Filing a PT-100 form in Horry County can be a daunting task, especially for those who are new to the process. The PT-100 form, also known as the Business Personal Property Tax Return, is a crucial document that businesses in Horry County must submit to the county government each year. In this article, we will break down the process of filing a PT-100 form in Horry County, making it easier for businesses to navigate the complexities of the tax filing process.

Understanding the PT-100 Form

The PT-100 form is a business personal property tax return that must be filed by all businesses in Horry County. The form is used to report the value of business personal property, such as equipment, machinery, and furniture, that is located in Horry County. The form is typically due on April 30th of each year, and failure to file can result in penalties and interest.

Who Needs to File a PT-100 Form?

Not all businesses in Horry County need to file a PT-100 form. However, most businesses that own personal property, such as equipment, machinery, and furniture, are required to file. This includes:

- Businesses with personal property valued at $100 or more

- Businesses that own vehicles, including cars, trucks, and boats

- Businesses that own equipment, such as computers, printers, and machinery

- Businesses that own furniture and fixtures, such as desks, chairs, and shelving

Exemptions

Some businesses may be exempt from filing a PT-100 form. These include:

- Businesses with personal property valued at less than $100

- Businesses that are exempt from taxation, such as non-profit organizations and government agencies

- Businesses that do not own personal property, such as service-based businesses

How to File a PT-100 Form

Filing a PT-100 form in Horry County is a relatively straightforward process. Here are the steps to follow:

Gather Required Information

Before filing a PT-100 form, businesses will need to gather certain information, including:

- Business name and address

- Business type and classification

- Description and value of personal property

- Acquisition date and cost of personal property

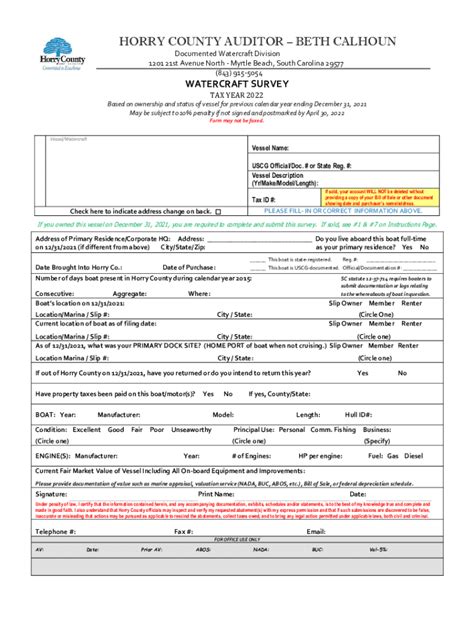

Complete the PT-100 Form

Once the required information has been gathered, businesses can complete the PT-100 form. The form is available on the Horry County Government website or can be obtained in person at the Horry County Treasurer's office.

Tips for Filing a PT-100 Form

Here are some tips to keep in mind when filing a PT-100 form in Horry County:

- File early: Filing early can help avoid penalties and interest.

- Be accurate: Make sure to report the correct value of personal property to avoid errors.

- Keep records: Keep records of personal property, including acquisition dates and costs.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing a PT-100 form:

- Failing to report all personal property

- Reporting incorrect values of personal property

- Failing to sign and date the form

Penalties for Late Filing

If a business fails to file a PT-100 form on time, penalties and interest may be assessed. The penalty for late filing is 10% of the tax due, plus interest at a rate of 10% per annum.

Conclusion

Filing a PT-100 form in Horry County can be a complex process, but by following the steps outlined above, businesses can make it easier. Remember to gather required information, complete the form accurately, and file on time to avoid penalties and interest. If you have any questions or concerns, don't hesitate to contact the Horry County Treasurer's office for assistance.

Encouragement to Take Action

If you're a business owner in Horry County, don't wait until the last minute to file your PT-100 form. Take action today and avoid penalties and interest. Contact the Horry County Treasurer's office for more information and to get started on the filing process.

What is the deadline for filing a PT-100 form in Horry County?

+The deadline for filing a PT-100 form in Horry County is April 30th of each year.

Who needs to file a PT-100 form in Horry County?

+Most businesses that own personal property, such as equipment, machinery, and furniture, are required to file a PT-100 form.

What happens if I fail to file a PT-100 form on time?

+If you fail to file a PT-100 form on time, penalties and interest may be assessed. The penalty for late filing is 10% of the tax due, plus interest at a rate of 10% per annum.