is compatible with your device.

Step 2: Upload the W-9 Form

Once you've chosen a digital signature platform, upload the W-9 form to the platform. You can upload the form from your computer or access it from your email. Make sure the form is complete and accurate before uploading it.

Step 3: Review the Form

Review the W-9 form carefully to ensure that all the information is accurate and complete. Check that your name, address, and taxpayer identification number (TIN) are correct. If you need to make any changes, you can do so before signing the form.

Step 4: Sign the Form

Once you've reviewed the form, sign it using your digital signature. You can use a typed signature or draw your signature using your mouse or touchscreen. Make sure your signature is clear and legible.

Step 5: Download and Share the Form

After signing the W-9 form, download it to your computer or access it from your email. You can then share the form with your clients or contractors, who can verify your taxpayer status.

Benefits of Using a Digital Signature Platform

Using a digital signature platform to sign a W-9 form offers several benefits, including:

- Convenience: You can sign the form from anywhere, at any time.

- Time-saving: You don't have to print, sign, and scan the document.

- Accuracy: Digital signatures reduce the risk of errors and ensure that the form is filled out correctly.

- Security: Digital signatures are secure and tamper-proof, reducing the risk of fraud.

Common Mistakes to Avoid When Signing a W-9 Form Online

When signing a W-9 form online, there are several common mistakes to avoid, including:

- Inaccurate information: Make sure all the information on the form is accurate and complete.

- Incorrect signature: Ensure that your signature is clear and legible.

- Incomplete form: Make sure the form is complete and all required fields are filled out.

Conclusion

Signing a W-9 form online is a convenient and efficient way to verify your taxpayer status. By following the 5 easy steps outlined above, you can sign a W-9 form online in minutes. Remember to choose a digital signature platform that meets your needs, review the form carefully, and avoid common mistakes.

If you have any questions or concerns about signing a W-9 form online, feel free to comment below. We'd be happy to help.

What is a W-9 form?

+A W-9 form is a document used by the Internal Revenue Service (IRS) to collect information from freelancers, independent contractors, and businesses. It verifies the taxpayer's identity and status.

Why do I need to sign a W-9 form?

+You need to sign a W-9 form to verify your taxpayer status and provide your taxpayer identification number (TIN) to clients or contractors.