As the world becomes increasingly complex, navigating the intricacies of tax law can be a daunting task. For individuals and businesses seeking to claim refunds or abatements, understanding the proper procedures is crucial. One such crucial document is Form 4136, also known as the "Credit for Federal Tax Paid on Fuels." In this comprehensive guide, we will delve into the world of Form 4136, exploring its purpose, benefits, and step-by-step instructions for claimants.

What is Form 4136?

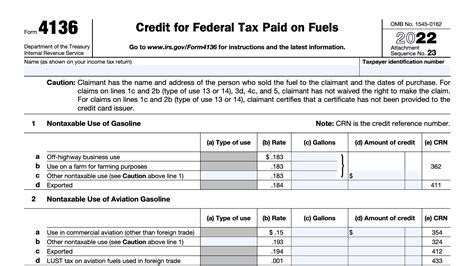

Form 4136 is a document used by the Internal Revenue Service (IRS) to claim a credit or refund for federal taxes paid on fuels. This form is typically used by individuals and businesses that have paid taxes on fuels, such as gasoline, diesel, or jet fuel, and are eligible for a credit or refund.

Benefits of Filing Form 4136

Filing Form 4136 can provide several benefits to claimants, including:

- Refund or credit: Claimants can receive a refund or credit for federal taxes paid on fuels, which can help reduce their tax liability.

- Simplified process: Form 4136 provides a straightforward process for claiming credits or refunds, reducing the administrative burden on claimants.

- Compliance: By filing Form 4136, claimants can ensure compliance with tax laws and regulations, reducing the risk of penalties or fines.

Step-by-Step Filing Guide

To file Form 4136, claimants must follow these steps:

Step 1: Determine Eligibility

Who is Eligible to File Form 4136?

Claimants must determine if they are eligible to file Form 4136. To be eligible, claimants must have paid federal taxes on fuels, such as gasoline, diesel, or jet fuel. Claimants can check their eligibility by reviewing their tax returns or consulting with a tax professional.

Step 2: Gather Required Documents

What Documents are Required to File Form 4136?

Claimants must gather the required documents to support their claim. These documents may include:

- Fuel receipts: Claimants must provide receipts for the fuels on which they paid federal taxes.

- Tax returns: Claimants must provide their tax returns for the year in which they paid federal taxes on fuels.

- Other supporting documents: Claimants may need to provide additional supporting documents, such as records of fuel usage or invoices.

Step 3: Complete Form 4136

How to Complete Form 4136

Claimants must complete Form 4136 accurately and thoroughly. The form requires claimants to provide information about their fuel purchases, tax payments, and other relevant details.

- Part I: Claimant Information: Claimants must provide their name, address, and taxpayer identification number.

- Part II: Fuel Information: Claimants must provide information about the fuels on which they paid federal taxes, including the type of fuel, quantity, and tax paid.

- Part III: Tax Payment Information: Claimants must provide information about their tax payments, including the date and amount of payment.

Step 4: Attach Supporting Documents

What Supporting Documents Must be Attached to Form 4136?

Claimants must attach the required supporting documents to Form 4136. These documents may include fuel receipts, tax returns, and other records.

Step 5: File Form 4136

How to File Form 4136

Claimants can file Form 4136 electronically or by mail. Electronic filing is available through the IRS website, while paper filing requires claimants to mail the completed form to the IRS address listed in the instructions.

Step 6: Receive Refund or Credit

How Long Does it Take to Receive a Refund or Credit?

After filing Form 4136, claimants can expect to receive a refund or credit within several weeks. The IRS typically processes claims within 6-8 weeks, although this timeframe may vary depending on the complexity of the claim.

By following these steps, claimants can ensure a smooth and successful filing process for Form 4136.

Additional Tips and Reminders

- Accuracy is key: Claimants must ensure that their Form 4136 is accurate and complete to avoid delays or rejection.

- Deadlines matter: Claimants must file Form 4136 by the deadline to avoid penalties or fines.

- Seek professional help: Claimants can consult with a tax professional to ensure compliance and accuracy.

Conclusion: A Successful Filing Experience

Filing Form 4136 requires attention to detail and a thorough understanding of tax laws and regulations. By following this step-by-step guide, claimants can ensure a successful filing experience and receive the refund or credit they deserve.