As a business owner, selling assets is an inevitable part of the entrepreneurial journey. Whether you're upgrading equipment, liquidating inventory, or closing shop, understanding the tax implications of these transactions is crucial. The IRS requires businesses to report the sale of assets on specific forms, and two of the most commonly used forms are Form 4797 and Form 8949. In this article, we'll delve into the world of Form 4797 vs Form 8949, exploring their purposes, differences, and how to use them correctly.

The Importance of Accurate Tax Reporting

When selling business assets, it's essential to report these transactions accurately to avoid any potential tax penalties or audits. The IRS requires businesses to report the sale of assets on specific forms, which help determine the gain or loss on the sale. This information is used to calculate the business's taxable income, which in turn affects the amount of taxes owed.

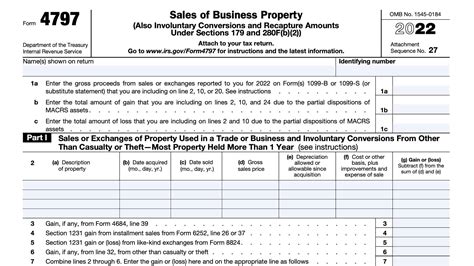

Form 4797: Sales of Business Property

Form 4797 is used to report the sale of business property, including:

- Depreciable assets, such as equipment, vehicles, and buildings

- Non-depreciable assets, such as land and intangible assets

- Assets used in a trade or business

The form requires businesses to report the following information:

- Description of the asset sold

- Date of sale

- Sales price

- Basis of the asset (original purchase price plus any improvements)

- Depreciation allowed or allowable

- Gain or loss on the sale

Form 8949: Sales and Other Dispositions of Capital Assets

Form 8949 is used to report the sale of capital assets, including:

- Stocks, bonds, and other securities

- Real estate

- Intellectual property

- Artwork and collectibles

The form requires businesses to report the following information:

- Description of the asset sold

- Date of sale

- Sales price

- Basis of the asset (original purchase price plus any improvements)

- Holding period (short-term or long-term)

- Gain or loss on the sale

Key Differences between Form 4797 and Form 8949

While both forms are used to report the sale of assets, there are key differences between them:

- Type of assets: Form 4797 is used for business property, while Form 8949 is used for capital assets.

- Depreciation: Form 4797 requires businesses to report depreciation allowed or allowable, while Form 8949 does not.

- Holding period: Form 8949 requires businesses to report the holding period of the asset, which affects the tax treatment of the gain or loss.

When to Use Form 4797

Use Form 4797 to report the sale of business property, including depreciable assets, non-depreciable assets, and assets used in a trade or business.

- Example: You sell a piece of equipment used in your manufacturing business for $10,000. The equipment was originally purchased for $8,000 and has been depreciated by $2,000 over the years. You would report this sale on Form 4797, calculating the gain or loss on the sale.

When to Use Form 8949

Use Form 8949 to report the sale of capital assets, including stocks, bonds, real estate, and intellectual property.

- Example: You sell a piece of artwork for $50,000. You originally purchased the artwork for $20,000 and have held it for over a year. You would report this sale on Form 8949, calculating the gain or loss on the sale and taking into account the long-term capital gains tax rate.

Tips for Completing Form 4797 and Form 8949

When completing Form 4797 and Form 8949, keep the following tips in mind:

- Accurate record-keeping: Keep accurate records of the asset's purchase price, depreciation, and sale price to ensure accurate reporting.

- Consult a tax professional: If you're unsure about which form to use or how to complete it, consult a tax professional for guidance.

- Use the correct forms: Use the correct forms to report the sale of assets, as using the wrong form can lead to tax penalties and audits.

Conclusion

Selling business assets can be a complex process, especially when it comes to tax reporting. Understanding the differences between Form 4797 and Form 8949 is crucial to ensure accurate reporting and avoid potential tax penalties. By following the tips and guidelines outlined in this article, you'll be well on your way to navigating the world of Form 4797 vs Form 8949 with confidence.

Frequently Asked Questions

What is the difference between Form 4797 and Form 8949?

+Form 4797 is used to report the sale of business property, while Form 8949 is used to report the sale of capital assets.

What type of assets are reported on Form 4797?

+Form 4797 is used to report the sale of depreciable assets, non-depreciable assets, and assets used in a trade or business.

What is the holding period for capital assets?

+The holding period for capital assets is the length of time the asset was held, which affects the tax treatment of the gain or loss.