If you're a resident of Texas, you may have come across the Texas Income Withholding for Support Form, also known as the TWIW. This form is used to withhold income from an employee's paycheck to support a child or spouse. In this article, we will discuss the importance of filling out the Texas Income Withholding for Support Form correctly and provide you with a step-by-step guide on how to fill it out.

The Texas Income Withholding for Support Form is a crucial document that ensures that the supporter's income is withheld and distributed to the recipient in a timely manner. It's essential to fill out the form accurately to avoid any delays or discrepancies in the support payments. In this article, we will outline the five ways to fill out the Texas Income Withholding for Support Form.

Why Accurate Completion is Crucial

Accurate completion of the Texas Income Withholding for Support Form is crucial for several reasons:

- It ensures that the correct amount of income is withheld from the supporter's paycheck.

- It prevents delays or discrepancies in the support payments.

- It helps to maintain a record of the support payments made.

- It provides a clear understanding of the support obligations and payments.

5 Ways to Fill Out Texas Income Withholding for Support Form

1. Gather Required Information

Before filling out the Texas Income Withholding for Support Form, it's essential to gather all the required information. This includes:

- The supporter's name and address

- The recipient's name and address

- The social security number or taxpayer identification number of both parties

- The amount of support to be withheld

- The frequency of the support payments (e.g., weekly, biweekly, monthly)

Required Documents

- A copy of the court order or administrative order for support

- A copy of the divorce decree or separation agreement (if applicable)

2. Determine the Withholding Amount

The next step is to determine the amount of income to be withheld. This amount should be specified in the court order or administrative order for support. If the amount is not specified, you can use the following guidelines:

- For child support, the withholding amount is usually a percentage of the supporter's income (e.g., 20% for one child, 25% for two children, etc.).

- For spousal support, the withholding amount is usually a fixed amount per month.

Calculating the Withholding Amount

- You can use the Texas Child Support Calculator to determine the withholding amount for child support.

- For spousal support, you can use the court order or administrative order to determine the withholding amount.

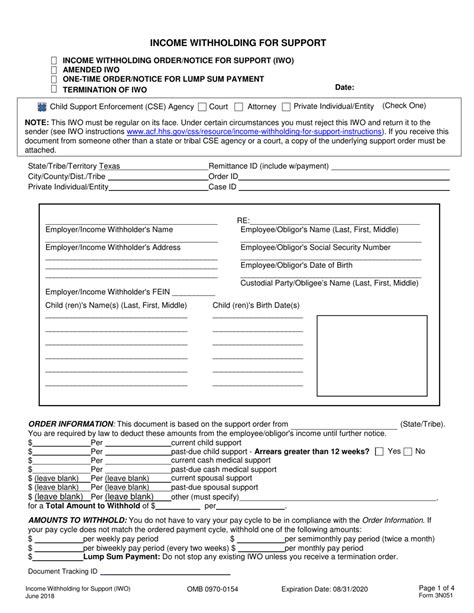

3. Fill Out the Form

Once you have gathered all the required information and determined the withholding amount, you can fill out the Texas Income Withholding for Support Form. The form consists of several sections, including:

- Section 1: Supporter's Information

- Section 2: Recipient's Information

- Section 3: Withholding Amount

- Section 4: Payment Frequency

- Section 5: Certification

Completing Section 1: Supporter's Information

- Enter the supporter's name and address

- Enter the supporter's social security number or taxpayer identification number

- Enter the supporter's employer's name and address (if applicable)

4. Sign and Date the Form

Once you have completed the form, it's essential to sign and date it. This ensures that the form is valid and can be used to withhold income for support.

Signing the Form

- Sign the form in the presence of a notary public (if required by law)

- Date the form with the current date

5. Submit the Form

The final step is to submit the Texas Income Withholding for Support Form to the appropriate authorities. This may include:

- The Texas Office of the Attorney General

- The court clerk's office

- The employer's payroll department

Submitting the Form

- Mail the form to the Texas Office of the Attorney General or the court clerk's office

- Fax the form to the employer's payroll department (if applicable)

Frequently Asked Questions

What is the Texas Income Withholding for Support Form used for?

+The Texas Income Withholding for Support Form is used to withhold income from an employee's paycheck to support a child or spouse.

How do I determine the withholding amount?

+The withholding amount can be determined using the court order or administrative order for support. You can also use the Texas Child Support Calculator to determine the withholding amount for child support.

Where do I submit the Texas Income Withholding for Support Form?

+The form can be submitted to the Texas Office of the Attorney General, the court clerk's office, or the employer's payroll department.

In conclusion, filling out the Texas Income Withholding for Support Form accurately is crucial to ensure that the correct amount of income is withheld from the supporter's paycheck. By following the five ways outlined in this article, you can ensure that the form is completed correctly and submitted to the appropriate authorities. If you have any further questions or concerns, please don't hesitate to comment below.