Are you considering withdrawing funds from your Prudential annuity? Withdrawing from an annuity can be a complex process, and it's essential to understand the steps involved to ensure a smooth and hassle-free experience. In this comprehensive guide, we will walk you through the Prudential annuity withdrawal form process, highlighting key aspects to consider and providing valuable insights to help you make informed decisions.

Understanding Prudential Annuity Withdrawal Options

Before initiating the withdrawal process, it's crucial to understand the types of withdrawals available to you. Prudential annuities offer various withdrawal options, including:

- Lump-sum withdrawal: Withdrawing a single payment from your annuity.

- Systematic withdrawal: Withdrawing regular payments from your annuity over a set period.

- Required Minimum Distribution (RMD): Withdrawing a minimum amount from your annuity each year, typically starting at age 72.

Prudential Annuity Withdrawal Form Requirements

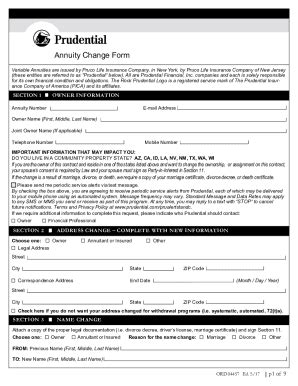

To initiate a withdrawal, you'll need to complete the Prudential annuity withdrawal form. The form will require you to provide personal and account information, as well as specify the withdrawal details. Here are some key requirements to keep in mind:

- Account information: You'll need to provide your annuity account number, contract number, and policy number.

- Withdrawal amount: Specify the amount you wish to withdraw, keeping in mind any applicable surrender charges or taxes.

- Withdrawal frequency: Choose the frequency of your withdrawal, such as a lump sum or systematic withdrawal.

- Beneficiary information: Provide beneficiary information, if applicable.

Step-by-Step Guide to Completing the Prudential Annuity Withdrawal Form

Here's a step-by-step guide to help you complete the Prudential annuity withdrawal form:

- Gather required documents: Ensure you have all necessary documents, including your annuity contract, identification, and tax-related documents.

- Access the withdrawal form: Download the Prudential annuity withdrawal form from the Prudential website or contact their customer service to request a form.

- Complete the form: Fill out the form accurately and thoroughly, ensuring all required information is provided.

- Specify withdrawal details: Clearly indicate the withdrawal amount, frequency, and beneficiary information, if applicable.

- Review and sign the form: Carefully review the form for accuracy and sign it in the presence of a notary public, if required.

- Submit the form: Mail or fax the completed form to Prudential, ensuring timely submission to avoid delays.

Common Mistakes to Avoid When Completing the Prudential Annuity Withdrawal Form

When completing the Prudential annuity withdrawal form, be aware of common mistakes that can lead to delays or rejection:

- Inaccurate account information: Double-check your account numbers and contract details to ensure accuracy.

- Insufficient withdrawal information: Clearly specify the withdrawal amount, frequency, and beneficiary information, if applicable.

- Missing signatures: Ensure all required signatures are provided, including notarization, if necessary.

Prudential Annuity Withdrawal Fees and Charges

When withdrawing from your Prudential annuity, be aware of potential fees and charges:

- Surrender charges: Fees applied when withdrawing funds within a certain period, typically ranging from 1-10 years.

- Administrative fees: Charges for processing and maintaining your annuity account.

- Tax implications: Withdrawals may be subject to income tax and potential penalties for early withdrawal.

Tax Implications of Prudential Annuity Withdrawals

Withdrawals from your Prudential annuity may have tax implications, including:

- Ordinary income tax: Withdrawals are taxed as ordinary income, potentially impacting your tax bracket.

- Penalties for early withdrawal: Withdrawing funds before age 59 1/2 may result in a 10% penalty, in addition to income tax.

Prudential Annuity Withdrawal FAQs

Here are some frequently asked questions about Prudential annuity withdrawals:

- Q: Can I withdraw from my Prudential annuity at any time? A: Yes, but you may be subject to surrender charges or tax implications.

- Q: How long does it take to process a Prudential annuity withdrawal? A: Processing times vary, but typically take 7-10 business days.

- Q: Can I change my withdrawal amount or frequency? A: Yes, but you may need to complete a new withdrawal form and potentially incur fees.

What is the minimum withdrawal amount from a Prudential annuity?

+The minimum withdrawal amount varies depending on the specific annuity product and contract terms. It's best to consult your contract or contact Prudential directly for more information.

Can I withdraw from my Prudential annuity if I'm still working?

+Yes, but you may be subject to tax implications and potential penalties for early withdrawal. It's essential to consider your individual circumstances and consult with a financial advisor before making a withdrawal.

How do I contact Prudential to initiate a withdrawal?

+You can contact Prudential by phone, email, or mail. Visit the Prudential website for specific contact information and to access the withdrawal form.

We hope this comprehensive guide has provided you with a clear understanding of the Prudential annuity withdrawal form process. If you have any further questions or concerns, please don't hesitate to reach out to us in the comments below. Share your experiences or ask for advice from our community of readers.