Mastering Form 8824: A Comprehensive Guide to Like-Kind Exchanges

Like-kind exchanges are a popular tax strategy used by real estate investors and businesses to defer capital gains taxes. However, to take advantage of this tax benefit, it's essential to fill out Form 8824 accurately and thoroughly. In this article, we'll provide a step-by-step guide on how to fill out Form 8824 like a pro.

What is Form 8824?

Form 8824, also known as the Like-Kind Exchanges, is a tax form used to report like-kind exchanges of real property, such as rental properties, commercial buildings, or land. The form is used to calculate the gain or loss from the exchange and to determine the amount of depreciation that can be claimed on the new property.

Step 1: Gather Required Information

Before filling out Form 8824, it's crucial to gather all the required information, including:

- Identification of the properties involved in the exchange

- Date of the exchange

- Fair market value of the properties

- Adjusted basis of the properties

- Depreciation claimed on the old property

- Boot received or paid in the exchange

What is Boot?

Boot refers to any cash or non-like-kind property received in the exchange. Boot is taxable and must be reported on Form 8824.

Step 2: Complete Part 1 of Form 8824

Part 1 of Form 8824 requires you to provide information about the properties involved in the exchange. This includes:

- Description of the properties

- Date of the exchange

- Fair market value of the properties

- Adjusted basis of the properties

How to Determine Fair Market Value

Fair market value is the price that a willing buyer would pay for the property in an arm's-length transaction. You can determine fair market value by using appraisals, comparable sales, or other methods.

Step 3: Calculate the Gain or Loss

In Part 2 of Form 8824, you'll need to calculate the gain or loss from the exchange. This involves subtracting the adjusted basis from the fair market value of the properties.

- Gain = Fair market value - Adjusted basis

- Loss = Adjusted basis - Fair market value

How to Report Boot

If you received boot in the exchange, you'll need to report it in Part 2 of Form 8824. Boot is taxable and must be reported as ordinary income.

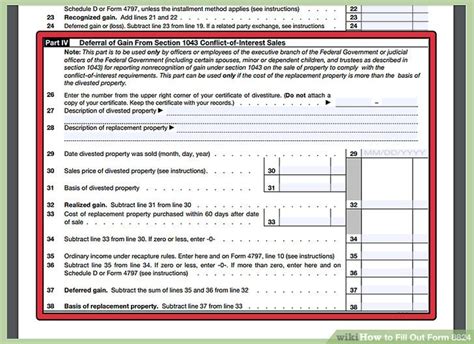

Step 4: Complete Part 3 of Form 8824

Part 3 of Form 8824 requires you to provide information about the new property acquired in the exchange. This includes:

- Description of the new property

- Date of the exchange

- Fair market value of the new property

- Adjusted basis of the new property

How to Determine the Basis of the New Property

The basis of the new property is the adjusted basis of the old property, plus any gain recognized in the exchange.

Step 5: Review and Sign Form 8824

Once you've completed Form 8824, review it carefully to ensure accuracy. Sign and date the form, and attach it to your tax return.

What Happens If I Make a Mistake?

If you make a mistake on Form 8824, you may be subject to penalties and interest. It's essential to seek professional help if you're unsure about how to complete the form.

What is a like-kind exchange?

+A like-kind exchange is a tax-deferred exchange of one property for another property of similar nature or character.

What is the deadline for filing Form 8824?

+The deadline for filing Form 8824 is the same as the deadline for filing your tax return.

Can I use Form 8824 for personal use property?

+No, Form 8824 is only used for reporting like-kind exchanges of business or investment property.

By following these steps and seeking professional help when needed, you can fill out Form 8824 like a pro and take advantage of the tax benefits of like-kind exchanges. Remember to review and sign the form carefully, and attach it to your tax return to avoid any penalties or interest.