The Form 8812, also known as the "Additional Child Tax Credit," is a crucial tax form for families with qualifying children under the age of 17. Filing this form accurately is essential to ensure that you receive the correct amount of tax credit. In this article, we will provide you with 5 valuable tips for completing the worksheet for Form 8812.

Understanding the Form 8812 Worksheet

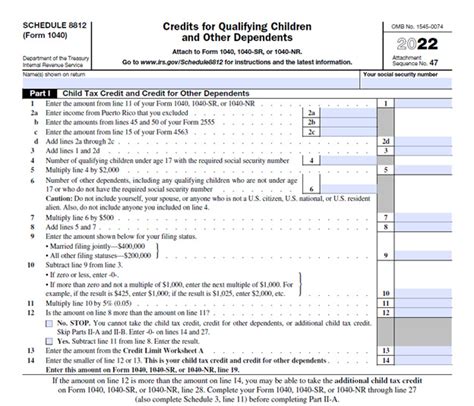

Before we dive into the tips, it's essential to understand the purpose of the Form 8812 worksheet. The worksheet is designed to help you calculate the Additional Child Tax Credit, which is a refundable tax credit. The credit is calculated based on the number of qualifying children you have, your earned income, and your tax liability. The worksheet is a step-by-step guide to ensure that you accurately calculate the credit.

Tip 1: Gather Required Documents and Information

To complete the worksheet, you will need to gather specific documents and information. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your qualifying children's names, dates of birth, and Social Security numbers or ITINs

- Your earned income from Form 1040, Line 1

- Your tax liability from Form 1040, Line 15

- Any other relevant tax credits or deductions

Make sure you have all the necessary documents and information before starting the worksheet.

Tip 2: Identify Qualifying Children

To qualify for the Additional Child Tax Credit, your children must meet specific requirements. These include:

- Being under the age of 17 as of December 31st

- Being claimed as a dependent on your tax return

- Being a U.S. citizen, national, or resident

- Having a valid Social Security number or ITIN

Ensure that your children meet these requirements before proceeding with the worksheet.

Tip 3: Calculate Earned Income

Earned income is a critical component of the Form 8812 worksheet. Earned income includes:

- Wages, salaries, and tips

- Net earnings from self-employment

- Taxable income from a disability retirement plan

Calculate your earned income by adding up the relevant amounts from your tax return. Make sure to include all sources of earned income.

Tip 4: Complete the Worksheet Steps

The Form 8812 worksheet consists of several steps. These steps include:

- Calculating the maximum Additional Child Tax Credit

- Determining the earned income limitation

- Calculating the credit phase-out

- Determining the credit amount

Complete each step carefully, using the relevant information and calculations. Make sure to follow the instructions and use the correct formulas.

Tip 5: Review and Verify Your Calculations

After completing the worksheet, review and verify your calculations. Double-check your math and ensure that you have included all relevant information. If you're unsure about any part of the worksheet, consider consulting a tax professional or the IRS.

By following these 5 tips, you can accurately complete the worksheet for Form 8812 and ensure that you receive the correct amount of Additional Child Tax Credit.

Additional Tips and Resources

- Use the IRS website to access the Form 8812 worksheet and instructions.

- Consult the IRS Publication 972, Child Tax Credit, for more information on the credit and the worksheet.

- If you're unsure about any part of the worksheet, consider consulting a tax professional or the IRS.

By following these tips and resources, you can ensure that you accurately complete the worksheet for Form 8812 and receive the correct amount of tax credit.

Take Action

If you have qualifying children and need to complete the Form 8812 worksheet, follow these 5 tips to ensure accuracy. Review and verify your calculations, and don't hesitate to seek help if needed. By taking action, you can ensure that you receive the correct amount of Additional Child Tax Credit and make the most of your tax refund.

Frequently Asked Questions

What is the purpose of the Form 8812 worksheet?

+The Form 8812 worksheet is designed to help you calculate the Additional Child Tax Credit, a refundable tax credit.

What documents do I need to complete the worksheet?

+You will need your Social Security number or ITIN, your qualifying children's names, dates of birth, and Social Security numbers or ITINs, and your earned income from Form 1040, Line 1.

How do I calculate earned income?

+Earned income includes wages, salaries, and tips, as well as net earnings from self-employment and taxable income from a disability retirement plan.