Understanding the Importance of Sales Tax Forms

As a business owner, it's essential to understand the significance of sales tax forms. These forms are used to report and remit sales tax collected from customers to the relevant state authorities. Failure to file sales tax forms accurately and on time can result in penalties, fines, and even audits. In this article, we'll guide you through the simple steps to fill out sales tax forms, ensuring you stay compliant with state regulations.

Sales tax forms are a critical component of any business that sells taxable goods or services. By accurately completing these forms, you'll not only avoid potential penalties but also ensure that you're contributing to the state's revenue. In this article, we'll break down the process into six straightforward steps, making it easier for you to navigate the world of sales tax forms.

Step 1: Gather Required Information

Before you start filling out the sales tax form, gather all the necessary information. This includes:

- Your business's identification number (usually your Federal Tax ID Number)

- The reporting period (e.g., monthly, quarterly, or annually)

- The total sales amount for the reporting period

- The total sales tax collected for the reporting period

- Any deductions or exemptions claimed

Having all the required information readily available will save you time and reduce the likelihood of errors.

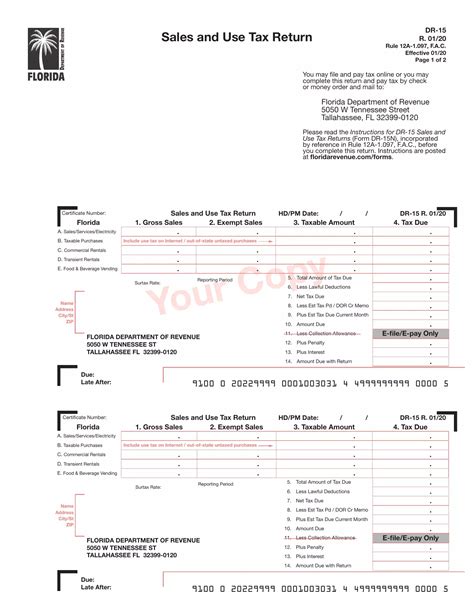

Types of Sales Tax Forms

There are several types of sales tax forms, including:

- ST-1 (Sales Tax Return)

- ST-2 (Sales Tax Exemption Certificate)

- ST-3 (Sales Tax Deduction Certificate)

Familiarize yourself with the specific form required by your state and ensure you're using the correct one.

Step 2: Determine Your Filing Frequency

Your filing frequency will depend on the state's requirements and your business's sales volume. Common filing frequencies include:

- Monthly

- Quarterly

- Annually

It's essential to determine your filing frequency to ensure you're meeting the state's deadlines.

Consequences of Late Filing

Failing to file your sales tax form on time can result in penalties, fines, and even audits. In some cases, late filing can lead to:

- Penalty fees (ranging from 5% to 20% of the total tax due)

- Interest charges (accruing daily or monthly)

- Audit risk (increasing the likelihood of a state audit)

Avoid these consequences by ensuring you file your sales tax form on time.

Step 3: Calculate Your Sales Tax Liability

To calculate your sales tax liability, follow these steps:

- Determine the total sales amount for the reporting period.

- Calculate the total sales tax collected for the reporting period.

- Apply any deductions or exemptions claimed.

- Calculate the net sales tax due.

Common Sales Tax Deductions

Some common sales tax deductions include:

- Sales tax on exempt sales

- Sales tax on items returned or exchanged

- Sales tax on items sold to other businesses for resale

Ensure you're aware of the deductions available in your state to minimize your sales tax liability.

Step 4: Fill Out the Sales Tax Form

Now that you have all the required information, it's time to fill out the sales tax form. Ensure you:

- Complete all required fields accurately

- Sign and date the form

- Attach any supporting documentation (e.g., invoices, receipts)

Tips for Accurate Form Completion

- Use a calculator to ensure accuracy

- Double-check your math and calculations

- Keep a record of your form submissions

By following these tips, you'll reduce the likelihood of errors and ensure a smooth filing process.

Step 5: Submit Your Sales Tax Form

Once you've completed the sales tax form, submit it to the relevant state authority. You can typically submit the form:

- Online through the state's website

- By mail

- In person

Ensure you meet the filing deadline to avoid penalties and fines.

Step 6: Keep Records and Monitor Your Account

After submitting your sales tax form, keep records of your submission and monitor your account. This includes:

- Keeping a copy of the submitted form

- Tracking your payment and account status

- Responding to any state notifications or inquiries

By following these steps, you'll ensure a smooth sales tax filing process and maintain compliance with state regulations.

Benefits of Accurate Sales Tax Filing

Accurate sales tax filing offers numerous benefits, including:

- Avoiding penalties and fines

- Reducing audit risk

- Ensuring compliance with state regulations

- Maintaining a positive business reputation

By following the simple steps outlined in this article, you'll be able to fill out your sales tax form with confidence and accuracy.

We hope this article has provided you with valuable insights into the world of sales tax forms. If you have any questions or concerns, feel free to comment below or share this article with your colleagues.

What is a sales tax form?

+A sales tax form is a document used to report and remit sales tax collected from customers to the relevant state authorities.

How often do I need to file a sales tax form?

+Your filing frequency will depend on the state's requirements and your business's sales volume. Common filing frequencies include monthly, quarterly, and annually.

What happens if I file my sales tax form late?

+Failing to file your sales tax form on time can result in penalties, fines, and even audits. In some cases, late filing can lead to penalty fees, interest charges, and increased audit risk.