Mastering Form RPD 41083, also known as the Repossession Affidavit, can seem daunting at first. However, by breaking down the process into manageable steps, you can become proficient in completing this form with ease. Whether you're a seasoned professional or new to the industry, understanding the intricacies of Form RPD 41083 is essential for smooth and efficient repossession processes.

In this article, we'll walk you through five easy steps to master Form RPD 41083. By following these steps and practicing regularly, you'll become more confident and efficient in your work, ensuring that you can handle repossession cases with precision and accuracy.

The Importance of Form RPD 41083

Before we dive into the steps, it's essential to understand the significance of Form RPD 41083. This form serves as a crucial document in the repossession process, providing vital information about the repossessed vehicle, the debtor, and the creditor. By accurately completing this form, you'll ensure that the repossession process is handled correctly, reducing the risk of errors and potential disputes.

Step 1: Gather Essential Information

To complete Form RPD 41083 accurately, you'll need to gather essential information about the repossessed vehicle, the debtor, and the creditor. This includes:

- Vehicle details: Make, model, year, vehicle identification number (VIN), and license plate number

- Debtor information: Name, address, and contact details

- Creditor information: Name, address, and contact details

- Repossession details: Date, time, and location of repossession

Make sure to verify the accuracy of this information to avoid errors and potential disputes.

Understanding the Form Structure

Form RPD 41083 consists of several sections, each requiring specific information. Understanding the form structure will help you navigate the completion process more efficiently.

Form RPD 41083 Structure

- Section 1: Vehicle Information

- Section 2: Debtor Information

- Section 3: Creditor Information

- Section 4: Repossession Details

- Section 5: Affidavit

Step 2: Complete Section 1 - Vehicle Information

Section 1 requires detailed information about the repossessed vehicle. Make sure to provide accurate information, including:

- Make, model, and year of the vehicle

- Vehicle identification number (VIN)

- License plate number

- Vehicle mileage (if applicable)

Use the vehicle's registration documents or title to verify the accuracy of this information.

Vehicle Information Example

- Make: Ford

- Model: F-150

- Year: 2015

- VIN: 1FTFW1EG5FFA12345

- License Plate Number: ABC123

Step 3: Complete Sections 2 and 3 - Debtor and Creditor Information

Sections 2 and 3 require information about the debtor and creditor, respectively. Make sure to provide accurate information, including:

- Debtor name and address

- Creditor name and address

- Contact details for both debtor and creditor

Use the loan agreement or contract to verify the accuracy of this information.

Debtor and Creditor Information Example

- Debtor Name: John Doe

- Debtor Address: 123 Main St, Anytown, USA 12345

- Creditor Name: XYZ Bank

- Creditor Address: 456 Financial St, Othertown, USA 67890

Step 4: Complete Section 4 - Repossession Details

Section 4 requires information about the repossession process, including:

- Date and time of repossession

- Location of repossession

- Name and contact details of the repossession agent

Use the repossession report or log to verify the accuracy of this information.

Repossession Details Example

- Date of Repossession: 2022-02-15

- Time of Repossession: 10:00 AM

- Location of Repossession: 789 Parking Lot, Anytown, USA 12345

- Repossession Agent: Jane Smith

- Repossession Agent Contact Details: (555) 123-4567

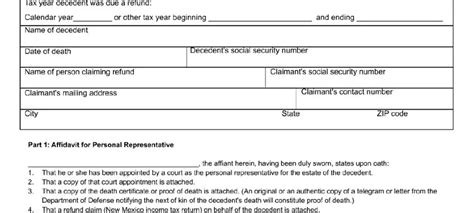

Step 5: Complete Section 5 - Affidavit

Section 5 requires the affiant (the person completing the form) to sign and verify the accuracy of the information provided. Make sure to read the affidavit carefully and sign it only if the information is accurate.

Affidavit Example

- I, [Name], hereby verify that the information provided in this form is accurate and true to the best of my knowledge.

- Signature: _____________________________

- Date: __________________________________

By following these five easy steps, you'll become proficient in completing Form RPD 41083 accurately and efficiently. Remember to verify the accuracy of the information provided and to use relevant documents to support your completion of the form.

Call to Action

Now that you've mastered Form RPD 41083, it's essential to practice regularly to reinforce your understanding. Try completing the form with sample data or by using real-life scenarios. Don't hesitate to reach out if you have any questions or need further clarification. Share your experiences and tips with others to help them master Form RPD 41083 as well.

FAQ Section

What is Form RPD 41083 used for?

+Form RPD 41083 is used to document the repossession of a vehicle and provide essential information about the repossessed vehicle, the debtor, and the creditor.

Who completes Form RPD 41083?

+Form RPD 41083 is typically completed by the repossession agent or the creditor's representative.

What happens if the information on Form RPD 41083 is inaccurate?

+If the information on Form RPD 41083 is inaccurate, it may lead to disputes or errors in the repossession process. It's essential to verify the accuracy of the information provided to avoid such issues.