Filling out tax forms can be a daunting task, especially for those who are new to the process. Form TC-40W, also known as the Withholding Tax Return, is a crucial document for individuals and businesses in certain states. It's essential to fill it out accurately to avoid any penalties or delays in receiving refunds. In this article, we will provide you with five valuable tips to help you navigate the process of filling out Form TC-40W with ease.

Understanding the Purpose of Form TC-40W

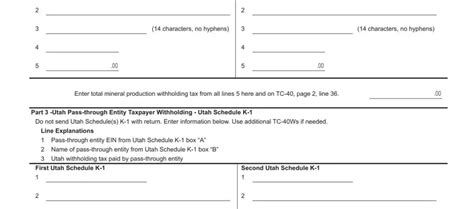

Before we dive into the tips, it's essential to understand the purpose of Form TC-40W. This form is used to report and pay withholding taxes on income earned by individuals and businesses. The form is typically filed quarterly, and the due dates are April 30th, July 31st, October 31st, and January 31st of the following year.

Tip 1: Gather All Necessary Documents

To fill out Form TC-40W accurately, you'll need to gather all necessary documents, including:

- W-2 forms for employees

- 1099 forms for independent contractors

- Payroll records

- Business income records

- Tax withholding tables

Having all these documents readily available will help you fill out the form quickly and accurately.

Tip 2: Determine Your Withholding Amount

To determine your withholding amount, you'll need to calculate the total amount of taxes withheld from your employees' wages or from your business income. You can use the tax withholding tables provided by the state to determine the correct amount.

- For employees, multiply the number of employees by the withholding rate

- For business income, multiply the total income by the withholding rate

Make sure to round the withholding amount to the nearest dollar.

Tip 3: Fill Out the Form Accurately

When filling out Form TC-40W, make sure to:

- Enter your business name and address correctly

- Provide your employer identification number (EIN)

- Report the correct withholding amount

- Sign and date the form

Double-check your math calculations and ensure that all information is accurate and complete.

Common Mistakes to Avoid

- Inaccurate business name or address

- Incorrect EIN

- Miscalculated withholding amount

- Unsigned or undated form

Tip 4: Submit the Form On Time

Form TC-40W is typically due on the last day of the month following the end of the quarter. Make sure to submit the form on time to avoid penalties and interest on unpaid taxes.

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st of the following year for the fourth quarter (October 1 - December 31)

Tip 5: Seek Professional Help When Needed

If you're unsure about filling out Form TC-40W or have complex tax situations, consider seeking professional help from a certified public accountant (CPA) or enrolled agent (EA). They can guide you through the process and ensure that your form is accurate and complete.

Benefits of Seeking Professional Help

- Accurate form preparation

- Reduced risk of penalties and interest

- Increased confidence in tax compliance

- Access to expert tax knowledge

By following these five tips, you'll be able to fill out Form TC-40W with ease and accuracy. Remember to gather all necessary documents, determine your withholding amount, fill out the form accurately, submit it on time, and seek professional help when needed.

Take the first step towards stress-free tax compliance by implementing these tips today!

What is Form TC-40W used for?

+Form TC-40W is used to report and pay withholding taxes on income earned by individuals and businesses.

What documents do I need to fill out Form TC-40W?

+You'll need W-2 forms for employees, 1099 forms for independent contractors, payroll records, business income records, and tax withholding tables.

What are the due dates for Form TC-40W?

+The due dates are April 30th, July 31st, October 31st, and January 31st of the following year.