Filing taxes can be a daunting task, especially when dealing with complex forms like the Form 8606. This form is used to report nondeductible contributions to traditional IRAs, distributions from Roth IRAs, and conversions from traditional to Roth IRAs. In this article, we will provide you with 5 tips for filing Form 8606 with FreeTaxUSA, making the process easier and less overwhelming.

Understanding Form 8606

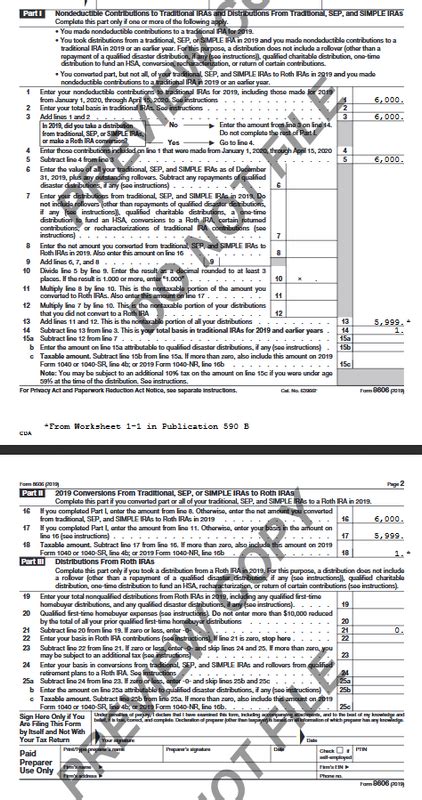

Before we dive into the tips, it's essential to understand what Form 8606 is and why it's necessary. Form 8606 is used to report nondeductible contributions to traditional IRAs, distributions from Roth IRAs, and conversions from traditional to Roth IRAs. This form helps the IRS keep track of your IRA contributions and distributions, ensuring you're in compliance with tax laws.

Tip 1: Gather Required Documents

To file Form 8606 accurately, you'll need to gather specific documents, including:

- Your IRA contribution records

- Your IRA distribution records

- Your Roth IRA conversion records

- Your tax return from the previous year (if applicable)

Having these documents readily available will save you time and reduce the likelihood of errors.

Filing Form 8606 with FreeTaxUSA

FreeTaxUSA is a popular tax preparation software that guides you through the tax filing process. When filing Form 8606 with FreeTaxUSA, follow these steps:

- Log in to your FreeTaxUSA account and select the " IRA and 401(k)" option.

- Answer the questions regarding your IRA contributions, distributions, and conversions.

- Enter the required information from your gathered documents.

- Review your entries carefully to ensure accuracy.

Tip 2: Report Nondeductible Contributions Correctly

When reporting nondeductible contributions to traditional IRAs, it's crucial to calculate the correct amount. You'll need to subtract the deductible portion from the total contribution amount. FreeTaxUSA will guide you through this calculation, but it's essential to understand the process to avoid errors.

Common Errors to Avoid

When filing Form 8606, it's easy to make mistakes. Here are some common errors to avoid:

- Failing to report all IRA contributions and distributions

- Incorrectly calculating nondeductible contributions

- Not reporting Roth IRA conversions

- Failing to sign and date the form

Tip 3: Take Advantage of FreeTaxUSA's Guidance

FreeTaxUSA offers guidance throughout the tax filing process, including Form 8606. Take advantage of this feature to ensure you're reporting your IRA information correctly. If you're unsure about any aspect of the form, FreeTaxUSA's support team is available to assist you.

Converting Traditional to Roth IRAs

Converting a traditional IRA to a Roth IRA can provide tax benefits, but it's essential to report this conversion accurately on Form 8606. When converting, you'll need to pay taxes on the converted amount, but it will be tax-free in the future.

Tip 4: Report Distributions from Roth IRAs Correctly

When reporting distributions from Roth IRAs, it's crucial to determine if the distribution is taxable or tax-free. FreeTaxUSA will guide you through this process, but it's essential to understand the rules surrounding Roth IRA distributions.

Avoiding Penalties and Fines

Failing to file Form 8606 or reporting incorrect information can result in penalties and fines. To avoid these consequences, ensure you're filing the form accurately and on time.

Tip 5: Review and Edit Before Submitting

Before submitting Form 8606, review your entries carefully to ensure accuracy. Check for any errors or omissions, and edit the form as needed. FreeTaxUSA allows you to review and edit your return before submitting it to the IRS.

What is Form 8606 used for?

+Form 8606 is used to report nondeductible contributions to traditional IRAs, distributions from Roth IRAs, and conversions from traditional to Roth IRAs.

Can I file Form 8606 electronically?

+Yes, you can file Form 8606 electronically using tax preparation software like FreeTaxUSA.

What happens if I fail to file Form 8606?

+Failing to file Form 8606 can result in penalties and fines. It's essential to file the form accurately and on time to avoid these consequences.

By following these 5 tips, you'll be able to file Form 8606 with FreeTaxUSA accurately and efficiently. Remember to gather required documents, report nondeductible contributions correctly, take advantage of FreeTaxUSA's guidance, report distributions from Roth IRAs correctly, and review and edit before submitting. If you have any questions or concerns, don't hesitate to reach out to FreeTaxUSA's support team.

Now that you've learned how to file Form 8606 with FreeTaxUSA, take the next step and start your tax return today!