Completing the Georgia Pt 61 Form is a crucial step for individuals and businesses in Georgia that engage in the sale or transfer of tangible personal property, including motor vehicles, trailers, and aircraft. This form serves as a tax return and is used to report and pay sales and use tax due on the sale or transfer of such property. In this article, we will explore five ways to complete the Georgia Pt 61 Form efficiently and accurately.

Understanding the Georgia Pt 61 Form

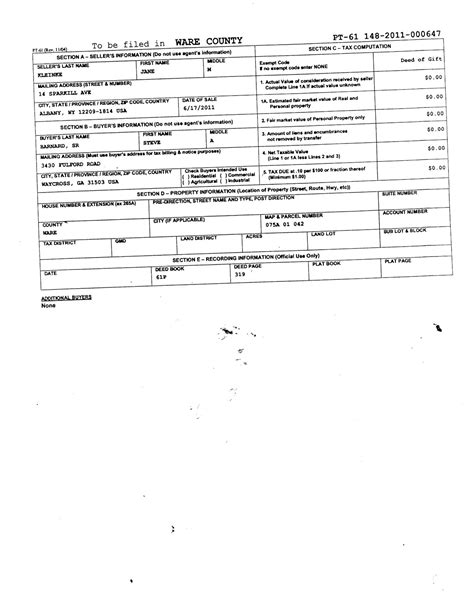

Before we dive into the methods of completing the form, it's essential to understand its purpose and the information required. The Georgia Pt 61 Form is used to report the sale or transfer of tangible personal property, including motor vehicles, trailers, and aircraft. The form requires details about the seller, buyer, and the property being sold or transferred.

Who Needs to File the Georgia Pt 61 Form?

Individuals and businesses that engage in the sale or transfer of tangible personal property in Georgia are required to file the Pt 61 Form. This includes dealers, lessors, and private individuals who sell or transfer property.

Method 1: Online Filing through the Georgia Tax Center

The Georgia Tax Center (GTC) is an online portal that allows taxpayers to file and pay their taxes electronically. To complete the Pt 61 Form online, follow these steps:

- Visit the GTC website and log in to your account.

- Click on the "File a Return" button and select "Sales and Use Tax" as the tax type.

- Choose the filing period and click "Next."

- Enter the required information, including the seller's and buyer's details, property description, and sales price.

- Calculate and pay the tax due using the online calculator.

- Review and submit the return.

Benefits of Online Filing

Online filing through the GTC offers several benefits, including:

- Convenience: File your return from anywhere, at any time.

- Accuracy: The online calculator ensures accurate calculations.

- Speed: Receive instant confirmation of your filing.

Method 2: Paper Filing by Mail

If you prefer to file the Pt 61 Form by mail, follow these steps:

- Download and print the form from the Georgia Department of Revenue website.

- Complete the form accurately, ensuring all required information is included.

- Calculate the tax due using the form's instructions.

- Attach any supporting documentation, such as invoices or receipts.

- Mail the completed form and payment to the address listed on the form.

Important Notes for Paper Filing

When filing by mail, keep the following in mind:

- Ensure the form is completed accurately and signed.

- Attach all required supporting documentation.

- Use a secure and trackable mailing method.

Method 3: Filing through a Tax Professional

If you're not comfortable completing the Pt 61 Form yourself, consider hiring a tax professional. They can guide you through the process and ensure accurate completion.

- Find a qualified tax professional with experience in Georgia sales and use tax.

- Provide the necessary documentation and information.

- Review and sign the completed form.

Benefits of Filing through a Tax Professional

Filing through a tax professional offers several benefits, including:

- Expertise: Tax professionals have in-depth knowledge of Georgia sales and use tax laws.

- Accuracy: They ensure accurate completion and minimize errors.

- Time-saving: Let the professional handle the paperwork.

Method 4: Filing through a Third-Party Software Provider

Several third-party software providers offer Georgia sales and use tax filing solutions. These providers can guide you through the process and ensure accurate completion.

- Research and select a reputable software provider.

- Follow the provider's instructions to complete the form.

- Review and submit the return.

Benefits of Filing through a Third-Party Software Provider

Filing through a third-party software provider offers several benefits, including:

- Convenience: File your return from anywhere, at any time.

- Accuracy: The software ensures accurate calculations.

- Speed: Receive instant confirmation of your filing.

Method 5: Filing through a Certified Public Accountant (CPA)

If you're a business owner or have complex sales and use tax needs, consider hiring a Certified Public Accountant (CPA). They can provide expert guidance and ensure accurate completion of the Pt 61 Form.

- Find a qualified CPA with experience in Georgia sales and use tax.

- Provide the necessary documentation and information.

- Review and sign the completed form.

Benefits of Filing through a CPA

Filing through a CPA offers several benefits, including:

- Expertise: CPAs have in-depth knowledge of Georgia sales and use tax laws.

- Accuracy: They ensure accurate completion and minimize errors.

- Time-saving: Let the CPA handle the paperwork.

What is the Georgia Pt 61 Form used for?

+The Georgia Pt 61 Form is used to report and pay sales and use tax due on the sale or transfer of tangible personal property, including motor vehicles, trailers, and aircraft.

Who needs to file the Georgia Pt 61 Form?

+Individuals and businesses that engage in the sale or transfer of tangible personal property in Georgia are required to file the Pt 61 Form.

Can I file the Georgia Pt 61 Form online?

+Yes, you can file the Pt 61 Form online through the Georgia Tax Center (GTC) website.

By following these five methods, you can complete the Georgia Pt 61 Form accurately and efficiently. Remember to choose the method that best suits your needs, and don't hesitate to seek professional help if you're unsure about any aspect of the process.