If you're dealing with tax issues, you might have received a Form 5564 Notice of Deficiency from the Internal Revenue Service (IRS). Receiving this notice can be intimidating, especially if you're not familiar with the tax laws and procedures. In this article, we'll break down what Form 5564 Notice of Deficiency is, what it means, and what you need to do if you receive one.

What is Form 5564 Notice of Deficiency?

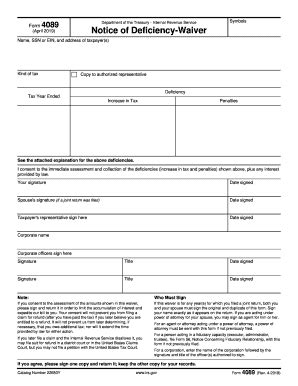

A Form 5564 Notice of Deficiency is a formal notice issued by the IRS to inform taxpayers of the proposed changes to their tax return. This notice is sent when the IRS determines that a taxpayer owes additional taxes, penalties, or interest due to an audit, examination, or review of their tax return.

Why did I receive a Form 5564 Notice of Deficiency?

There are several reasons why you might receive a Form 5564 Notice of Deficiency:

- Audit or examination: The IRS may have audited or examined your tax return and determined that you owe additional taxes, penalties, or interest.

- Discrepancies in tax return: The IRS may have found discrepancies in your tax return, such as unreported income, incorrect deductions, or credits.

- Tax law changes: The IRS may have applied changes in tax laws or regulations to your tax return, resulting in additional taxes owed.

What does the notice mean?

The Form 5564 Notice of Deficiency is a formal notice that:

- Explains the proposed changes: The notice explains the proposed changes to your tax return, including any additional taxes, penalties, or interest.

- Provides a 90-day deadline: The notice provides a 90-day deadline for you to respond, pay the proposed amount, or file a petition with the U.S. Tax Court.

- Outlines your options: The notice outlines your options, including paying the proposed amount, filing a petition with the U.S. Tax Court, or seeking assistance from a tax professional.

What should I do if I receive a Form 5564 Notice of Deficiency?

If you receive a Form 5564 Notice of Deficiency, it's essential to take immediate action:

- Read the notice carefully: Read the notice carefully to understand the proposed changes and the deadline for response.

- Seek professional help: Consider seeking help from a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), to understand your options and develop a plan.

- Pay the proposed amount: If you agree with the proposed changes, pay the amount owed by the deadline to avoid additional penalties and interest.

- File a petition: If you disagree with the proposed changes, file a petition with the U.S. Tax Court within the 90-day deadline.

How to respond to a Form 5564 Notice of Deficiency?

If you decide to respond to the notice, follow these steps:

- Complete Form 5564: Complete Form 5564, Notice of Deficiency, and attach any supporting documentation.

- Explain your position: Clearly explain your position and the reasons why you disagree with the proposed changes.

- Provide supporting documentation: Provide supporting documentation, such as receipts, invoices, or bank statements, to support your position.

- Mail the response: Mail the response to the address listed on the notice.

Consequences of ignoring a Form 5564 Notice of Deficiency

Ignoring a Form 5564 Notice of Deficiency can have severe consequences:

- Additional penalties and interest: You may be subject to additional penalties and interest on the amount owed.

- Loss of appeal rights: You may lose your right to appeal the proposed changes.

- U.S. Tax Court proceedings: The IRS may file a lawsuit with the U.S. Tax Court to collect the amount owed.

FAQs

What is the purpose of Form 5564 Notice of Deficiency?

+The purpose of Form 5564 Notice of Deficiency is to inform taxpayers of proposed changes to their tax return and provide a deadline for response.

What happens if I ignore a Form 5564 Notice of Deficiency?

+If you ignore a Form 5564 Notice of Deficiency, you may be subject to additional penalties and interest, lose your right to appeal, and face U.S. Tax Court proceedings.

Can I appeal a Form 5564 Notice of Deficiency?

+Receiving a Form 5564 Notice of Deficiency can be a stressful experience, but understanding your options and taking immediate action can help you navigate the process. Remember to seek professional help, read the notice carefully, and respond by the deadline to avoid additional penalties and interest.