Mastering Form SSA-1724 is crucial for anyone seeking to apply for Social Security disability benefits. This form, also known as the "Claim for Amounts Due in the Case of a Deceased Beneficiary," is used to claim benefits that were owed to a deceased individual. In this article, we will break down the process of completing Form SSA-1724 into 5 easy steps, making it more manageable for applicants.

Understanding the Importance of Form SSA-1724

Form SSA-1724 is a critical document for individuals who are seeking to claim benefits on behalf of a deceased beneficiary. This form is used to claim benefits that were owed to the deceased individual, such as Social Security disability benefits, retirement benefits, or survivor benefits. By mastering Form SSA-1724, applicants can ensure that they receive the benefits they are entitled to in a timely and efficient manner.

Who is Eligible to File Form SSA-1724?

To be eligible to file Form SSA-1724, the applicant must be the authorized representative of the deceased beneficiary's estate or a survivor who is entitled to receive the benefits. This may include:

- The executor or administrator of the deceased beneficiary's estate

- A surviving spouse or child

- A parent or other family member who was dependent on the deceased beneficiary

Step 1: Gathering Required Documents and Information

Before starting the application process, it is essential to gather all required documents and information. This may include:

- The deceased beneficiary's Social Security number

- Proof of death, such as a death certificate

- Proof of relationship to the deceased beneficiary, such as a marriage certificate or birth certificate

- Information about the deceased beneficiary's earnings and work history

What Documents Are Required?

The following documents are typically required to complete Form SSA-1724:

- A certified copy of the deceased beneficiary's death certificate

- A certified copy of the deceased beneficiary's birth certificate

- A certified copy of the applicant's birth certificate or proof of relationship to the deceased beneficiary

- A copy of the deceased beneficiary's Social Security card or proof of Social Security number

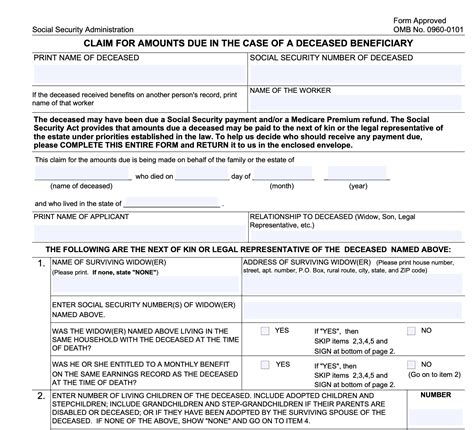

Step 2: Completing Form SSA-1724

Once all required documents and information have been gathered, the applicant can begin completing Form SSA-1724. The form is typically completed in the following order:

- Section 1: Claimant Information

- Provide the applicant's name, address, and Social Security number

- Provide the deceased beneficiary's name, Social Security number, and date of death

- Section 2: Deceased Beneficiary Information

- Provide the deceased beneficiary's date of birth, place of birth, and occupation

- Provide information about the deceased beneficiary's earnings and work history

- Section 3: Survivor Information

- Provide information about the applicant's relationship to the deceased beneficiary

- Provide the applicant's date of birth, place of birth, and occupation

How to Complete Form SSA-1724

To complete Form SSA-1724, the applicant should:

- Read the instructions carefully before starting the application

- Use black ink to complete the form

- Sign the form in the presence of a notary public

- Attach all required documents and supporting evidence

Step 3: Submitting Form SSA-1724

Once Form SSA-1724 has been completed, the applicant can submit it to the Social Security Administration (SSA) for processing. The form can be submitted in one of the following ways:

- In person at a local SSA office

- By mail to the SSA's Office of Disability Determinations

- Online through the SSA's website

How to Submit Form SSA-1724

To submit Form SSA-1724, the applicant should:

- Make a copy of the completed form and supporting documents

- Attach the original documents to the form

- Submit the form and documents to the SSA in a timely manner

Step 4: Following Up on the Application

After submitting Form SSA-1724, the applicant should follow up on the application to ensure that it is being processed in a timely manner. This can be done by:

- Contacting the SSA's Office of Disability Determinations

- Checking the status of the application online

- Following up with the SSA by phone or mail

How to Follow Up on the Application

To follow up on the application, the applicant should:

- Keep a record of all correspondence with the SSA

- Follow up with the SSA in a timely manner

- Be prepared to provide additional information or documentation as needed

Step 5: Receiving Benefits

Once the application has been processed, the applicant will be notified of the decision. If the application is approved, the applicant will begin receiving benefits in the form of a monthly payment.

How to Receive Benefits

To receive benefits, the applicant should:

- Provide bank account information for direct deposit

- Receive benefits by mail or direct deposit

- Report any changes in income or eligibility to the SSA

By following these 5 easy steps, applicants can master Form SSA-1724 and ensure that they receive the benefits they are entitled to in a timely and efficient manner.

We hope this article has been informative and helpful in guiding you through the process of completing Form SSA-1724. If you have any further questions or concerns, please do not hesitate to reach out to us.

What is Form SSA-1724?

+Form SSA-1724 is a document used to claim benefits that were owed to a deceased beneficiary, such as Social Security disability benefits, retirement benefits, or survivor benefits.

Who is eligible to file Form SSA-1724?

+The applicant must be the authorized representative of the deceased beneficiary's estate or a survivor who is entitled to receive the benefits.

What documents are required to complete Form SSA-1724?

+The following documents are typically required: a certified copy of the deceased beneficiary's death certificate, a certified copy of the deceased beneficiary's birth certificate, and a copy of the deceased beneficiary's Social Security card or proof of Social Security number.