As an employer, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial tax form you need to file annually is the Form 943, which reports your federal tax liability as an employer. In this article, we'll delve into the details of Form 943, its importance, and how to complete it accurately.

What is Form 943?

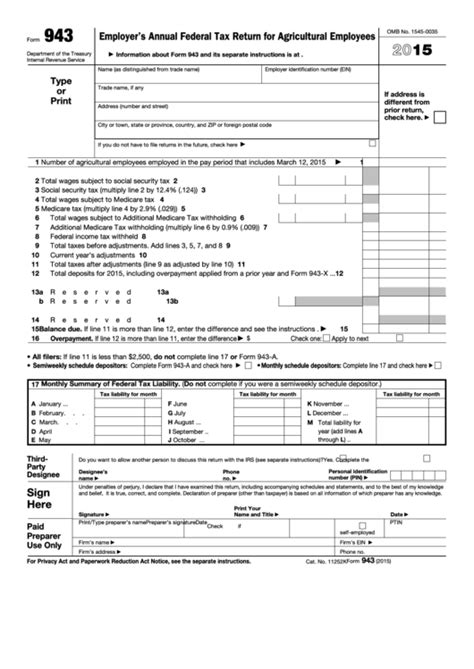

Form 943 is the Annual Federal Tax Return for Employers of Agricultural Workers. It's used to report the federal income tax withholding and social security and Medicare taxes on agricultural wages. If you're an employer of agricultural workers, you're required to file this form annually to report your tax liability.

Who Needs to File Form 943?

You need to file Form 943 if you're an employer of agricultural workers and you've paid wages subject to federal income tax withholding or social security and Medicare taxes. This includes:

- Agricultural employers who have paid $2,500 or more in cash wages to agricultural workers in a calendar year.

- Agricultural employers who have paid $1,000 or more in cash wages to agricultural workers in a calendar quarter.

- Employers of household workers who have paid $2,400 or more in cash wages to household workers in a calendar year.

When is Form 943 Due?

Form 943 is due by January 31st of each year. However, if you're filing electronically, you have until March 31st to submit the form.

What Information is Required on Form 943?

Form 943 requires you to report the following information:

- Your employer identification number (EIN)

- The total amount of agricultural wages paid

- The total amount of federal income tax withheld

- The total amount of social security and Medicare taxes paid

- The total amount of taxes due or overpaid

How to Complete Form 943

To complete Form 943, follow these steps:

- Gather necessary information: Collect all necessary information, including your EIN, total agricultural wages paid, federal income tax withheld, and social security and Medicare taxes paid.

- Complete Part 1: Report your EIN, total agricultural wages paid, and federal income tax withheld.

- Complete Part 2: Report your social security and Medicare taxes paid.

- Complete Part 3: Calculate your total taxes due or overpaid.

- Sign and date the form: Sign and date the form to certify that the information is accurate.

Tips for Accurate Completion

To ensure accurate completion of Form 943, follow these tips:

- Use the correct EIN: Make sure to use your correct EIN to avoid any delays or penalties.

- Report accurate wages: Report the correct total agricultural wages paid to avoid any errors.

- Double-check calculations: Double-check your calculations to ensure accuracy.

- Sign and date the form: Sign and date the form to certify that the information is accurate.

Penalties for Late or Inaccurate Filing

Failure to file Form 943 on time or accurately can result in penalties, including:

- Late filing penalty: A penalty of 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%.

- Inaccurate filing penalty: A penalty of 20% of the unpaid taxes.

Electronic Filing Options

You can file Form 943 electronically through the Electronic Federal Tax Payment System (EFTPS) or through a tax professional. Electronic filing offers several benefits, including:

- Faster processing: Electronic filing is processed faster than paper filing.

- Reduced errors: Electronic filing reduces the risk of errors.

- Convenience: Electronic filing is convenient and can be done from anywhere.

Conclusion

Form 943 is an essential tax form for employers of agricultural workers. By understanding the requirements and accurately completing the form, you can avoid any penalties or fines. Remember to file Form 943 on time, and consider electronic filing for faster processing and reduced errors.

Additional Resources

For more information on Form 943, visit the IRS website or consult with a tax professional.

What is the deadline for filing Form 943?

+Form 943 is due by January 31st of each year. However, if you're filing electronically, you have until March 31st to submit the form.

Who needs to file Form 943?

+You need to file Form 943 if you're an employer of agricultural workers and you've paid wages subject to federal income tax withholding or social security and Medicare taxes.

What information is required on Form 943?

+Form 943 requires you to report your employer identification number (EIN), total agricultural wages paid, federal income tax withheld, social security and Medicare taxes paid, and total taxes due or overpaid.