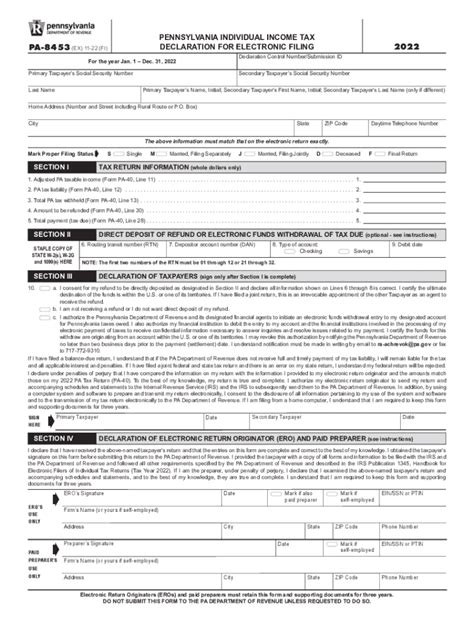

Filling out tax forms can be a daunting task, especially for those who are new to the process. The PA-8453 form, in particular, is used by the Pennsylvania Department of Revenue to report individual income tax withheld from certain types of income. In this article, we will provide a step-by-step guide on how to fill out the PA-8453 form correctly, highlighting five essential ways to ensure accuracy and avoid potential errors.

Understanding the PA-8453 Form

The PA-8453 form is used to report individual income tax withheld from various types of income, including pensions, annuities, and certain types of retirement accounts. It is essential to understand the purpose of the form and the information required to complete it accurately.

Who Needs to File the PA-8453 Form?

Individuals who receive certain types of income, such as pensions, annuities, or retirement account distributions, may need to file the PA-8453 form. This includes:

- Recipients of pension or annuity income

- Beneficiaries of retirement accounts, such as 401(k) or IRA plans

- Individuals who receive income from certain types of trusts or estates

1. Gather Required Information

Before filling out the PA-8453 form, it is essential to gather all required information. This includes:

- Your name, address, and Social Security number

- The type and amount of income received

- The amount of tax withheld

- The payer's name, address, and Federal Employer Identification Number (FEIN)

Where to Find the Required Information

You can find the required information on your:

- 1099-R forms, which report pension, annuity, and retirement account distributions

- W-2 forms, which report employment income

- Payer's statements, which provide information about the payer and the income paid

2. Complete the Form Accurately

Once you have gathered all the required information, it is time to complete the PA-8453 form. Make sure to:

- Use black ink and print clearly

- Complete all required fields, including your name, address, and Social Security number

- Report the correct type and amount of income received

- Report the correct amount of tax withheld

- Sign and date the form

Common Mistakes to Avoid

Common mistakes to avoid when completing the PA-8453 form include:

- Incomplete or incorrect information

- Math errors

- Failure to sign and date the form

3. Report Income Correctly

When reporting income on the PA-8453 form, make sure to:

- Report the correct type of income, such as pension, annuity, or retirement account distribution

- Report the correct amount of income received

- Report the correct amount of tax withheld

Types of Income to Report

You should report the following types of income on the PA-8453 form:

- Pension and annuity income

- Retirement account distributions, such as 401(k) or IRA plans

- Certain types of trust or estate income

4. Calculate Tax Withheld Correctly

When calculating tax withheld on the PA-8453 form, make sure to:

- Use the correct tax withholding tables

- Calculate the correct amount of tax withheld based on the income received

- Report the correct amount of tax withheld on the form

How to Calculate Tax Withheld

You can calculate tax withheld using the following steps:

- Determine the type and amount of income received

- Use the tax withholding tables to determine the correct amount of tax withheld

- Calculate the tax withheld based on the income received and the tax withholding tables

5. Submit the Form on Time

Finally, make sure to submit the PA-8453 form on time to avoid any penalties or fines. The form is typically due by January 31st of each year, but it is essential to check the Pennsylvania Department of Revenue's website for specific filing deadlines.

Consequences of Late Filing

Late filing of the PA-8453 form can result in penalties and fines, including:

- A penalty of 5% of the tax due per month, up to a maximum of 25%

- A fine of up to $1,000

By following these five essential steps, you can ensure that you fill out the PA-8453 form correctly and avoid any potential errors or penalties.

We hope this article has provided you with a comprehensive guide on how to fill out the PA-8453 form correctly. If you have any further questions or concerns, please do not hesitate to comment below.

What is the purpose of the PA-8453 form?

+The PA-8453 form is used to report individual income tax withheld from certain types of income, including pensions, annuities, and retirement account distributions.

Who needs to file the PA-8453 form?

+Individuals who receive certain types of income, such as pensions, annuities, or retirement account distributions, may need to file the PA-8453 form.

What is the deadline for filing the PA-8453 form?

+The PA-8453 form is typically due by January 31st of each year, but it is essential to check the Pennsylvania Department of Revenue's website for specific filing deadlines.