As a business owner in California, it's essential to understand the tax requirements for your company. One of the critical tax forms for S corporations in California is the FTB Form 568, also known as the California S Corporation Franchise Tax Return. In this article, we'll delve into the details of FTB Form 568, its purpose, and what you need to know to file it accurately.

What is FTB Form 568?

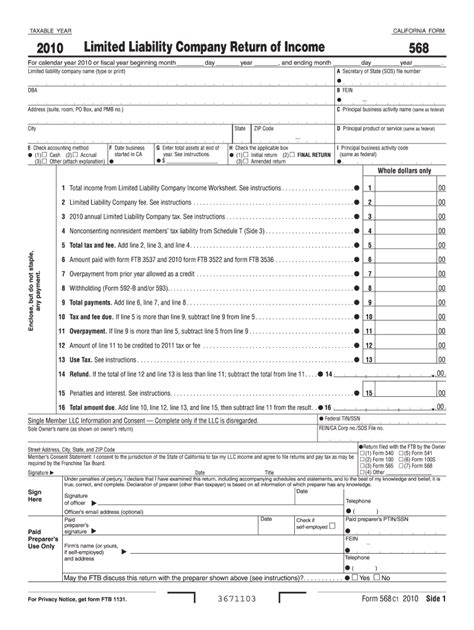

FTB Form 568 is the annual tax return form required for S corporations operating in California. The form is used to report the corporation's income, deductions, and credits, as well as to calculate the franchise tax owed to the state. The California Franchise Tax Board (FTB) requires all S corporations to file this form by the 15th day of the third month following the close of the corporation's tax year.

Who needs to file FTB Form 568?

All S corporations registered in California must file FTB Form 568, regardless of their income level or profit status. This includes:

- Domestic S corporations: corporations formed in California and operating within the state.

- Foreign S corporations: corporations formed outside of California but doing business in the state.

Key Components of FTB Form 568

The FTB Form 568 consists of several sections, including:

- Business Information: The corporation's name, address, and employer identification number (EIN).

- Income and Deductions: The corporation's total income, deductions, and credits, including federal income tax deduction, business income, and passive income.

- Franchise Tax Computation: The calculation of the franchise tax owed, based on the corporation's net income and the applicable tax rate.

- Credit and Payments: The reporting of any credits, such as the research and development credit, and payments made towards the franchise tax.

Filing Requirements and Deadlines

The FTB Form 568 must be filed annually, and the deadline for filing is typically March 15th for calendar-year corporations. If the corporation's tax year-end is not December 31st, the filing deadline will be the 15th day of the third month following the close of the corporation's tax year.

Penalties for Late Filing or Non-Compliance

Failure to file FTB Form 568 or making late payments can result in penalties and interest. The FTB may impose:

- Late filing penalty: 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

- Late payment penalty: 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

- Interest: on the unpaid tax and penalties, calculated from the original due date.

How to File FTB Form 568

The FTB Form 568 can be filed electronically through the California FTB's website or by mail. It's recommended to file electronically to ensure timely and accurate processing.

Additional Requirements and Considerations

In addition to filing FTB Form 568, S corporations in California must also:

- File federal Form 1120S: with the Internal Revenue Service (IRS).

- Maintain accurate records: to support the information reported on FTB Form 568.

- Comply with other California tax requirements: such as withholding tax, sales tax, and employment tax.

Tips for Filing FTB Form 568

To ensure accurate and timely filing of FTB Form 568:

- Consult with a tax professional: to ensure compliance with all California tax requirements.

- Use the correct tax year: to avoid errors and potential penalties.

- Report all income and deductions: to minimize the risk of audit or penalty.

Conclusion

Filing FTB Form 568 is a critical requirement for S corporations operating in California. Understanding the form's components, filing requirements, and deadlines is essential to avoid penalties and ensure compliance with California tax laws. By following the tips and guidelines outlined in this article, you can ensure accurate and timely filing of FTB Form 568.

We encourage you to share your thoughts and experiences with filing FTB Form 568 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the deadline for filing FTB Form 568?

+The deadline for filing FTB Form 568 is typically March 15th for calendar-year corporations. If the corporation's tax year-end is not December 31st, the filing deadline will be the 15th day of the third month following the close of the corporation's tax year.

Can I file FTB Form 568 electronically?

+Yes, the FTB Form 568 can be filed electronically through the California FTB's website.

What are the penalties for late filing or non-compliance?

+Failure to file FTB Form 568 or making late payments can result in penalties and interest, including a late filing penalty, late payment penalty, and interest on the unpaid tax and penalties.