As a non-resident of Alabama, you may be required to file a state income tax return, known as Form 40NR. This form is used to report income earned from Alabama sources, and it's essential to understand the requirements and process for filing. In this comprehensive guide, we'll walk you through the Alabama Form 40NR, its purpose, and the steps to complete and submit it accurately.

Who Needs to File Form 40NR?

Not everyone is required to file Form 40NR. You should file this form if you're a non-resident of Alabama and have income from Alabama sources, such as:

- Wages or salaries earned from an Alabama employer

- Rent or royalty income from Alabama properties

- Interest or dividend income from Alabama banks or investments

- Capital gains from the sale of Alabama properties or investments

Even if you don't have a physical presence in Alabama, you may still be required to file Form 40NR if you have income from Alabama sources. It's essential to review the Alabama tax laws and regulations to determine if you need to file this form.

What is Form 40NR?

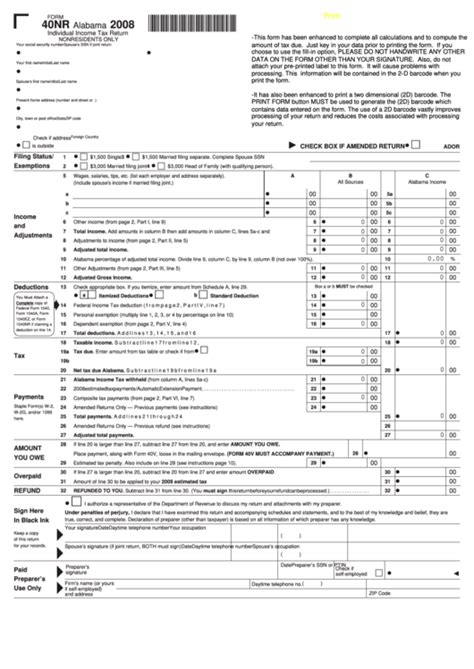

Form 40NR is the non-resident income tax return for the state of Alabama. It's used to report income earned from Alabama sources and calculate the tax liability. The form is similar to the federal income tax return, Form 1040, but it's specific to Alabama's tax laws and regulations.

How to Complete Form 40NR

Completing Form 40NR requires gathering information and documentation related to your Alabama income. Here's a step-by-step guide to help you complete the form:

- Identify Your Filing Status: Determine your filing status, which will affect the tax rates and deductions you're eligible for.

- Report Income: Report all income earned from Alabama sources, including wages, salaries, rent, royalties, interest, dividends, and capital gains.

- Claim Deductions: Claim deductions for expenses related to your Alabama income, such as mortgage interest, property taxes, and charitable donations.

- Calculate Tax Liability: Calculate your tax liability using the Alabama tax rates and tables.

- Claim Credits: Claim credits for taxes paid to other states or the federal government.

Where to File Form 40NR

You can file Form 40NR electronically or by mail. The Alabama Department of Revenue recommends e-filing, as it's faster and more secure. You can e-file through the Alabama Department of Revenue's website or through a tax preparation software.

If you prefer to file by mail, send the completed form to:

Alabama Department of Revenue Individual and Business Tax Division P.O. Box 327710 Montgomery, AL 36132-7710

Due Date and Penalties

The due date for Form 40NR is April 15th of each year. If you fail to file or pay taxes by the due date, you may be subject to penalties and interest.

FAQs

Who is considered a non-resident of Alabama?

+A non-resident of Alabama is an individual who does not have a permanent home in the state and does not intend to remain in the state indefinitely.

What is the deadline for filing Form 40NR?

+The deadline for filing Form 40NR is April 15th of each year.

Can I file Form 40NR electronically?

+Yes, you can file Form 40NR electronically through the Alabama Department of Revenue's website or through a tax preparation software.

Conclusion

Filing Form 40NR is a crucial step in reporting your Alabama income and paying taxes. By understanding the requirements and process, you can ensure accuracy and avoid penalties. If you have any questions or concerns, consult the Alabama Department of Revenue's website or seek professional tax advice.

Take action today and file your Alabama Form 40NR to stay compliant with state tax laws. Share your experiences and tips in the comments below, and don't forget to share this article with others who may need guidance on filing their non-resident income tax return.