Updating your beneficiary information with Franklin Templeton is a straightforward process that ensures your assets are distributed according to your wishes in the event of your passing. Beneficiary designations can be a crucial aspect of your financial and estate planning, allowing you to designate who will inherit your assets without the need for probate. This guide will walk you through the simple process of updating your Franklin Templeton beneficiary using their convenient form.

The Importance of Keeping Beneficiary Information Up-to-Date

Before diving into the process, it's essential to understand why keeping your beneficiary information current is vital. Life events such as marriage, divorce, birth of children, or the death of a beneficiary can significantly impact your wishes regarding asset distribution. Outdated beneficiary designations can lead to unintended consequences, such as assets being distributed to former spouses or individuals you no longer wish to benefit. Regularly reviewing and updating your beneficiary information ensures that your assets are transferred according to your current intentions.

Gathering Necessary Information

To update your beneficiary information with Franklin Templeton, you'll need to have certain details readily available. This includes:

- Your account number(s) with Franklin Templeton

- The name(s) and birthdate(s) of your beneficiary(ies)

- The social security number or tax identification number of your beneficiary(ies)

- The percentage of the account you wish to allocate to each beneficiary

Having this information organized will make the process smoother and less prone to errors.

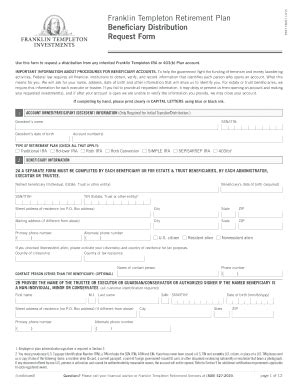

Obtaining the Beneficiary Update Form

You can obtain the beneficiary update form from Franklin Templeton's official website or by contacting their customer service directly. The form may be titled as "Beneficiary Designation Form" or something similar. Ensure you download or request the most current version of the form to avoid any issues with the update process.

Completing the Beneficiary Update Form

When completing the form, pay close attention to the following:

- Clearly write your account number and your name as it appears on your Franklin Templeton account.

- Provide accurate and complete information for each beneficiary, including their relationship to you.

- Specify the percentage of the assets you wish to allocate to each beneficiary. Ensure the percentages add up to 100%.

- Sign and date the form according to the instructions provided.

Submitting the Form

Once the form is completed, you can submit it to Franklin Templeton via mail, fax, or potentially through their online portal, depending on the options available at the time. Ensure you keep a copy of the completed form for your records and verify with Franklin Templeton that they have received and processed your update.

Following Up

After submitting the form, it's a good idea to follow up with Franklin Templeton to confirm that your beneficiary update has been successfully processed. This step ensures that your wishes are accurately reflected in their records.

Conclusion: Simplifying Estate Planning with Beneficiary Updates

Updating your beneficiary information with Franklin Templeton is a straightforward yet crucial step in managing your financial legacy. By following the steps outlined in this guide, you can ensure that your assets are distributed according to your current wishes, providing peace of mind for you and your loved ones. Remember, regular reviews of your beneficiary designations are essential for maintaining alignment with your evolving life circumstances.

Take Action Today

- Download the beneficiary update form from Franklin Templeton's website or request it via phone.

- Gather all necessary information to accurately complete the form.

- Submit the completed form according to the provided instructions.

- Follow up to confirm successful processing.

By taking these steps, you'll be ensuring that your financial affairs are in order and that your assets will be distributed as you intend.

How often should I review my beneficiary information?

+It's a good idea to review your beneficiary information every few years or upon significant life events such as marriage, divorce, or the birth of children.

Can I update my beneficiary information online?

+Check with Franklin Templeton as options may vary. Some accounts may allow online updates, while others may require submitting a form via mail or fax.

What happens if I don't update my beneficiary information?

+Failure to update your beneficiary information can lead to unintended distributions of your assets, potentially causing confusion and legal issues for your loved ones.