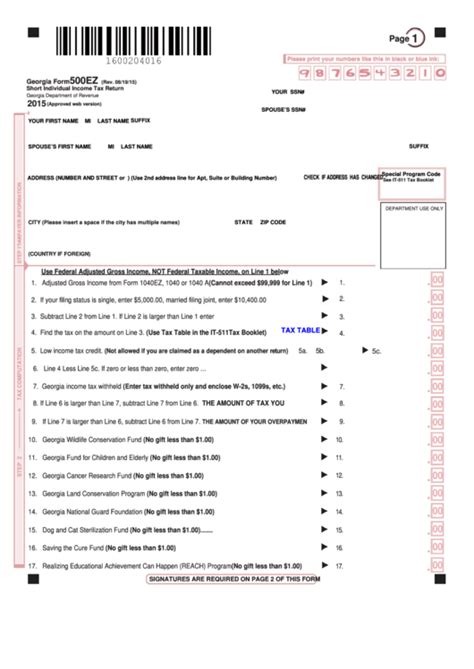

Tax season is upon us, and for many Georgians, that means navigating the complexities of state tax returns. One of the most common forms for individual filers is the Georgia Form 500EZ. While tax filing can seem daunting, breaking down the process into manageable steps can make all the difference. In this article, we'll walk you through the 5 easy steps to simplify your filing experience with Georgia Form 500EZ.

Step 1: Gather Necessary Documents and Information

Before starting your tax return, make sure you have all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- W-2 forms from all employers

- 1099 forms for freelance work or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

Why is this step important?

Having all the necessary documents and information will help you avoid errors and ensure you're taking advantage of all the deductions and credits you're eligible for.

Step 2: Choose Your Filing Status

Your filing status determines which tax rates and deductions apply to you. The options for Georgia Form 500EZ include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to choose the right filing status

Consider your marital status, dependents, and income to determine the best filing status for your situation. If you're unsure, you can consult with a tax professional or use the IRS's filing status tool.

Step 3: Report Your Income

On Georgia Form 500EZ, you'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Freelance work or self-employment income

- Interest and dividends

- Capital gains

- Unemployment benefits

What to include and what to exclude

Make sure to include all income earned during the tax year, but exclude non-taxable income such as gifts, inheritances, and life insurance proceeds.

Step 4: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. On Georgia Form 500EZ, you can claim:

- Standard deduction

- Itemized deductions (if you have a lot of medical expenses, mortgage interest, or charitable donations)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

How to maximize your deductions and credits

Keep accurate records of your expenses and charitable donations throughout the year. Consult with a tax professional or use tax software to ensure you're taking advantage of all the deductions and credits you're eligible for.

Step 5: Review, Sign, and Submit Your Return

Once you've completed your tax return, review it carefully for errors or omissions. Sign and date the form, then submit it to the Georgia Department of Revenue by the tax filing deadline.

What to do if you need an extension

If you need more time to file, you can submit Form 504, Application for Automatic Extension of Time for Filing Individual Tax Returns. This will give you an additional 6 months to file your return.

By following these 5 easy steps, you can simplify your filing experience with Georgia Form 500EZ and ensure a smooth tax filing process.

Share Your Thoughts!

Have you filed your Georgia Form 500EZ tax return? Share your experiences and tips in the comments below!

FAQ Section

What is the deadline for filing Georgia Form 500EZ?

+The deadline for filing Georgia Form 500EZ is typically April 15th, but it may vary depending on the tax year and any extensions filed.

Can I e-file my Georgia Form 500EZ tax return?

+Yes, you can e-file your Georgia Form 500EZ tax return through the Georgia Department of Revenue's website or using tax software.

What happens if I don't file my Georgia Form 500EZ tax return on time?

+If you don't file your Georgia Form 500EZ tax return on time, you may be subject to penalties and interest on any taxes owed.