Investing in the stock market can be a lucrative venture, but it also comes with its own set of risks. As an investor, it's essential to have a clear understanding of the measures in place to protect your interests. One such measure is the SIPC-7 form, also known as the Securities Investor Protection Corporation (SIPC) coverage form. In this article, we will delve into the world of SIPC-7 forms, explaining their importance, how they work, and what they mean for investors.

The Securities Investor Protection Corporation (SIPC) is a non-profit organization established by Congress in 1970 to protect investors in the event of a brokerage firm's bankruptcy or insolvency. SIPC provides limited coverage to customers of registered brokerage firms, ensuring that investors' securities and cash are protected up to a certain amount.

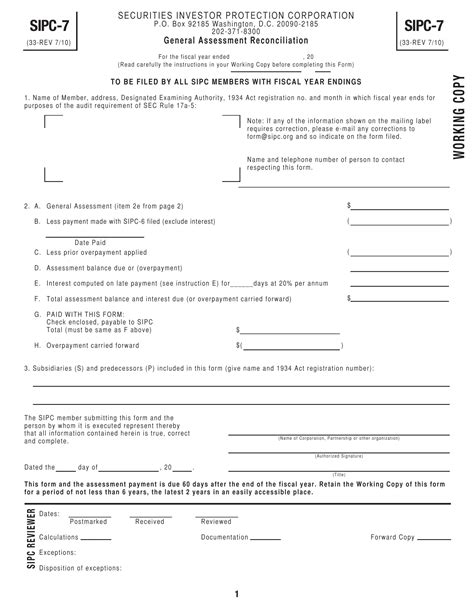

What is a SIPC-7 Form?

A SIPC-7 form is a document that outlines the terms and conditions of SIPC coverage for a specific brokerage firm. It provides detailed information about the firm's SIPC membership, including the types of securities and cash that are eligible for coverage, as well as the limits of coverage.

The SIPC-7 form is an essential document for investors, as it helps them understand the level of protection they have in the event of a brokerage firm's bankruptcy or insolvency. By reviewing the form, investors can make informed decisions about their investments and ensure that they are adequately protected.

How Does SIPC Coverage Work?

SIPC coverage is designed to protect investors in the event of a brokerage firm's bankruptcy or insolvency. When a firm becomes insolvent, SIPC steps in to liquidate the firm's assets and distribute the proceeds to customers. SIPC coverage provides limited protection to customers, ensuring that they can recover some or all of their investments.

Here's how SIPC coverage works:

- SIPC provides coverage for eligible securities, such as stocks, bonds, and mutual funds.

- SIPC also provides coverage for cash held in a brokerage account.

- SIPC coverage is limited to $500,000 per customer, including a $250,000 limit for cash claims.

- SIPC coverage does not protect against market losses or declines in the value of investments.

Eligible Securities and Cash

SIPC coverage is limited to eligible securities and cash. Eligible securities include:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Options contracts

SIPC also provides coverage for cash held in a brokerage account, including:

- Cash deposits

- Dividend and interest payments

- Proceeds from the sale of securities

Benefits of SIPC-7 Forms

SIPC-7 forms provide several benefits to investors, including:

- Transparency: SIPC-7 forms provide clear and concise information about a brokerage firm's SIPC membership and coverage limits.

- Accountability: SIPC-7 forms hold brokerage firms accountable for their actions and ensure that they comply with SIPC regulations.

- Protection: SIPC-7 forms provide investors with a level of protection against brokerage firm insolvency or bankruptcy.

How to Read a SIPC-7 Form

Reading a SIPC-7 form can be complex, but it's essential to understand the information provided. Here are some tips to help you read a SIPC-7 form:

- Review the firm's SIPC membership information, including their membership number and date of membership.

- Check the types of securities and cash that are eligible for coverage.

- Review the coverage limits, including the $500,000 per customer limit and the $250,000 limit for cash claims.

- Check for any exclusions or limitations on coverage.

Conclusion

SIPC-7 forms play a crucial role in investor protection, providing transparency, accountability, and protection against brokerage firm insolvency or bankruptcy. By understanding the SIPC-7 form, investors can make informed decisions about their investments and ensure that they are adequately protected.

As an investor, it's essential to review the SIPC-7 form for your brokerage firm and understand the level of protection you have. Remember to always do your research and consult with a financial advisor before making any investment decisions.

Final Thoughts

Investor protection is a top priority, and SIPC-7 forms play a critical role in ensuring that investors are protected. By understanding the SIPC-7 form and the benefits it provides, investors can make informed decisions about their investments and sleep better at night knowing that their interests are protected.

If you have any questions or concerns about SIPC-7 forms or investor protection, please don't hesitate to reach out to us. We're always here to help.

What is SIPC coverage?

+SIPC coverage is a type of insurance that protects investors in the event of a brokerage firm's bankruptcy or insolvency. It provides limited coverage to customers, ensuring that they can recover some or all of their investments.

What is a SIPC-7 form?

+A SIPC-7 form is a document that outlines the terms and conditions of SIPC coverage for a specific brokerage firm. It provides detailed information about the firm's SIPC membership, including the types of securities and cash that are eligible for coverage, as well as the limits of coverage.

How do I read a SIPC-7 form?

+Reading a SIPC-7 form can be complex, but it's essential to understand the information provided. Review the firm's SIPC membership information, including their membership number and date of membership. Check the types of securities and cash that are eligible for coverage, and review the coverage limits.