As an employer, you're required to file Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips, with the Internal Revenue Service (IRS) by February 28th of each year. This form is used to report tip income and allocated tips received by employees who receive cash and non-cash tips. In this article, we'll provide detailed instructions on how to complete Form 8027 accurately.

Understanding Form 8027 and Its Importance

Before we dive into the instructions, it's essential to understand the purpose of Form 8027. This form is used to report the following:

- Total tips received by employees who receive cash and non-cash tips

- Total allocated tips, which are tips allocated to employees who receive non-cash tips

- Total tips reported by employees

- Total allocated tips reported by employers

Form 8027 is crucial for employers to report tip income accurately and ensure compliance with the IRS regulations. Failure to file Form 8027 or reporting inaccurate information can result in penalties and fines.

Step-by-Step Instructions for Completing Form 8027

To complete Form 8027 accurately, follow these step-by-step instructions:

Box 1: Employer Identification Number (EIN)

- Enter your Employer Identification Number (EIN) in Box 1. This is a nine-digit number assigned to your business by the IRS.

Box 2: Employer's Name and Address

- Enter your business name and address in Box 2. Ensure the address is the same as the one on file with the IRS.

Box 3: Total Tips Received

- Enter the total tips received by employees who receive cash and non-cash tips in Box 3. This includes tips received from credit card receipts, cash tips, and non-cash tips.

Box 4: Total Allocated Tips

- Enter the total allocated tips in Box 4. This includes tips allocated to employees who receive non-cash tips.

Box 5: Total Tips Reported by Employees

- Enter the total tips reported by employees in Box 5. This includes tips reported by employees on their income tax returns.

Box 6: Total Allocated Tips Reported by Employers

- Enter the total allocated tips reported by employers in Box 6. This includes tips allocated to employees who receive non-cash tips.

Box 7: Number of Employees

- Enter the number of employees who receive cash and non-cash tips in Box 7.

Box 8: Signature

- Sign and date the form in Box 8. Ensure the signature is the same as the one on file with the IRS.

Additional Requirements

In addition to completing Form 8027, employers must also:

- Keep accurate records of tip income and allocated tips

- Report tip income and allocated tips on employees' W-2 forms

- Withhold and pay Social Security and Medicare taxes on tip income

Common Mistakes to Avoid

When completing Form 8027, avoid the following common mistakes:

- Failing to report total tips received and allocated tips

- Incorrectly calculating tip income and allocated tips

- Failing to keep accurate records of tip income and allocated tips

- Not withholding and paying Social Security and Medicare taxes on tip income

By following these instructions and avoiding common mistakes, you can ensure accurate completion of Form 8027 and compliance with IRS regulations.

Additional Resources

For more information on Form 8027 and tip income reporting, refer to the following resources:

- IRS Publication 15 (Circular E), Employer's Tax Guide

- IRS Publication 531, Reporting Tip Income

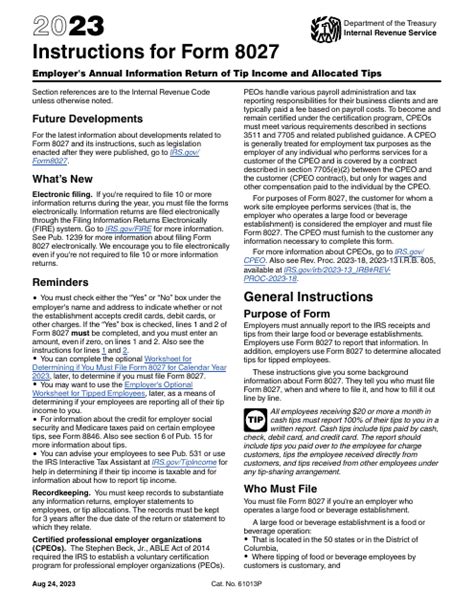

- IRS Form 8027 Instructions

Conclusion

Completing Form 8027 accurately is crucial for employers to report tip income and allocated tips correctly. By following these step-by-step instructions and avoiding common mistakes, you can ensure compliance with IRS regulations and avoid penalties and fines. Remember to keep accurate records of tip income and allocated tips, report tip income and allocated tips on employees' W-2 forms, and withhold and pay Social Security and Medicare taxes on tip income.

We hope this article has provided valuable insights and guidance on completing Form 8027 accurately. If you have any questions or concerns, please feel free to comment below.

FAQ Section

What is Form 8027?

+Form 8027 is the Employer's Annual Information Return of Tip Income and Allocated Tips, which is used to report tip income and allocated tips received by employees who receive cash and non-cash tips.

When is Form 8027 due?

+Form 8027 is due by February 28th of each year.

What are the common mistakes to avoid when completing Form 8027?

+Common mistakes to avoid include failing to report total tips received and allocated tips, incorrectly calculating tip income and allocated tips, failing to keep accurate records of tip income and allocated tips, and not withholding and paying Social Security and Medicare taxes on tip income.