Are you a small business owner or an individual with a side hustle, struggling to navigate the complexities of the IRS tax system? Filing taxes can be a daunting task, especially when it comes to reporting income from installment sales. IRS Form 6252 is a crucial document for reporting income from installment sales, but it can be overwhelming for those who are new to the process. In this article, we will provide you with 5 essential tips for filing IRS Form 6252 correctly, ensuring you avoid common mistakes and stay on the right side of the taxman.

What is IRS Form 6252?

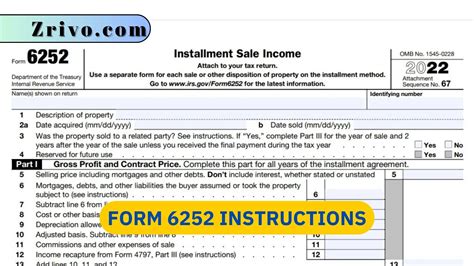

Before we dive into the tips, let's quickly define what IRS Form 6252 is. IRS Form 6252, also known as the Installment Sale Income form, is used to report income from installment sales. An installment sale occurs when you sell property, such as real estate or a business, and the buyer pays for it in installments over a period of time. This form is used to calculate the taxable gain from the sale and report it on your tax return.

Tips for Filing IRS Form 6252 Correctly

Tip 1: Understand the Reporting Requirements

To accurately complete Form 6252, you need to understand the reporting requirements. You must report all installment sales, regardless of the amount of the sale. This includes sales of:

- Real property, such as houses or buildings

- Business assets, such as equipment or inventory

- Securities, such as stocks or bonds

- Intellectual property, such as patents or copyrights

Ensure you report all installment sales, even if you don't receive any payments during the tax year.

Tip 2: Determine the Correct Filing Status

Your filing status affects how you complete Form 6252. If you're a sole proprietor, you'll report the installment sale income on Schedule C (Form 1040). If you're a partnership or S corporation, you'll report the income on Form 1065 or Form 1120S, respectively.

Common Filing Status Mistakes to Avoid

- Failing to report installment sale income on the correct form

- Incorrectly reporting installment sale income as ordinary income

- Failing to file Form 6252 for each installment sale

Tip 3: Calculate the Correct Gain

To calculate the gain from an installment sale, you'll need to determine the selling price, the adjusted basis, and the installment sale income. The gain is calculated by subtracting the adjusted basis from the selling price.

Calculating Gain: A Step-by-Step Guide

- Determine the selling price

- Calculate the adjusted basis

- Calculate the installment sale income

- Calculate the gain by subtracting the adjusted basis from the selling price

Tip 4: Complete the Form Accurately

When completing Form 6252, ensure you:

- Report the correct selling price and adjusted basis

- Calculate the correct gain and installment sale income

- Enter the correct amount on Line 22 (Installment sale income) of Schedule C (Form 1040)

Common Form 6252 Mistakes to Avoid

- Incorrectly reporting the selling price or adjusted basis

- Failing to calculate the correct gain and installment sale income

- Incorrectly entering the amount on Line 22 of Schedule C (Form 1040)

Tip 5: Keep Accurate Records

Maintaining accurate records is essential for completing Form 6252 correctly. Keep records of:

- The sale agreement

- The buyer's payments

- The selling price and adjusted basis

- The gain and installment sale income calculations

Record-Keeping Best Practices

- Keep all records related to the installment sale in a secure location

- Ensure all records are accurate and up-to-date

- Consider consulting with a tax professional to ensure record-keeping compliance

What is the deadline for filing Form 6252?

+The deadline for filing Form 6252 is the same as the deadline for filing your tax return. For most individuals, this is April 15th of each year. However, if you file for an extension, the deadline is October 15th.

Can I e-file Form 6252?

+Yes, you can e-file Form 6252. In fact, the IRS encourages electronic filing, as it reduces errors and speeds up processing times.

Do I need to file Form 6252 if I don't receive any payments during the tax year?

+Yes, you must file Form 6252 even if you don't receive any payments during the tax year. You'll report the sale on the form, but you won't have any income to report.

In conclusion, filing IRS Form 6252 correctly requires careful attention to detail and a thorough understanding of the reporting requirements. By following these 5 tips, you can ensure you avoid common mistakes and accurately report your installment sale income. Remember to keep accurate records, calculate the correct gain, and complete the form accurately. Don't hesitate to reach out to a tax professional if you have any questions or concerns.

We hope you found this article informative and helpful. If you have any comments or questions, please don't hesitate to reach out. Share this article with your friends and family who may be struggling with IRS Form 6252.