The G45 tax form is a crucial document for individuals and businesses to report their annual income and claim tax deductions. However, the complexity of the form often leaves taxpayers confused and overwhelmed. In this article, we will break down the G45 tax form into simple, easy-to-understand sections, providing a comprehensive guide to help you navigate the process with ease.

Why is the G45 Tax Form Important?

The G45 tax form is a vital document for the government to assess an individual's or business's tax liability. It is used to report income from various sources, claim deductions and exemptions, and calculate the amount of tax owed. The form is typically filed annually, and failure to do so can result in penalties and fines. By understanding the G45 tax form, you can ensure that you are meeting your tax obligations and taking advantage of available tax savings.

What is Included in the G45 Tax Form?

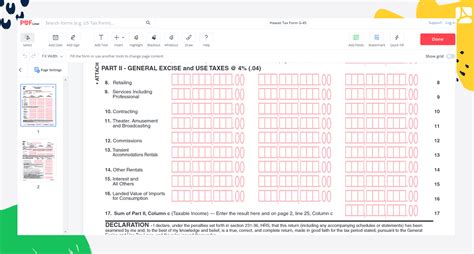

The G45 tax form is divided into several sections, each with its own specific purpose. The main sections include:

- Personal Details: This section requires your personal information, such as name, address, and tax identification number.

- Income: This section requires you to report all sources of income, including employment income, self-employment income, and investment income.

- Deductions: This section allows you to claim deductions for expenses related to your income, such as business expenses or charitable donations.

- Exemptions: This section allows you to claim exemptions for specific expenses, such as mortgage interest or medical expenses.

- Tax Liability: This section calculates your total tax liability based on your income and deductions.

Step-by-Step Guide to Filing the G45 Tax Form

Filing the G45 tax form can be a daunting task, but by following these steps, you can ensure that you are doing it correctly.

Step 1: Gather Required Documents

Before starting the G45 tax form, gather all required documents, including:

- P60: Your P60 certificate, which shows your employment income and tax deducted.

- P45: Your P45 certificate, which shows your employment income and tax deducted when you leave a job.

- Bank Statements: Your bank statements, which show your income and expenses.

- Invoices and Receipts: Invoices and receipts for business expenses or charitable donations.

Step 2: Complete the Personal Details Section

Complete the personal details section with your name, address, and tax identification number. Make sure to double-check your information to avoid errors.

Step 3: Report Your Income

Report all sources of income, including employment income, self-employment income, and investment income. Make sure to include all relevant documents, such as your P60 and P45 certificates.

Step 4: Claim Deductions and Exemptions

Claim deductions for expenses related to your income, such as business expenses or charitable donations. Also, claim exemptions for specific expenses, such as mortgage interest or medical expenses.

Step 5: Calculate Your Tax Liability

Calculate your total tax liability based on your income and deductions. Make sure to double-check your calculations to avoid errors.

Tips and Tricks for Filing the G45 Tax Form

Here are some tips and tricks to help you file the G45 tax form with ease:

- File Early: File your G45 tax form early to avoid last-minute rush and potential errors.

- Seek Professional Help: Seek professional help if you are unsure about any aspect of the G45 tax form.

- Keep Records: Keep records of all documents and calculations to avoid errors and potential audits.

Common Mistakes to Avoid When Filing the G45 Tax Form

Here are some common mistakes to avoid when filing the G45 tax form:

- Incorrect Information: Make sure to provide accurate and up-to-date information to avoid errors.

- Missing Documents: Make sure to include all required documents to avoid delays and potential audits.

- Miscalculations: Double-check your calculations to avoid errors and potential audits.

Conclusion

Filing the G45 tax form can be a complex and daunting task, but by following these steps and tips, you can ensure that you are doing it correctly. Remember to gather all required documents, complete the personal details section, report your income, claim deductions and exemptions, and calculate your tax liability. By avoiding common mistakes and seeking professional help when needed, you can file your G45 tax form with ease and confidence.

We hope this article has been helpful in understanding the G45 tax form. If you have any questions or comments, please feel free to share them below.

What is the G45 tax form used for?

+The G45 tax form is used to report annual income and claim tax deductions.

What documents do I need to file the G45 tax form?

+You will need to provide your P60 and P45 certificates, bank statements, and invoices and receipts for business expenses or charitable donations.

How do I calculate my tax liability?

+Your tax liability is calculated based on your income and deductions. Make sure to double-check your calculations to avoid errors.