Are you struggling to fill out Form 4506-B, also known as the Request for Copy of Transcript of Tax Return? This form is used to request a transcript of your tax return from the Internal Revenue Service (IRS), and it's a crucial document for various purposes, such as applying for a mortgage, student loan, or tax preparation. However, filling out this form can be daunting, especially if you're not familiar with tax terminology. In this article, we will break down the process into 5 easy steps to help you fill out Form 4506-B correctly.

Step 1: Gather Required Information

Before you start filling out Form 4506-B, make sure you have the following information readily available:

- Your name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's name and Social Security number or ITIN (if applicable)

- The tax year(s) for which you're requesting a transcript

- The type of transcript you're requesting (e.g., tax return transcript, tax account transcript, etc.)

- Your address and phone number

Tax Year and Transcript Type

When filling out Form 4506-B, you'll need to specify the tax year(s) for which you're requesting a transcript. You can request transcripts for up to four tax years. Additionally, you'll need to choose the type of transcript you want:

- Tax Return Transcript: A line-by-line copy of your tax return

- Tax Account Transcript: A summary of your tax account, including payments, penalties, and interest

- Record of Account Transcript: A combination of the tax return transcript and tax account transcript

- Verification of Non-Filing Letter: A letter stating that the IRS has no record of a tax return for a specific year

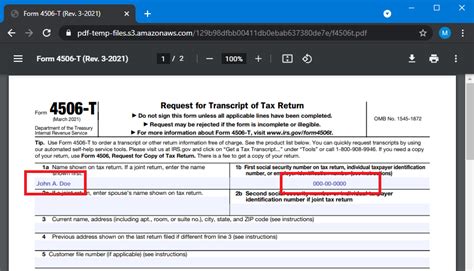

Step 2: Fill Out Part 1 – Taxpayer Information

In Part 1 of Form 4506-B, you'll need to provide your taxpayer information. This includes:

- Your name and Social Security number or ITIN

- Your spouse's name and Social Security number or ITIN (if applicable)

- Your address and phone number

Make sure to write your name and Social Security number or ITIN exactly as they appear on your tax return.

Name and Social Security Number or ITIN

When filling out Part 1, it's essential to ensure that your name and Social Security number or ITIN match the information on your tax return. If you've recently changed your name or address, make sure to update the IRS by filing Form 8822, Change of Address.

Step 3: Fill Out Part 2 – Tax Year and Transcript Type

In Part 2 of Form 4506-B, you'll need to specify the tax year(s) for which you're requesting a transcript and the type of transcript you want. Make sure to follow the instructions carefully and choose the correct options.

- Tax Year: Enter the tax year(s) for which you're requesting a transcript. You can request transcripts for up to four tax years.

- Transcript Type: Choose the type of transcript you want, such as tax return transcript, tax account transcript, etc.

Multiple Tax Years and Transcript Types

If you're requesting transcripts for multiple tax years or types, make sure to list each year and type separately.

Step 4: Fill Out Part 3 – Signature and Date

In Part 3 of Form 4506-B, you'll need to sign and date the form. Make sure to sign your name exactly as it appears on your tax return.

- Signature: Sign your name in the designated area.

- Date: Enter the date you're signing the form.

Spouse's Signature

If you're filing a joint tax return, your spouse will also need to sign the form.

Step 5: Submit the Form

Once you've completed Form 4506-B, you can submit it to the IRS by mail or fax. Make sure to follow the instructions carefully and include any required documentation.

- Mail: Send the form to the IRS address listed in the instructions.

- Fax: Fax the form to the IRS fax number listed in the instructions.

Tracking Your Request

After submitting Form 4506-B, you can track the status of your request by contacting the IRS or checking your online account.

By following these 5 easy steps, you'll be able to fill out Form 4506-B correctly and obtain the tax transcript you need.

What is Form 4506-B used for?

+Form 4506-B is used to request a transcript of your tax return from the Internal Revenue Service (IRS).

How long does it take to receive a tax transcript?

+The IRS typically processes requests for tax transcripts within 10-15 business days.

Can I request a tax transcript online?

+Yes, you can request a tax transcript online through the IRS website.

We hope this article has helped you understand how to fill out Form 4506-B correctly. If you have any further questions or concerns, feel free to ask in the comments below. Don't forget to share this article with others who may find it helpful.