The SBA 4506-T form is a crucial document for small business owners and lenders alike. It's a request for transcript of tax return, which is used to verify the income and creditworthiness of a borrower. In this article, we'll delve into the world of SBA 4506-T forms, exploring their importance, benefits, and requirements.

The SBA 4506-T form is a vital component of the loan application process for small businesses. It allows lenders to assess the creditworthiness of borrowers by verifying their tax returns. This form is typically used in conjunction with other financial documents, such as balance sheets and income statements, to get a comprehensive picture of a business's financial health.

The SBA 4506-T form is an essential tool for lenders, as it helps them make informed decisions about loan applications. By verifying a borrower's tax returns, lenders can assess their creditworthiness and determine whether they're eligible for a loan. This form is also useful for small business owners, as it allows them to demonstrate their financial stability and creditworthiness to potential lenders.

Benefits of the SBA 4506-T Form

The SBA 4506-T form offers several benefits for both lenders and small business owners. Here are some of the most significant advantages of this form:

- Verification of tax returns: The SBA 4506-T form allows lenders to verify a borrower's tax returns, which is essential for assessing their creditworthiness.

- Assessment of creditworthiness: By verifying tax returns, lenders can assess a borrower's creditworthiness and determine whether they're eligible for a loan.

- Reduced risk: The SBA 4506-T form helps lenders reduce the risk of lending to borrowers who may not be creditworthy.

- Increased transparency: The form provides transparency into a borrower's financial situation, which is essential for lenders making informed decisions.

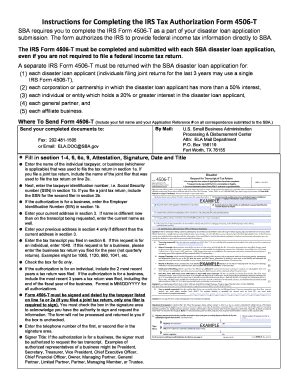

How to Fill Out the SBA 4506-T Form

Filling out the SBA 4506-T form is a straightforward process that requires some basic information about the borrower and the lender. Here are the steps to follow:

- Step 1: Identify the borrower: The form requires the borrower's name, address, and taxpayer identification number (TIN).

- Step 2: Identify the lender: The form requires the lender's name, address, and TIN.

- Step 3: Specify the tax returns: The form requires the borrower to specify the tax returns they're requesting, including the tax year and type of return.

- Step 4: Sign and date the form: The borrower must sign and date the form, authorizing the IRS to release their tax returns to the lender.

Common Mistakes to Avoid When Filling Out the SBA 4506-T Form

When filling out the SBA 4506-T form, it's essential to avoid common mistakes that can delay or prevent the processing of the form. Here are some mistakes to avoid:

- Inaccurate information: Ensure that all information on the form is accurate, including the borrower's name, address, and TIN.

- Incomplete information: Ensure that all required information is provided, including the tax year and type of return.

- Unsigned or undated form: Ensure that the borrower signs and dates the form, authorizing the IRS to release their tax returns.

FAQs About the SBA 4506-T Form

Here are some frequently asked questions about the SBA 4506-T form:

- What is the SBA 4506-T form used for?: The SBA 4506-T form is used to request a transcript of tax return, which is used to verify the income and creditworthiness of a borrower.

- Who needs to fill out the SBA 4506-T form?: The borrower must fill out the SBA 4506-T form, authorizing the IRS to release their tax returns to the lender.

- How long does it take to process the SBA 4506-T form?: The processing time for the SBA 4506-T form varies, but it typically takes 10-15 business days.

In conclusion, the SBA 4506-T form is a vital component of the loan application process for small businesses. By understanding the benefits, requirements, and common mistakes to avoid, borrowers and lenders can ensure a smooth and efficient process. If you have any questions or concerns about the SBA 4506-T form, feel free to comment below or share this article with others.

What is the purpose of the SBA 4506-T form?

+The SBA 4506-T form is used to request a transcript of tax return, which is used to verify the income and creditworthiness of a borrower.

Who needs to fill out the SBA 4506-T form?

+The borrower must fill out the SBA 4506-T form, authorizing the IRS to release their tax returns to the lender.

How long does it take to process the SBA 4506-T form?

+The processing time for the SBA 4506-T form varies, but it typically takes 10-15 business days.